THE MONEY MARKET.

STOCK EXCHANGE, FRIDAY EVENING.—The apprehensions expressed in our last report, of a further decline, have been in some measure realized; but we have at the same time the pleasure of communicating a change for the better which has since succeeded.

The pressure on the Exchequer Bill market, which was slightly felt on Saturday, had increased on Monday, and lowered the price to 56s. Con- sols, which left off on Saturday at 861, opened on Monday at 861, and very soon fell to 861: but at this point some purchases gave the market greater firmness, and before the close of the day, prices had recovered to

861 to On the following morning, appearances seemed so favourable that buyers were found at 861, and a further improvement was expected; but some further and extensive sales of Exchequer Bills soon after oc- curring, the price of those securities fell to 40s. ; which put the dealers in Consols out of spirits, and caused sales which depressed the price to 86g. Had the pressure continued in the Exchequer market, there is no doubt that a further decline in other securities would have followed; but the sales seemed to be concluded about mid-day on Tuesday ; and a consider. able purchase by an eminent broker following, gave firmness to the mar- ket, and instantly recovered the price to 54s. A good deal of money stock was brought to market both on Tuesday and Wednesday, without however causing any material variation in prices ; which indeed rather advanced, and had on Wednesday touched 87. On Thursday, 871 to f were the prices during the morning; but they declined a little in the afternoon. This morning the first prices were 87 and 86i; but the market was evidently firm, and improved as the day advanced, first to 873, and

eventually to 871 to i.

The speculators for a rise have derived great comfort from the declara-

tion made this week by Ministers, in both Houses of Parliament, of the favourable state of our foreign relations; and they talk, with the greatest confidence, of a further and material rise in prices; which indeed is pro- bable enough, if one might judge from the present appearance of the mar- ket. The statements which have been published of the revenue for the year ending 5th January last, are also exceedingly encouraging. The gradual feeling this week in the City is, that the Catholic question will be disposed of with less difficulty than was lately talked of. What the Pre- mier said on Tuesday of foreign affairs has likewise given rise to more sanguine expectations of afavourable termination of the Turkish question. These are the arguments insisted on by those who anticipate a rise of the fnnds during the Spring. Their opponents suggest the probability of a funding of Exchequer Bills, of which they imagine that the falling price of those bills is a proof. They: anticipate embarrassment and difficulty from the state of the corn speculations, which they say have been greatly overdone, and are likely to occasion many failures : and they still insist on the operation of the new law of the currency ; which, although at pre- sent overlooked, will produce a powerful effect erelong. Money has been less plentiful this week, both in the Stock Exchange and out of doors. In the Foreign Market, the changes which have taken place this week have been mostly for the worse, and the value of all the South American Bonds seems fast sinking. The unfavourable news from Mexico, which arrived on Wednesday, occasioned an immediate fall of 3 per cent. in the Bonds of that State, and they have not since recovered beyond 25 : Colom- bian Bonds are at about 181, Peruvian 13, Buenos Ayres 34. The accounts brought from Rio Janiero are likewise extremely unfavourable ; and Brazil Stock has fallen in consequence about one and a half per cent., the present price being 611 to 62. The Emperor having, as is reported, re- fused to hearken to the recommendations of our Government, of an ami- cable arrangement with his brother Don Miguel, Portuguese Stock has fallen to 48i. Russian Stock, on the other hand, is maintained at 98 to 983 with sur- passing firmness : but the French Funds have declined from the high price of last week j per cent. ; the last Paris prices known here (those of Wednesday) being 76, 45. The Spanish Stocks again attracted some speculation, and have been done at 10 this week, but are now not quite so high—say 91 to 3. The Shares of all the Mexican Mining Associations have been affected by the news from Mexico. Brazil Shares are also lower. SATURDAY, ONE O'CLOCK.—Consols opened at 87 sellers—afterwards buyers. The market is now not quite so good—say 87 to L.

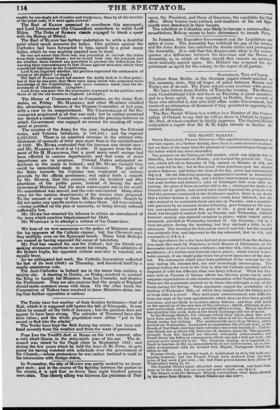

Bank Stock, div.8per Cent.2112 Colombian, IR 19 3 per Cent. Reduced, 88d * Ditto, 1824, 6 per Cent. 3 per Cent. Consols, 871 * * Danish, 3 per Cent. 64* 65 31 per Cent. 1818, 97a 97 French 5 per Cents.

34- per Cent. Reduced, 97* 97 Ditto 3 per Cents.

New 4 per Cents. 1822, 1011 102 1011 Greek 5 per Cent. 14 15 4 per Cents. 1826, 1051 Mexican 6 per Cent 25 25* Long Annuities, (which expire 5th Jan. Neapolitan 5 per Cent.

1860) 20* Peruvian, 6 per Cent. 13 14

India Stock, div. 101 per Cent. 231 '2 1 Portuguese, 5 per Cent. 48 49

South Sea Stock, div. 3* per Cent. Prussian, India Bonds, (4 per Cent. until March, Russian, 98 98*

1829, thereafter 3perCent.) 53 pm Spanish, 91 1 Exchequer Bills, (interest 2d. per Cent. SHARES.

per Diem,) 53 58 Anglo-Mexican, Consols for Account 87.1 1 a Brazilian, Imperial,

FOREIGN FUNDS. Real Del Monte,

Austrian Bonds, 5 per cent. 981 Bolanos, Brazilian Bonds, 5 per cent. 611 62 Colombian, Buenos Ayres 6 Cent. 34 United Mexican,

Previous page

Previous page