Portfolio

Off to the highlands

Nephew Wilde

My stockbroker, Wotherspool, was rather surprised about my decision to buy S. Hoffnung last week. But now that the £ has been floated I am more than pleased that I acted on Uncle George's recommendation. Wotherspool, in fact, confided in me that after the depressing record of my portfolio he thought I might be content to stay out of the market. He said that he himself had contemplated suicide. The best method of departure he decided was to strap himself to a railway line outside London Bridge station — then his masticated corpse might be lain to rest in Southwark Cathedral and he would for ever be in easy reach to haunt the City that drove him to his gory end. The plan was so far developed, Wotherspool added, that he had actually reached the middle of London Bridge when he made his Whittingtonian return. "Why?" I asked, wondering whether he had decided poison would be less messy. "Well, with all these damn train strikes, old boy, I might have died of starvation waiting to be run over, wouldn't I?"

I can certainly see that Wotherspool spends his time dreaming and neglecting his clients. In a way, though, I am not unduly worried — if he had kept me up to date when prices were slipping so fast recently, I would undoubtedly have sold in the general panic. Now I am of the persuasion that the market is on the upturn and the area where there will be keenest interest is in overseas stocks. Already, in certain cases, there has been sharp appreciation in such situations.

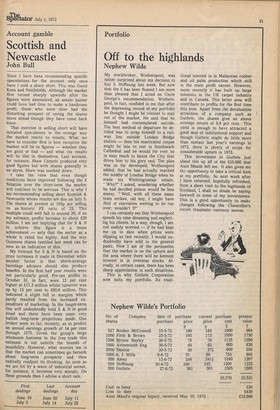

This is why Guthrie Corporation now suits my portfolio. Its tradi tional interest in in Malaysian rubber and oil palm production which still is the main profit earner. However, more recently it has built up large interests in the UK carpet industry and in Canada. This latter area will contribute to profits for the first time this year. Apart from the devaluation attraction of a company such as Guthrie, the shares give an above average return of 5.8 per cent. This yield is enough to have attracted a good deal of institutional support and though Guthrie might do little more than sustain last year's earnings in 1972, there is plenty of scope for considerable upturn in 1973: This investment in Guthrie just about ties up all of the £10,000 that Aunt Maude left me. It also gives me the opportunity to take a critical look at my portfolio. So next week after I have returned, hopefully refreshed, from a short visit to the highlands of Scotland, I shall no doubt be saying farewell to some of my investments. This is a good opportunity to make changes following the Chancellor's recent traumatic currency moves.

Previous page

Previous page