Account gamble

Scottish and Newcastle

John Bull

Since I have been recommending specific speculations for the account only once have I sold a share short. This was Guest Keen and Nettlefolds. Although the market first turned sharply upwards after the figures were announced, an astute punter could have had time to make a handsome profit; those who were slow had the disturbing prospect of seeing the shares move ahead though they have come back since.

That exercise in selling short will have initiated speculators in the strange way the market reacts to results. What we have to consider first is how receptive the market will be to figures — whether they are good or bad — and what the results will be like in themselves. Last account, for instance, Shaw Carpets produced very good figures but with shares generally in an abyss, Shaw was marked down.

I take the view that even though conditions have improved following the £ flotation over the short-term the market will continue to be nervous. This is why I am recommending selling short Scottish & Newcastle whose results are due on July 5. The shares at present at 102p are selling on an historic PE ratio of 23. This multiple could well fall to around 20, if on my estimate, profits increase to about £20 million. I am not implying that for S & N to achieve this figure is a mean achievement — only that the sector as a Whole is rated too highly. And the way Guinness shares tumbled last week can be seen as an indication of this.

My forecast for S & N is based on the price increases it made in December while another factor is that above-average barrelage advance should also produce benefits. In the first half year results were not particularly good. Pre-tax profits to October 31, in fact, were 12 per cent higher at £11.3 million whilst turnover was Up by 13 per cent to £85.6 million. This indicated a slight fall in margins which partly resulted from the increased expenditure of marketing. In the longer-term this will undoubtedly hold S & N in good stead and there have been some very bullish long-term projections made. One broker went so far, recently, as to predict an annual earnings growth of 14 per cent through 1975. Given the group's large wholesale business in the free trade this estimate is not outskie the bounds of possibility. However, what worries me is that the market can sometimes go berserk about long-term prospects and then radically readjust its thinking. As soon as we are hit by a wave of industrial unrest, for instance, it becomes very myopic. On these grounds then I advise a short sale.

First Last Account dealings dealings day June 19 June 30 July 11 July 3 July 14 July 25

Previous page

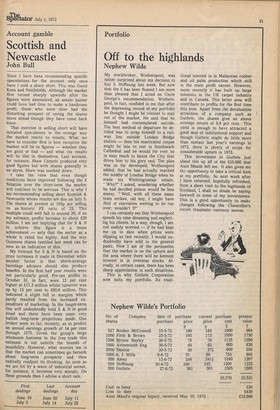

Previous page