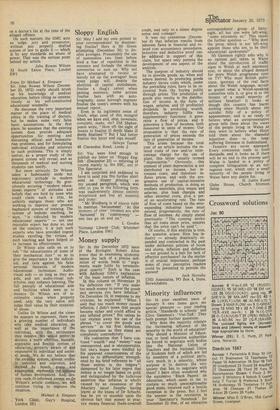

Money supply

Sir: In the December 1972 issue of the Ecologist, Robert Allen notes that in examining economic issues the lack of a precise definition of words leads to "arguments made futile by terminological opacity." Such is the case with Anthony Gibb's explanation of the basic nature of inflation.

In this column on November 25 his definition ran: "If you make too much money to cover the goods and services you have inflation." On December 16, in response to my criticism, he explained: "When I said that too much money caused inflation, I didn't mean that people became richer and could afford to pay inflated prices." But unless he can explain away his use of the phrase "to cover the goods and services" in his first definition, the quotations as they stand are completely contradictory. His contention that I have confused " wealth " and " money " was unsupported, and is unsupportable, but one's hopes were kindled by his apparent consciousness of the need so to differentiate; strengthened by his brief reference to "all those entries in the ledgers "; dampened by his later regret that money is no longer based on gold; and extinguished by the ludicrous assertion that inflation is wholly caused by an expansion of the fiduciary issue! Despite having learnt at the knees of Dr Schacht, has he yet to stumble upon the obvious fact that money in practice means financial (bank-created) credit, and only to a minor degree notes and coinage?

It was my contention (Decem ber 9) that inflation results from inherent flaws in financial and related cost accountancy procedures. Inductive and deductive proof can be adduced in support of this claim, but space only permits the development of one aspect of the analysis.

The purpose of industry should be to provide goods, as, when and where desired. In producing goods industry incurs costs which, under the prevailing rules, have to be recovered from the buying public through prices. The production of goods also results in the distribu tion of income in the form of wages, salaries, and (if profitable) dividends. In producing wealth, therefore, industry fulfils two supplementary functions: it generates a flow of prices, and it generates a flow of incomes, both measured in units of money. Our proposition is that the rate of generation of prices exceeds the rate of generation of income.

This arises because the total cost of an article includes the related costs of raw and/or intercentage charge for the use of plant, this latter usually termed "depreciation." Obviously, this element of plant depreciation is not distributed as income, but increases costs, and therefore inflates prices, and with the progressive use of capital-intensive methods of production, is doing so mediate materials, plus wages and salaries, plus loan charges and other external costs, plus a perat an accelerating rate. The rate of flow of costs based on the everexpanding industrial base must exceed, progressively, the rate of flow of incomes. As simply stated previously: "The cunning device that all costs enter price, ensures that the price can't be paid ". Of course, if this analysis is true, the question arises: How has industry — already drastically expanded and contracted in the past under deliberate policies of boom and slump, inflation and deflation — not ground to a halt for lack of effective purchasers? As the matter is of crucial importance, perhaps some of your perceptive readers could be permitted to provide the answer!

Jack Hornsby CHD Associates, PO Box 4. Duns, Berwickshire

Previous page

Previous page