Banking in 1929

IT may be doubted whether either during or since the War there has been a much more difficult .yeaf for banking than the one which has recently closed. It is popularly supposed that when money rates are high bankers' profits are at their best. This is far from being the case, however, and the notion leaves altogether out of consideration the high rates which often have to be given-to attract-deposits when-money stands at a-high level. It is quite true that on a good deal of money on `! drawing " account bankers pay no interest at all, and -it is also true that the advertised rate. of interest allowed on deposits is usually so much below the pre- vailing Bank Rate which governs the bankers' charge for adVances ,that it might be supposed that a high Bank must ust inevitably increase banking profits. A great deal of the money, however, which is on deposit With the banks is of a character where very high rates are often paid as a result of competition between the banks to secure the use of the money for fixed periods. And if this is so during times when the dearness 'of money is more or less .centralized in this country, the point is emphasized still further when, as was the case last year, there is- a great- drift of capital from all centres to the United States . owing to the high rates for money paid at that centre._ is a point, there- fore; which has to be allowed or when considering the question 'of-how far bankers may have profited by dearer money rates, for on balance the average of Bank Rate and of money rates was higher in 1929 than in 1928.

DIVIDENDS MAINTAINED.

It :was not merely the attraction of funds toNew York with which bankers hid to contend .during 109. The prolonged boom - in the United States emitted unsound financial conditions at so many centres that repercussions in the shape of financial losses here and on the Continent, together with depressed trade, to say nothing of the Hatry. frauds, made the year an excep- tionally trying one in the shape of bad debts. It speaks well, therefore, for the general conduct and management of the banks that; in spite of these drawbacks, dividends should in all cases have been maintained, while in nearly all cases the financial position of the banks after the declaration of the usual dividends was even stronger than - a ,year efore _ - - „ DEPOSITS -LOWER. • - Before; however,--dealing with-lhe-question-of bankers' profits and dividends, it will be interesting to note the general effect-of financial conditions -here and abroad upon the main. items of the bankers' balance sheets. From the tables which follow it will be seen that there has .been a somewhat material contraction in the total of deposits, and especially of the deposits of the Big Five, ,when compared with a year earlier, although as compared with two ,years ago deposits show a Moderate increase and a substantial gain when compared with December, 1926. Moreover, it seems not unlikely that the contraction • on the present occasion was more apparent than real, -that is to say, it was probably con- nected with operations in Government loans. Briefly

DEPOSITS.

Dec. 31st, 1927.

£ Barclays Bank .. 318,373,472 Lloyds Bank .. 357,184,897 Midland Bank - . 374,375,146 National Provincial Bank 273,597,202 Westminster Bank 280,612,020

• •

Dec. 31st, 1928.

£ 335,081,222 352,157,420 394,591,227 290,310,252 294,086,580 Dec. 31st, 1929.

£ 337,439,214 351,644,965 379,622,758 271,712,337 285,160,311 ' Total .. 1,604,142,737 1;666;226;701 1,625,579,585 District Bank .. 53,721,367 52,254,949 52,240,052 Lancashire & Yorkshire

Bank .. . 24;026,215

* Manchester & County -

Bank _ . , 19,178,500, 19,587,527

18,281;581

Martins Bank .. 62,800,872 82,932,881 82,620,494 National Bank .. - 36,577,997 37,476,108 37,393,114 Union Bank of Man- chester .. .. 17,734,302 18,069,360 16,798,273 Williams Deacon's Bank 32,662,567 32,221,394 31,792,588 Total .. 246,791,820 242,542,219 239,126,102

* Now absorbed by Martins Bank.

stated,--these-operations at .the end_ of 1928 tended to swell somewhat artificially the total of deposits, just as at the end of 1929 they had the reverse effect. Nor in considering the decline in deposits must the fact be overlooked that as -shown in a preceding- table, the total of investments was down by nearly £20,000,000, a circumstance which would automatically lead to some contraction in . deposits because, of course, when the banks in the aggregate are sellers of Investments, pur- chased by their customers—the public—must for the time being reduce their deposits.

STRONG CASH POSITION.

It speaks well for the consistently ccnservative attitude adopted by the banks that throughcut ad the periods of difficulty, and notwithstanding, as I shall show later, banking advances having risen curi–g the year, the total of cash on hand has been n or than maintained, the-• following table showing that b th as regards the " Big Five and the provincial banking institutions the total of cash is slightly higher than last year, while in the case of the " Big Five ' the proportion of cash to liabilities is also higher than last year.

CASH TN HAND AND AT THE BANK Or ENGLAND.

Barclays Bank Lloyds Bank ..

Midland Bank - — National Provincial Bank Westminster Bank ..

Total • • ' Dec. 31st, 1927.

£ 49,564,180 45,155,865 49,763,778 32,078,961 31,585,106

Dec. 31st, 1928. £ 50,413,030 42,345,128 45,440,918 34,362,652 35,117,593 Dec. 31st, 1929. £ 51,850,334 44,203,998 46,918,243 31,626,945 35,467,196 208,147,890 207,679,321 - 210,066,716 District Bank .. 8,246,430 8,043,459 8,063,750 Lancashire & Yorkshire

Bank *5,197,594 t t Manchester & County

Bank *3,900,360 *5,381,751 - *4,386,989 Martins Bank, 7,394,983 9,121,948 10,332,182 National Bank . • 4,023,898 3,698,033 4,370,015 Union Bank of Man- chester .. *4,551,541 *6,557,651 *5,514,919 Williams Deacon's Bank 4,233,254 3,635,407 3,883,780 . Total 37,548,060 36,438,249 36,551,635 * Including Money at call and short notice. t Now absorbed by Martins Bank. PROPORTION OF CASH DT HAND AND AT DEPOSITS. Cre. Ilst,

HANK Or ENGLAND TO

Dee'. 31st, Dee. 31st,

1927 1928 1925

0/0 0/0

oh

Barclays Bank .. ..,

16.6 .. 15.5. 15.4 Lloyds Bank .. .. 12.6 12.0 12.6 Midland Bank .. 13.3 11.5 12.4 lititional Provincial Bank 11.7 11.8 11.6 Westminster Bank .. 11.3 11.9 ; 12.4 Total .. .. 13.0 12.6 12.9 District. Bank . , 15.3 15.4 17.3 Lancashire and _Yorkshire

-

Bank .. .. 21.6 *

Manchester and County: - -

' Bank - .. 20.3

27.5.

24.0 Martins Bank .. 11.8 11.0 - 12.1 National Bank 11.0 -

11.1

Vnion Bank of Manchester -25.7.

36.3 32:8 Williams Deacon's Bank 13.0 11.3" 12.2

Total . ;;T- 15-.2 --.-.--

18.6 18.2 *Now, absorbed by Martins Bank.

CHECK TO STOCK- EXCHANGE ACTIVITIES. • But although the actual total.of cash on hand and the proportion of such cash to liabilities tended to increase, there was quite a sharp fall in the total. of money at call and short notice, the figures of the " Big Five " showing a drop of about £15,000,000, and four provincial institutions• a decline of about £1,450,000, In- this case there is little doubt that the fall-Was connected with The great 'declihe during the second' half of the year in financial and Stock Exchange activities. Indeed, the material- reduction Which then.J-Ook place in brokers' loans has ever since added to the :supplies_ of credits Offered for 'CinPlOyinerit`in the open moneymarket.

MONEY AT CALL AND SHORT NOTICE.

Dec. 31st., Deo. 31st., 1927 1928

£ £

Dec. 31st., 1929 Barclays Bank :. 26041,049 - 23,988,400 23,582,200 Lloyds Bank .. 26,623,546 26,819,228 26,484,815 Midland Bank .. 27,509,077 27,681,297 21,670,909 National Provincial Bank 21,817,455 25,920,942 19,413,496 Westminster Bank ..

36,520,212. 34,813,607

33,169,823 Total ..

138,511,339 139,223,474

124,321,243 District Bank .. .. 5,786,620 4,724,125 3,857,140 Martins Bank .. 6,679,533 5,420,745 5,975,000 National Bank . . *4,433,565 *5,499,400 *3,820,091 Williams Deacon's Bank 2,952,915 2,871,374 3,412,190 Total .. .. 19,852,633 18,515,664 17,064,421 *Including Stock Exchange Loans and Treasury Bills. .

LOANS STILL EXPAND.

Bearmg in mind what has been said with regard to the reduction in loans to the Stock Exchange, we may not unfairly note that loans and advances have increased a little over the large total of the previous

LOANS AND ADVANCES.

Barclays Bank Lloyds Bank .. .. Midland Bank Dec. 31st, 1927.

161,867,906 187,798,225 206,487,910 Dec. 31st, 1928.

168,620,475 187,155,085 214,050,972 Dec. 31st, 1929.

172,926,488 191,752,253 210,374,230 National Provincial Bank 140,715,210 150,523,520 . 156,678,357 Westminster Bank .. 137,054,470 149,098,900 147,350,592 Total 839,923,724 869,448,952 879,081,920 District Bank .. 25,120,405. _ .23,249,695 24,327,283 Lancashire and York- shire Bank .. • • ' 10,039;268

Manchester and County

Bank 12,132,317 10,995,681 10,952,898 Martins Bank .. .. 36,572,971 42,600,478 42,246,172 National Bank 15,359,400 15,393,677 16,093,008 Union Bank of Man- chester . • • • 10,780,258 9,258,142 8,926,803 Williams Deacon's Bank 18,249,923 17,642,886 16,825,826 Total .. 128,254,542 119,140,559 119,371,990 *Now absorbed by Martins Bank:

.year, while the advance over the years 1927 and 1926 is still: more pronounced. This steady maintenance of and even expansion in the total'' ofloans and-advances .Suggests that there is certainly, some trade don* somewhere, even when all allowance is made for the undoubted depression in some of the staple industries and also for the fact that some of the loans and advances . . appearing -the-bankers' balance sheets still represent frozen credits which it will take some little time yet to liquidate thoroughly. And, indeed, all the speeches at the recent annual bank meetings confirm this idea of the trade depression being by no means universal, some industries being in a fairly prosperous condition while in others there is, undoubtedly, a disposition on the part of the banks to finance very freely any industry where fresh resources have been required either to finance new business or to provide amounts required for the replacing of obsolete-plant, &c. The foregoing table shows the total of loans and advances at the end of last year compared with the two previous years.

" ACCEPTANCE " BUSINESS.

As regards the acceptances by the banks and the Bills discounted, the_ circumstances operating during the past year have been of a very exceptional character. There is little doubt that during the latter half of 192K and perhaps in the early part of the current year there was a considerable growth in acceptance and discounting business in London as a consequence of the very high money rates in New York tending to drive away such business from that centre. It- is not improbable that if the figure of about March last had been taken the acceptances might have shown an increase, but the changed conditions in the. New York Money Market

ACCEPTANCES, ENDORSEMENTS, &C.

Dec. 31st, Dec. 31st, 1927. 1928.

£ £

Barclays Bank .. 12,830,669 24,847,317 Lloyds Bank .. r *5,952,940 *13,347,012

• • 1.117,815,176 t46,994,172

Midland Bank .. .. 36,997,594 74,441,134 National Provincial Bank 12,024,760 19,563,740 Westminster Bank .. 12,572,869 26,538,040 Total .. 118,194,008 205.758,415 154,466,346 District Bank 1,029,527 2,464,878 2,400,469

Lancashire and Yorkshire-

Bank . 119,689 Manchester and County 305,850 560,072 499,102 6,389,255 10,949,041 7,184,161 57,359 34,669 643,163 713,185 633,788 '1,393,259 1,520,117 1,023,094 Total .. .. 9,880,742 16,264,652 11,775,283 *Ac,ceptances.

t Endorsements, guarantees and other obligations. I Now absorbed by Martins Bank.

HILLS DISCOIJNTED.

Dec. 31st, Dee. 31st, 1927.

£ Lloyds Bank .. ..

Midland Bank

Barclays Bank 06 52,048,834

32,518,234 49,314,778 National Provincial Bank 38,993,472 Westminster Bank .. 36,839,342 Total .. 209,714,860 231,062,019 196,067,528 District Bank .. 3,402,174 5,146,317 5,029,779 Lancashire and York-

shire Bank .. 3;221,102 * *

Manchester and County 771,310 Bank • . • • 2,646,294 Martins Bank .. 2,329,697 National Bank . . Union Bank of Man- cheater . - • . 743,228 Williams Deacon's Bank 2,499,629 Total .. 15,613,434 • 16,161,696 " 14,617,221 * Now absorbed by Martins Bank.

during the closing-months .of. last year have brought about a quick change in the situation, and the total of acceptances of the -Big-Five at:,the--. end of December, as shown in the table aboVe, is very materially below the figure at the end of the previous year. On the other hand, it will be seen that the great advance in the year 1928 has been by no means wholly lost, the total at the end of 1929 showing. a material increase over the figures

Dec. 31st, 1929.

£ 21,991,928 *8,603,47(1 t43,622,815 37,474,366 15,174,188 27,599,579 Bank

• •

Martins Bank National Bank ..

Union Bank of Manchester Williams Deacon's Bank.. 1928. £ 38,258,570 49,281,472 63,347,503 43,547,739 36,626,735 Dec. 31st, 1929. £ 36,966,668 39,625,276 58,783,657 28,190,610 32,501,317 849,083 570,558 3,702,147 3,862,087 2,292,965 2,311,260 619,912 . 469,465 3,551,272 2,374,072

in 1927, while they are almost double those for 1926. Pali pawn with the falling off in acceptances there has als6 been a material decline in Bills discounted, but in that case, and also, perhaps, to some extent in accept- ances, it is to be feared that dull trade may have also played its part.

INVEST3LENTS -SMALLER.

I have already referred to the fact that Bankers' Investments have fallen during the year, the total of the Big Five being £196,500,000 against 1209;000,000 a year ago, while for the Provincial Institutions the total is £60,000,000 against £67,000,000, making a total drop of about £20,000,000. If, however, comparison were made with three years ago it would be found that the total decline in the Investments was about £27,000,000, and this movement is rather striking because it means roughly that notwithstanding trade depression there has been a sufficient expansion in Loans and Advances to account in part for this sale of Investments. In fact, the expansion in Loans and Advances over the same period has been about U5,000,000.

INVESTMENTS.

' Dec. 31sti' 1927. Dec. 31st, 1928.

£ Dec. 31st, 1929. £ Barclays Bank 53,30,700 58,546,192 52,736,790 Lloyds Bank .. 39,936,888 38,10.8,681 37,134,127 Midland Bank .. 35,435,530 36,868,697 32,928,890 National Provincial Bank .35,578,615 36,975,699 , 35,823,629 Westminster Bank .. 40,032,750 38,438,974 37,923,453 Total .. 294,373,483 208,938,243 196,546,889 District Bank 14,793,704 14,786,851 14,826,830 Lancashire and Yorkshire Bank .. .. 7,580,590

* *

Manchester and. County Bank , . 4,215,897 4,207,647. .. 4,221,639 Martins Bank .. .. 10.421,735 25,104,768 17,807,868 National Bank .. .. 15,552,527 15,130,928 14,556,259 Union Bank of Manchester 2,664,208 2,637,659 2,877,592 Williams Deacon's Bank.. 5,284,671 5,349,677 6,017,161

TOTAL ..

60,513,332 67,217,530 60,307,349 NOTE. These _figures_ do not include investments in affiliated * Now absorbed by Martins Bank.

ANALYTICAL.

Previous page

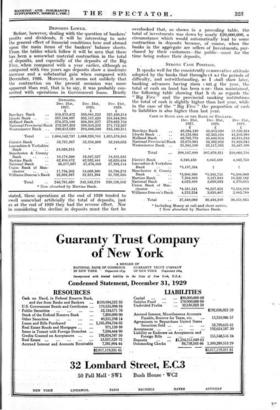

Previous page