LOMBARD STREET.*

MR. BAGE110T'S book is not a history of Lombard Street, as we- rather hoped it would have been, but a descriptive account of the present system of Credit, of which Lombard Street is the centre, and upon which English business is maintained. It is as lucid as Mr. Bagehot always is, but is in one respect unsatisfactory, for his ob- ject is to show that the system, though imperfect or indeed unsound, is practically beyond the range of large or permanent improvement. He avers that our sole reserve of capital is now always lodged in the Bank of England. Trade is falling more and more out of the hands of the capitalists and into the hands of men who discount their bills, and this for the simple reason that the latter make the most money :—" If a rrerchaut have £50,000 all his own,—to gain 10 per cent. on it he must make £5,000 a year, and must charge for his goods accordingly ; but if another has only £10,000, and borrows £40,000 by discounts (no extreme instance in our modern trade), he has the same capital of £50,000 to use, and can sell much cheaper. If the rate at which he borrows be 5 per cent., he will have to pay £2,000 a year ; and if, like the old trader, he make £5000 a year, he will still, after paying his interest, obtain £5,u)0 a year, or 30 per cent., on his own £10,000. As most merchants are content with much less than 30 per cent., he will be able, if he wishes, to forego some of that profit, lower the price of the commodity, and drive the old-fashioned trader—the man who trades on his own capital—out of the market." The money for this discounting is furnished by the saving districts, whose bankers lend their money to discounting houses in Lombard Street, to be employed at the greatest profit pro- curable. Of course, the Lombard Street houses, paying interest on every penny, must employ it, or almost all of it, and keep their very moderate reserve with the Bank of England. So also do the Joint-Stock Banks, and even the Private Banks, so that the saved wealth of England may thus be said quite justly to be held. in the Bank, which, again, depends for its security on being able to return the bankers and discounters' reserves, and to make them, advances on their securities when needful. So that it may very well happen, as did happen on 29th December, 1869, that the. Bank has,—

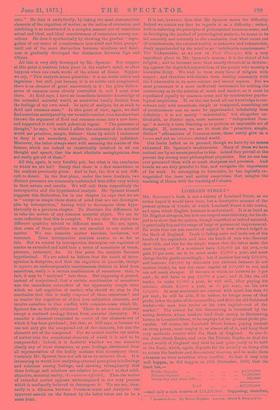

Public deposits Private deposits ... ..• Seven-day and other bills ...

Total ... £27,235,000 —and only a cash reserve of £11,297,000. Supposing, therefore, ... £8,585,000 ... 16,205,000 445,000

I • Lombard Street. By Wither Bagehot. London: Henry 13. King and Co. a panic to set in, as may set in any day if a great provincial Bank or moderately good London Bank breaks, every Bill discounter, or Joint-Stock Bank, or Private Bank rushes for cash to the Bank of England, and unless it can obtain it must close its doors. A refusal ris fatal, and yet, as the Bank itself lends on discounts for the benefit of its shareholders, a refusal may come, unless the Bank is allowed to pay in notes instead of specie. " We see, then, that the banking reserve of the Bank of England—some £10,000,000 on an average of years now, and formerly much less—is all which is held against the liabilities of Lombard Street ; and if that were all, we might well be amazed at the immense development of our credit system—in plain English, at the immense amount of our debts payable on demand, and the smallness of the sum of actual money which we keep to pay them if demanded. But there is more to come. Lombard Street is not only a place requiring to keep a reserve, it is itself a place where reserves are kept. All country bankers keep their reserve in London. They only retain in each country town the minimum of cash necessary to the trans- action of the current business of that country town. Long ex- perience has told them to a nicety how much this is, and they do not waste capital and lose profit by keeping more idle. They send the money to London, invest a part of it in securities, and keep the rest with the London bankers and the bill-brokers. The habit of Scotch and Irish bankers is much the same. All their spare money is in London, and is invested as all other London money now is ; and, therefore, the Reserve in the Banking Department of the Bank of England is the banking reserve not only of the Bank of England, but of all London,—and not only of all London, but -of all England, Ireland, and Scotland too." Moreover, all mer- chants are dependent on their bankers for their ability to make payments, and it comes therefore to this, that all business throughout England isdependent on the Bank, and if its doors were shut all Eng- land would be reduced in twenty-four hours to a state of barter. The -solvency or insolvency of England depends therefore upon that one Bank, which is managed by men strangely chosen, and who do not think themselves trustees for the public. The Directors are all -merchants, not bankers ; their personal fortunes are not merged in the Bank, and they are liable to direct pressure from their share- holders who want more dividend. The Directors are under no legal and no practical pressure to help the public in time of trouble, and if badly advised might decline help till the evil was irreparable. The tendency is not to decline help, the Gover- nors being nervous of public opinion, but to afford it ; but the tendency might any day be the other way. No rules exist, and there is an overplus of amateur banking in the Bank Parlour, and therefore Mr. Bagehot, despairing of any change in the Bank system, would make its government as strong as pos- sible. At present, "The Bank of England is governed by a Board of Directors, a Governor, and a Deputy-Governor; and the mode in which these are chosen, and the time for which they hold office, affect the whole of its business. The Board of Directors is in fact self-electing. In theory a certain portion go out annually, remain out for a year, and are subject to re-election by the Proprietors. But in fact they are nearly always, and always if the other directors wish it, re-elected after a year. Such has been the unbroken prac- tice of many years, and it would be hardly possible now to break it. When a vacancy occurs by death or resignation, the whole Board chooses the new member, and they do it, as I am told, with great care. For a peculiar reason, it is important that the Directors should be young when they begin ; and accordingly the Board run over the names of the most attentive and promising young men in the old-established firms of London, and select the one who, they think, will be most suitable for a Bank director. There is a considerable ambition to fill the office. The status which is given by it, both to the individual who fills it and to the firm of merchants to which he belongs, is considerable. There is surprisingly little favour shown in the selection ; there is a great wish on the part of the Bank Directors for the time being to provide, to the beat of their ability, for the future good govern- ment of the Bank. Very few selections in the world are made with nearly equal purity. There is a sincere desire to do the bat for the Bank, and to appoint a well-conducted young man who has begun to attend to business, and who seems likely to be fairly sensible and fairly efficient twenty years later." Whenever a vacancy occurs, however, the youngest man always retires, while there exists within the Board another Board called the Committee of Treasury, which is supposed to deal with Government, but which really holds an indefinite authority over all great affairs. The defect of this system is that there is no permanent Execu- tive, and no possibility of creating an avowed one. A per- manent Governor of the Bank of England would be a

monarch of the City, and would usually be incompetent, from the frightful effort made to attain the throne, the French plan of nominating the Governor directly by the State would not work in England, a Governor elected by the Board would be a partisan, and Mr. Bagehot falls back upon the English Constitu- tional example. He would have a permanent Under-Secretary, such as exists in every State department. " Such a Deputy-Governor would not be at all a ' king' in the City. There would be no mischievous prestige about the office, there would be no attraction in it for a vain man, and there would be nothing to make it an object of a violent canvas or of unscrupulous electioneering. The office would be essentially subordinate in its character, just like the permanent secretary in a political office. The pay should - be high, for good ability is wanted ; but no pay would attract the most dangerous class of people. The very influential, but not very wise, City dignitary who would be so very dangerous is usually very opulent ; he would hardly have such influence if he were not opulent ; what he wants is not money, but position.' A Governorship of the Bank of England he would take almost without salary, perhaps he would even pay to get it; but a minor office of essential subordination would not attract him at all. We may augment the pay enough to get a good man, without fearing that by such pay we may tempt—as by social privilege we should tempt—exactly the sort of man we do not want. . . . The permanent Governor ought to give his whole time to the business of the Bank. He ought to be forbidden to engage in any other concern. All the present Directors, including the Governor and Deputy-Governor, are engaged in their own business, and it is very possible, indeed it must perpetually have happened, that their own busi- ness as merchants most occupied the minds of most of them, just when it was most important that the business of the Bank should occupy them. It is at a panic and just before a panic that the business of the Bank is most exacting and most engross- ing. But just at that time the business of most merchants must be unusually occupying, and may be exceedingly critical. By the present constitution of the Bank, the attention of its sole rulers is most apt to be diverted from the Bank's affairs just when those affairs require that attention the most." Such an officer ought to be a trained Banker, a man of position, and of somewhat undefined powers. " Such an officer, if sound, able, and industri- ous, would soon rule the affairs of the Bank. He would be acquainted better than anyone else both with the traditions of the past and with the facts of the present, he would have a great ex- perience, he would have seen many anxious times, be would always be on the watch for their recurrence. And he would have a peculiar power of guidance at such moments, from the nature of the men with whom he has most to deal. Most Governors of the Bank of England are cautious merchants, not profoundly skilled in bank- ing, but most anxious that their period of office should be prosper- ous, and that they should themselves escape censure. If a ' safe ' course is pressed upon them they are likely to take that course. Now it would almost always be ' safe ' to follow the advice of the great standing 'authority ;' it would always be most ' unsafe' not to follow it." The permanent Deputy-Governor would, in fact, be the per- manent executive of the Board, which his experience would enable him to advise. The danger would be that if an able man got the office he would master the Board, and would create within the Bank just that evil which has so oppressed all Banks within the United States, the excessive authority which always accretes to the President.

We have confined our review of Lombard Street to its single leading thought,—that on the good management of the Bank of England depends the safety of Trade throughout the United Kingdom, that no radical change can be introduced, that its management is not of necessity perfect, and that it might be made as perfect as human institutions can be. That single thought will most interest our readers, but we have in adhering to it done in- jury to Mr. Bagehot, who touches incidentally a hundred points connected with his subject, and pours serene, white light upon them all. The only point on which we conceive him to be faintly prejudiced is against Private Banks. He says they need hereditary ability, which is not discoverable ; and if they were really governed by single men, we should agree with him, but as they are not, but governed by small hereditary Com- mittees, with able colleagues chosen by co-optation, we should not consider their want of ability inevitable. We do not like Private Banks, in which the owners may be stealing our money without anybody being aware of it ; but, nevertheless, private banks need not perish from fatuity. Suppose the Grosvenor family to have set up a private Bank in Queen Anne's reign, what would it be worth now ?

Previous page

Previous page