Why Savings Sustain Equities

By NICHOLAS DAVENPORT.

THE professional investors in the City are frowning on the ebullience of the equity share markets. They think that the rise since July, 1962, when this 37 per cent in twenty-one months. Of course, this is merely recovering the ground lost since the great deflationary slump of Mr. Selwyn I-loyd—the market is still 4 per cent below the all-time peak reached in May, 1961—but it is Pretty fast going and the professionals feel the 'socialist threat,' whatever it may be, is likely to appear less menacing to the small investor than it does to the City professionals. The small investor 'does not as a rule allow political alarms to upset his saving and investing habits. The steady rise in new block issues by the unit trusts this year in spite of the political upset to the markets in January is proof of the small in- vestors' composure. Net new investment in unit trusts has recently been running at the rate of over £80 million a year. As a market force sus- taining the boom in equity shares this is rela- tively small by comparison with the huge funds accruing to the life and pension funds, which are managed by the City professionals, but it is growing at a very fast rate. I extract the fol- lowing figures of personal savings from the Economic Report 1963:

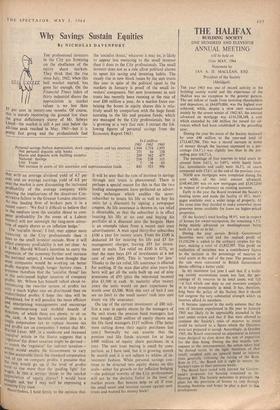

Ini million 1961 1962 1963 1,944 1,754 1,993 271 84 238 209 362 477 214 238 315 7 34 60 843 923 996 Personal savings (before depreciation, stock appreciation and tax reserves) Net personal deposits with banks .. .... ..

.. Shares and deposits with building societies .. .. .. National Savings .. .. .. Unit Trusts. .. . . . . .

Net increase in assets of life assurance and superannuation funds

that with an average dividend yield of 4.7 per cent and an average earnings yield of 6.8 per Cent the market is now discounting the increased profitability of the average company while ignoring the implications of the disastrous Con- servative failure in the Greater London elections. As one leading firm of brokers puts it in a recent report: 'We find it difficult to believe that in the medium term the socialist threat to com- pany profitability [in the event of a Labour victory] will not outweigh the long-term attrac- tion of equity shares as an inflation hedge.' The 'socialist threat,' I feel, may appear more menacing to the City professionals than it does to the small investor outside.' How it will affect company profitability is not yet clear. As it is Mr. Harold Wilson's intention to carry the expansion of the economy further and increase the national output, I would have thought that most companies would be working on better Profit margins through longer factory runs. I Presume therefore that the 'socialist threat' lies in the anticipated higher taxation of company profits. Mr. Wilson has himself talked about re- introducing the two-tier system of profits tax With a much higher rate on distributed than on undistributed profits. I hope this idea will be abandoned, for it will penalise the more efficient and enterprising managements and encourage the unenterprising and slothful boards of directors, of which there are plenty, to sit on 'lie cash. A less harmful socialist idea is a single corporation tax to replace income tax and profits tax on companies. I notice that Mr. Harold Lever, MP, in a moderate and reasoned socialist' article in the Statist suggests that a regulator' for direct taxation might be devised- t„,,„)Illateh the 'regulator' for indirect taxation- '''uch would enable the Government to vary Within acceptable limits the standard corporation Pe of tax on company profits. 1 presume that the rate would go up. if the level of profits .Were to rise more than the 'guiding light' for wages. Is this a serious 'threat to the market 9preciation of equity shares? I would have (bought not, but I may well be expressing a Minority City view. Nevertheless, I hold firmly to the opinion that

It will be seen that the rate of increase in savings through unit trusts is phenomenal. There is perhaps a special reason for this in that the two leading managements have perfected an advert- ising technique which enables the saver- subscriber to insure his life as well as buy his units (at a discount) by signing a newspaper coupon. As life assurance is thrown in, tax relief is obtainable, so that the subscriber is in effect

• insuring his life at no cost and buying his portfolio at a discount into the bargain. Here is an example taken from a recent unit trust advertisement. A man aged thirty-five subscribes £100 a year for twenty years. From his £100 is deducted £4 for insuring his life and £3 for management charges, leaving £93 for invest- ment in units. Tax relief on £100 is £151, so that the man buys £93 of investments at a net cost of only £841. This is 'money for jam.' Thanks to the tax relief, life assurance is effected for nothing. if the man dies after nine years his heirs will get all the units built up out of nine premiums of £93 (plus the reinvested income) plus £1,100 in cash. At maturity after twenty years the units would on past experience be worth over £3,500. With this sort of bait I can see no limit to the small savers' rush into unit trusts via life assurance.

On top of the current investment of £80 mil- lion a year in equity shares by the managers of the unit trusts the pension fund managers last year bought £220 million of equity shares and the life fund managers £115 million. (The latter were cutting down their equity purchases last Year.) Normally we can assume that the pension and life funds account for at least £400 million of equity share purchases in a year. The unit trust buying is small by com- parison, as I have said, but it is growing month by month and it is not subject to whims of in- vestment fashion. While personal savings con- tinue to be directed into equity shares on this scale—either for growth or for inflation hedging —the political worries of the City professionals will not be the decisive factor in the level of market prices. But heaven help us all if ever the small saver and investor turned against unit trusts and wanted his money back!

Previous page

Previous page