FINANCE AND INVESTMENT

By CUSTOS

PEAK profits, flanked by warnings of lower earnings in 1952, have now become a recur- ring theme in company reports. The latest illustration of what investors may expect- ant' of a more drastic kind that in most other branches of industry—comes from Courtaulds, the textile and rayon manufac- turers. For the year to March 31st group profits established a new record £19,018,408 against £17,270,823 and even after allowing for U.K. taxation of £9,387,569 against £8,046,638 and other tax charges consoli- dated profit of the group was up from £8,221,159 to £8,724,953. So far, so good. These earnings have enabled the Courtaulds board to maintain the dividend on the £24,000,000 of Ordinary Stock at the 111 per cent. rate to which it was raised from 71 per cent. a year ago. They are also able to put large sums to reserves against increased cost of replacing fixed assets, raw materials and other stocks. The sting in the directors' preliminary statement is in the tail. They point out that during the first three quarters of the past financial year the demand for the company's products was considerable and that, difficulties on the raw material side having been overcome, pro- duction was at a high level. During the final quarter there was a sudden and progressive worsening of conditions in most sections of the business. This led to substantial increase of stocks of materials and finished goods, and consequently to a serious curtail- ment of output.

A Dividend Warning Since the end of the financial year several of the company's factories have temporarily ceased production and, in the words of the Courtaulds board, " the rayon industry in this country as well as abroad is now going through a major trade recession." As for the financial implications, Courtaulds stockholders are warned that the present indications are that " unless there is a rapid and material improvement no dividend may be earned " for the year ending March 3.

There can be no surprise that following this statement Courtaulds £1 Ordinary Units have fallen a shilling or so, and now stand at 32s. to yield not far short of 7 per cent. Clearly, they may go lower if the worst happens and the recession in the textile trade becomes more intense, but from the long term standpoint the units must surely be considered cheap. Courtaulds has alert management and strong finances to enable it to see the depression through and take advantage quickly of the improvement when it comes. I would certainly not advise stockholders to sell.

Cotton Trade Surprises

Recent news from the cotton section of the textile trade, at least so far as last year's profits and dividends are concerned, has been surprisingly good. Fine Spinners report group trading profits together with investment income at £4,379,227 for the year to March 31st, which is only about £500,000 below the peak of £4,879,418 for the year to March 31st, 1951. Taxation has called for rather less at £2,274,567 against £2,400,657 and net profit after tax and depre- ciation comes out at £1,185,641 against £1,366,418. Until we have the chairman's statement it is impossible to tell how steep the fall in earnings may have been during the second half of the company's financial year. Meantime, however, stockholders will derive some comfort from the board's decision to maintain the ordinary dividend at the 121 per cent. rate to which it was raised from 8 per cent. at this time last year. In the market the results have been received with consider- able caution, in that Fine Spinners £1 Ordinary Units are still quoted around 19s. to give a yield of 12f per cent. They appear to me to be under-valued at this price.

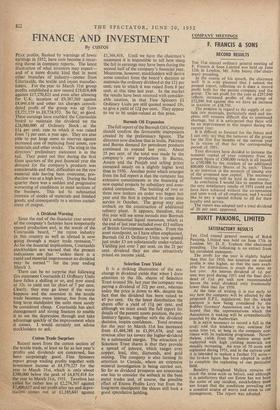

Burmah Oil Expansion The full report of the Burmah Oil Company should confirm the favourable impressions created by the preliminary figures. The directors now disclose that in India, Pakistan and Burma demand for petroleum products continued to expand last year. About 25 per cent. of the total was made by the company's own production in Burma, Assam and the Punjab and selling prices remained steady on a slightly higher level than in 1950. Another point which emerges from the full report is that the company has extensive commitments in the financing of new capital projects by subsidiary and asso- ciated companies. The building of two or three new tankers on order was begun last year and the first is expected to come into service in October. The group may also embark on the construction of additional refinery plant, It appears, therefore, that this year will see some inroads into Burmah Oil's substantial liquid resources, which at the end of last year included over £13 million of British Government securities. From the asset standpoint, as I have often emphasised, Burmah Oil £1 Ordinary Units now quoted just under £3 are substantially under-valued. Yielding just over 7 per cent. on the 21 per cent. dividend they are also attractively priced on income yield.

Selection Trust Yield It is a striking illustration of the sea- change in dividend yields that when 1 drew attention to the 10s. shares, of Selection Trust around 50s. last year the company was paying a dividend of 32i per cent., whereas today the price is down to 40s. despite the fact that the dividend has been raised to 45 per cent. On the latest distribution the shares offer a yield of 111 per cent. and although we must await the full report for details of the present assets position, the pre- liminary figures, together with the dividend decision, inspire confidence. Total revenue for the year to March 31st has increased from £1,404,288 to £1,991,674, and net revenue after tax covers the higher ilividend by a substantial margin. The attraction of Selection Trust shares is that they provide a spread of interest, which ranges over copper, lead, zinc, diamonds, and gold mining. The company is also turning its attention to Canada, where an extensive mineral investigation is being carried out. So far as dividend prospects are concerned one has to consider the setback in the base metal trades and, of course, the possible effect of Excess Profits Levy but from the long-term standpoint the shares still look a good speculative holding.

Previous page

Previous page