FINANCE AND INVESTMENT

By CUSTOS

WHETHER or not there was any real justification for the whispering campaign against speculation in the stock markets, the mere hint of the possibility of official action seems to have been followed by a decline in activity. I doubt, however, whether this is the whole explanation of the market pause. For one thing, 'very few people seriously believe that any drastic official action is either necessary or likely. For another, markets were due for a period of consolidation for technical reasons. Prices are, in fact, behaving well. Most of the ground gained in the long advance of recent months is being held, and I shall be surprised if buyers do not take up the running again once they have recovered their wind.

BRITISH CEI ANESE PLAN

The second and it is safe to say final revised edition of the British Celanese funding scheme confirms City forecasts, and does justice to the second preference holders. There is to be a compulsory sinking fund, out of earnings, attached to the funding certificates whose interest will be 5 instead of 4 per cent. It seems reasonable, therefore, to assume that the quotation for the certificates will not be much below par. Deducting 8s. cad. for the nominal value of the allotment of certificates, plus the half-year's dividend, from the current price of 29s. 4d., one is left with 2 IS. as the ex-all valuation of the second preference shares. If, as seems probable, the 71- per cent. basic dividend.is supplemented by the 2j- per cent. participating payment, making to per cent., a price of 27s. 6d. would not be unreasonable.

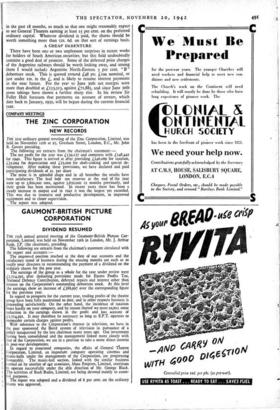

A FILM OFFER As a further step in consolidating its interests, the Gaumont- British Picture Corporation is now offering 12s. 6d. a share to holders of the 6s. 8d. participating preferred ordinary shares -in General Theatres. Whether this offer is generous, reasonable or niggardly it is impossible for me or the shareholders to whom it is made to tell, since the accounts of General Theatres for the year to March 31st have not yet been published. These accounts, along with the final dividend—there was a 4 per cent. interim—are due ; but, as things stand, shareholders have no authentic information about earnings for any period beyond March 31st, 1941. As everyone knows, the fortunes of the entertainment industry have improved tremendously

in the past 18 months, so much so that one might reasonably expect to see General Theatres earning at least 15 per cent. on the preferred ordinary capital. Whatever dividend is paid, the shares should be worth something more than 12s. 6d. on that sort of earnings basis.

A CHEAP DEBENTURE

There have been one or two unpleasant surprises in recent weeks for holders of South American securities; but this field undoubtedly contains a good deal of promise. Some of the deferred prior charges of the Argentine railways should be worth locking away, and among them I would include Argentine North-Eastern 5 per cent. " B " debenture stock. This is quoted around £48 per LI oo nominal, or just under ros. in the L, and is likely to resume interest payments in the near future. For the yea* to June 3oth net receipts were more than doubled at £153,513, against £71,885, and since June 3oth gross takings have shown a further sharp rise. In his review Sir Follet Holt forecasts that payments on account of arrears, which date back to January, 1932, will be begun during the current financial year.

Previous page

Previous page