THE CITY

Investment Notes

By CUSTOS

T'I1E attempt to put the equity market better in the new Stock Exchange account is fizzling °tit as I write. The latest bulletin of the National Institute of Economic and Social Research cer- lainly does not encourage bullishness. The first quarter of 1965, it says, marked the end of two Years of rapid expansion. National output dropped and although it should recover in the thild quarter it will probably rise only slowly. hereafter and flatten out in 1966 under the com- bined impact of the budget measures, the restraint on public investment, the approaching turning- 14)61 in private industrial investment and the Probable slower rise in world trade in manufac- tares. Consumer expenditure dropped sharply in the second quarter and in real terms is likely to he only I per cent higher in the next twelve 11101ths. Unemployment, they say, could double by the end of 1966. This is a sober enough fore- ca, but even so it does not suggest more than a moderate recession. Until the half-yearly reports e,onle from the leading companies the equity share markets must mark time.

Retail Trade Shares

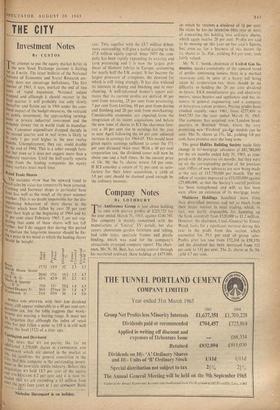

The statistics chow that the upward trend in e: il sales by value has temporarily been arrested.

Clothing and footwear shops in particular have (10,e less well as the result of the poor summer weather. This is no doubt responsible for the dis- appointing behaviour of store shares in the market which have fallen by over 20 per cent sine their high at the beginning of 1964 and by We her cent since February 1965. I,am not sug- gesting that some of these shares will not fall further, but I do suggest that during this period Of reaction the long-term investor should be fix- ing a price in his mind at which the leading shares should be bought.

Z-. ta, 0,„ • s 0 ':::) A I-..C.)

17/71

15/9 12 2.3 3.7 20/41 17/6 16/1 1.5 4.7 45/6 42/9 35 2.1 4.1

15/6 33/- 28/i

1.4 4.3

30/6 27./6ex 26

1.8 4.7

23/3 19/9 20

1.4 5.0

AND SPENCER, with their low dividend Cover, still appear vulnerable to a 40 per cent cor- porar;

--on tax, but the table suggests that WOOL- H'Ottrit are nearing a buying range. It 'must not be forgotten that although the index of retail sales has just fallen a point to 118 it is still well above the level (112) of a year ago.

Cttrrinkton and Dewhurst The "-c news that ict are paying 16s. for an additional 1,250,000 shares in CARRINGTON AND 1,)twitirasT which arc quoted in the market at st. 6c1. confirms the general conviction in the City that this company is the outstanding invest- ment in the new-style textile industry. Before this acquisition in held 13.7 per cent of the equity and coukrauffas 6.2 per cent and it is now. re- vealed that ICI are extending a £3 million loan ever the 'next four years at i per cent over Bank

Nicholas Davenport is on holiday.

-CI Z

''' )'''.

0..

1100 hist

rks & Spencer alworth 5/- ....

MARKS

S 'A'•a/-

5/- ted Drapery 5/-

tsh Home Stores

5/-

'A'

rate. This, together with the £3.7 million deben- tures outstanding, will give a useful gearing to the £7.8 million equity capital. Since 1957 the com- pany has been rapidly expanding its weaving and yarn processing and it is now the largest pat,- ducer of filament fabrics in Europe, accounting for nearly half the UK output. It has become the largest processor of crimplene, the demand for which is still rising strongly. It has also widened its interests in dyeing and finishing and in tiler- chanting. A well-informed broker's report esti- mates that its current profits are derived 40 per cent from weaving, 25 per cent from processing, 5 per cent from knitting, 10 per cent from dyeing and finishing, and 20 per cent from merchanting. Considerable economies are expected . from the integration of its recent acquisitions and before the new issue of shares to ICI the chairman fore- cast a 10 per cent rise in earnings for the year to next April following the 64 per cent adjusted increase in earnings for 1964-65. This would have given equity earnings sufficient to cover the 171 per cent dividend twice over. With a 40 per cent corporation tax, the dividend cover will now be about one and whalf times. At the current price of 14s. 9d. the 5s. shares return 5.8 per cent. If ICI consider a return of 51 per cent as satis- factory for their latest acquisition, a yield of 5.8 per cent should be deemed good enough by the ordinary investor.

Previous page

Previous page