Mr. Lloyd's Wicked Alternative

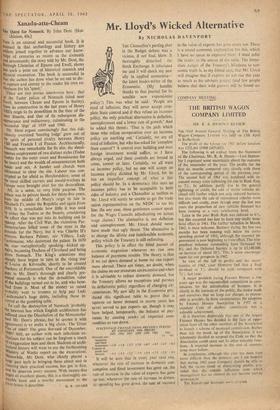

By NICHOLAS DAVENPORT Tan Chancellor's parting shot in the Budget debate was a vicious, if not foul, blow. It thoroughly disturbed the Stock Exchange. It infuriated me and it will shock my new ally in applied economics— the latest leader-writer of the Economist. (My humble thanks to that journal for its sensible new expansionist policy!) ,This was what he said: 'People are tired of inflation; they will never accept com- plete State control and if they refuse an incomes policy, the only practical alternative is deflation, unemployment and a lower rate of growth.' And he added this threat: 'That is the path which those who refuse co-operation over an incomes policy are marking out.' Certainly, we are all tired of inflation, but who has asked for 'complete State control'? A control over building and over foreign investment would suffice, as I have always urged, and these controls arc bound to come, sooner or later. Certainly, we all want an incomes policy, but no one will accept an incomes policy dictated by Mr. Lloyd, for he has an imperfect concept of what a fair policy should be. In a democracy like ours an incomes policy has to be acceptable to both sides of industry and a Chancellor as tactless as Mr. Lloyd will surely be unable to get the trade union representatives on the NEDC to toe his line. (In any case, these gentlemen cannot speak for the Wages Councils adjudicating on actual wage claims.) The alternative is not deflation and unemployment. Mr. Lloyd should never have made that ugly threat. The alternative is to change the idiotic and indefensible economic policy which the Treasury is still enforcing. This policy is in effect the blind pursuit of economic stagnation whenever we run into balance of payments trouble. The theory is that if we cut down demand at home we can export more abroad. There are times, no doubt, when the claims on our resources are excessive and when it is advisable to reduce domestic demand, but the Treasury allows no exceptions and pursues its deflationist policy regardless of .changing cir- cumstances. My new ally in the Economist pro- duced this significant table to prove that a squeeze on home demand in recent years has never served to put exports up, though it may have helped, temporarily, the balance of pay- ments by causing stocks of imported com- modities to run down.

PERCENTAGE! CHANGE FROM PREVIOUS PERIOD AT CONSTANT 1958 PRICES 1955 1956 1957 1958 1959 1960 1961 Personal con- (i) sumption and fixed investment 4-3.8 +1.8. +2.7 +2.0 +4.7 +4.7 + 2.7 —0.3 Exports of goods and

services 1-6.5 +4.3 -1 2.1 —1.9 +3.3 4 5.3 -( 2.9 - 0.3 It will be seen that in every year save one, whenever the rate of increase in domestic con- sumption and fixed investment has gone up, the rate of increase in the value of exports has gone up too: whenever the rate of increase in domes- tic spending has gone down, the rate of increase in the value of exports has gone down too. There is a sound economic explanation for this, which I have no space to expound here: I must refer the reader to the source of the table. The imme- diate danger of the Treasury's blindness to eco- nomic truth is, as my friend says, that Mr. Lloyd will iniagine that if exports do not rise this year as much as his advisers predict (and few people believe that their wild guesses will be found ac-

curate) then his Budget must have been insufficiently stern and deflationary. In point of fact it was far too deflationary for the present state of the economy. It was based on the assump- tion that productive investment in manufactur- ing industry—the key to our export future— would go on falling, probably by about 20 per cent. over the next twelve months. Any Chan- cellor who in these circumstances exacts forced savings from the public to the extent of a £433 million surplus 'above-the-line'—on top of a phenomenal rise in personal savings over the past few years—is courting disaster

The irrelevance of this Budget to our export needs is typical of the Treasury's ignorance of commercial life. The recent economic report ou the UK, published by the OECD in Paris, had a lengthy explanation why British exports had risen much more slowly in the past, decade than the exports of continental countries. It con- cluded: 'A major explanation . . . must be sought in the complex of factors making for ex- port competitiveness. This includes market re- search, salesmanship and after-sales services, where British exports have fallen behind some of their continental rivals. But a major factor must lie in the field of costs and prices.' And referring to the wage-cost inflation prevalent in recent times it added: 'Restrictions upon de- mand have not provided a satisfactory solution.' It pointed to the relatively lower level of pro- ductive investment in the UK caused by 'a certain lack of confidence on the part of busi- ness' and by the 'irregular pattern of expansion'

(i.e., the `stop-go' technique) which induced em- ployers in the restrictive periods to hoard their labour and so hamper the growth of the capital' goods industries. It ended: 'The investment undertaken [in the UK] has not been of sufficiently capital-deepening [i.e., labour-saving] character.'

Have I not stressed these same points ad nauseam in these columns? The Government's failure to direct investment intelligently or even to find out which industries were falling down on productive investment, the absurdity of rely- ing on indiscriminate investment allowances (which often encourage tax-dodging rather than productive, labour-saving investment), the folly of raising industrial costs not only by 'political' taxes like that on fuel oil but by restricting out- put for 'restraint' purposes-1 will not repeat them all. But I would call attention to what the clever, commercially-minded Mr. Kennedy is doing when he directs his attention to the same problem of encouraging exports in his own country. He proposes, first, to revise the tax depreciation schedules in order to shorten the tax 'lives' of industrial equipment; secondly, to give businessmen a tax credit for investment (now agreed at 7 per cent.) to encourage them to modernise their plant. In other words, he takes direct action to foster productive, labour-saving investment, which he knows will help the Ameri- can export trade. Here Mr. Lloyd takes indirect action to hamper and restrain productive, labour- saving investment, which he ought to know will kill the British export trade. A happy Easter!

Previous page

Previous page