Banks and their Liquidity Ratio

By J. GRAHAME-PARKER WHATEVER may be posterity's verdict on the Government's revival of the orthodox methods of monetary control, there can be little doubt that it will be regarded as having produced something akin to a revolution in British banking. The conditions under which our joint stock institutions have operated in the past six months changed more radically than in any similar period since the war ; and those conditions have certainly left a heavy imprint on their balance-sheets.

On November 7th last year Bank Rate came back to life. The initial movement was modest in the extreme, but it sufficed to set in motion a rising trend in interest rates which was greatly accelerated on Budget Day this year when Bank Rate was rudely raised to 4 per cent. The significance of the restoration of the use of Bank Rate as a weapon of control was that it marked the end of the rigid struc- ture of money rates and the beginning of a new era of flexibility.

Of far greater importance in their effects, however, were two subsidiary developments. The first was the removal of the Treasury bill " peg " and the restoration of initiative in the market to the Bank of England's " special buyer." The second, and for the banks themselves the more vital, was the simultaneous funding of £1,000 million of Treasury bills into one, two, and three-year serial Funding stock. The importance of that operation, to which the clearing banks contributed £500 'million,. was the reduction that it brought about in the ratio of the bank's liquid assets to deposits.

SURPLUS OF ASSETS The return of the traditional discipline to the Discount Market could not of itself restore effective control over the whole structure of bank credit because the commercial banks had a very replete reservoir of surplus liquid assets, mainly Treasury bills and short loans made to the Discount Market against the security of bills. As long as that reservoir remained full to the brim the banks could always secure additional cash by reducing their bill purchases from the market or by calling in loans. To meet these demands, the Discount Market might well be forced to borrow at penal rates from the Bank of England but that would not stop the flow of additional cash to the banking system. The significance of the funding operation was that, at one fell stroke, it removed virtually the whole of that surplus liquidity. This can plainly be seen from the accompanying table. The exchange of Treasury bills for the new serial Funding bonds-the only way such bonds could be then obtained-caused a large transfer of resources. from bill portfolios to investment portfolios, although the impact Was softened in a modest degree by other influences, such as the reduction by the Discount Market of its own bill cases, partly because of the increased risks it now runs and partly to the reduction in allotment of bills at the tenders for several weeks. A further cushioning was made possible by the release of funds to the banks through repayments of Treasury deposit receipts, the war-created medium which -did not finally disappear until February of this year. Nevertheless, the effect on the liquid assets structure was severe. The aggregate liquidity ratio (cash, call money andobills) indeed, fell from 39 per cent. in October to 32 per cent. in November, with some banks showing ratios below 31 per cent. Before the war, of course the conventional ratio was 30 per cent. By April, the aggregate liquidity ratio had declined further to 31.6 per cent., but it turned Upwards last month, mainly because Martin's Bank showed a ratio of no less than 37.8 per cent. EFFECTIVE NEW DISCIPLINE As a matter of fact, successive monthly clearing bank statements have reflected the effectiveness of the new credit discipline, although the demonstration of this effectiveness has to be sought .less in the behaviour of the total volume of 'credit than in the trend of those portions that are represented by bank advances and investments.

The normal tendency of advances is strongly upwards at this time of the year but the check to the rise in that asset has been very marked. The steep fall in May, of course, was due to repayments by the British Electricity Authority of overdrafts from the proceeds of the recent loan but when it is borne in mind that the requirements of public borrowers, notably of the gas and electricity and gas industries, and of the expanding engineering industries remain very heavy, the fall in the total since November very plainly shows that a firm control is being exercised over all other borrowers.

The fact that advances are being so firmly restrained does not appear, however, to have sufficed to prevent sales of gilt-edged securities. Aggregate investment portfolios have declined for six successive months. It is true that the pace has slackened of late but the total downward movement since November is £100 million, to which has to be added an apparent decline of about £25 million in November itself (excluding the banks' take-up of the new funding stocks in that month). An appreciable part of this severe contrac- tion reflects book adjustments to allow for depreciation, but it seems that some banks are still tending to sell, maybe for the purpose of sustaining their conventional asset ratios.

TREASURY DEMANDS The movement in deposits themselves have been a little disappoint- ing on the whole and the apparent contrary tendencies in deposits on the one hand and of advances and investments on the other lies in the Treasury's demand,for credit.

This scissors movement between the non-liquid assets and the liquid assets involves a reciprocal movement in the liquidity ratio and it is this which will be watched closely in the coming weeks. The trend of the ratio will depend partly on the pace of the expansion of arms expenditure and partly on the speed with which the import cuts narrow the Government's borrowings of the sterling counter- part of the overseas deficit. It will also be governed by the attitude of the authorities towards credit. If the events of the past few months mean anything they surely point to a new departure in British central banking technique, namely the control of the volume of bank credit through the liquidity ratio instead of the cash ratio ; and the Govern- ment can certainly influence the liquidity ratio by being " tough."

In a period of change like the present, any attempt to forecast banking trends would be more than usually dangerous. Even on the assumption that the international atmosphere deteriorates no further, the size of banking deposits and the disposition of banking assets seem set for striking fluctuations. Re-armament activity and the intensified export drive-and the import cuts already men- tioned-may call for a good deal of additional bank finance, which may offset any reductions of accommodation achieved in spheres of lower priority. A reversal of our unfavourable overseas balance would eliminate the Treasury's ability to repay debt from receipts of sterling against foreign currencies but, here agaih, the results of the disinflationary policy would be an important offsetting factor. Where the balance will lie as between these and other cross-currents on banking it is impossible to foresee but it is a fairly safe assump- tion that bank balance-sheets at the end of this year will look very different from those presented five months ago. Finally, there seems little chance that bank shareholders, who have suffered probably more severely than any other class of investor from the political and economic developments of the post-war period, will secure greater rewards.

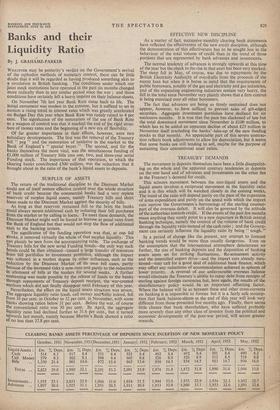

CLEARING BANKS ASSETS PERCENTAGE OF DEPOSITS SINCE INCEPTION OF NEW MONETARY POLICY

October, 1951 November, 1951 December,1951 January, 1952 February, 1952 March, 1952 April,, 1952 May, 1952

• aluid Assets : £m. % Deps. £m. % Deps. £m. % Deps. £m. % Deps. £m. % Deps. £m. % Deps. £m. % Deps. £m. % Deps. Cash .. 514 8.3 517 8.4 531 8.4 521 8.4 492 8.4 492 8.4 501 8.4 490 8.2 Call Money 579 9.3 562 9.1 598 9.4 605 9.8 526 8.9 526 8.9 512 8.5 '518 8.8 Bills' .. 1,330 21.4 901 14.6 972 15.4 965 15.6 856 14.5 854 14.5 883 14.7 936 16.0 - - TOTAL .. 2,423 39.0 1,980 32.1 2,101 33.2 2,091 33.8 1,874 31.8 1,872 31.8 1,896 31.6 1,944 33.0 Advances .. 1,897 30.6 1,925 31.1 1,931 30.5 1,911 30.8 1,933 32.8 1,946 33.1 1,953 32.6 1,891 32.6 nvest ments . . 1,555 25.1 2,033 32.9 1,966 31.0 1,954 31.5 1,944 33.0 1,935 32.9 1,934 32.3 1,932 32.7

Previous page

Previous page