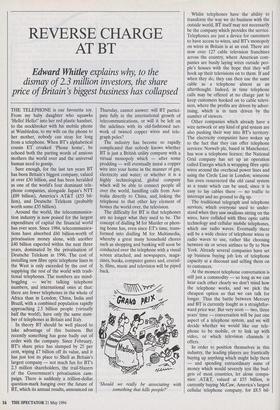

REVERSE CHARGE AT BT

Edward Whitley explains why, to the

dismay of 2.3 million investors, the share price of Britain's biggest business has collapsed

THE TELEPHONE is our favourite toy. From my baby daughter who squawks 'Hello! Hello!' into her red plastic handset, to the stockbroker with his mobile phone at Wimbledon, to my wife on the phone to her mother, nobody can stray for long from a telephone. When BT's alphabetical cousin ET croaked 'Phone home', he echoed both the parting words of anxious mothers the world over and the universal human need to gossip.

Sure enough, for the last ten years BT has been Britain's biggest company, valued at over £30 billion, and has been heralded as one of the world's four dominant tele- phone companies, alongside Japan's NTT (189 billion), America's AT&T (i55 bil- lion), and Deutsche Telekom (probably worth some £35 billion).

Around the world, the telecommunica- tion industry is now poised for the largest expenditure of capital the financial world has ever seen. Since 1984, telecommunica- tions have absorbed £60 billion-worth of privatisation money alone, with another £40 billion expected within the next three years, dominated by the privatisation of Deutsche Telekom in 1996. The cost of installing new fibre optic telephone lines in the West is only exceeded by the cost of supplying the rest of the world with tradi- tional telephones. The numbers are mind- boggling — we're talking telephone numbers, and international ones at that: there are fewer telephones in the whole of Africa than in London; China, India and Brazil, with a combined population rapidly approaching 2.5 billion people (virtually half the world), have only the same num- ber of telephones as Britain and Italy.

In theory BT should be well placed to take advantage of this business. But recently something has gone badly out of order with the company. Since February, BT's share price has slumped by 25 per cent, wiping £7 billion off its value, and it has just lost its place to Shell as Britain's largest company — not much fun for BT's 2.3 million shareholders, the trail-blazers of the Government's privatisation cam- paign. There is suddenly a trillion-dollar question-mark hanging over the future of BT, which its annual results, announced on Thursday, cannot answer: will BT partici- pate fully in the international growth of telecommunications, or will it be left on the sidelines with its old-fashioned net- work of twisted copper wires and tele- graph poles?

The industry has become so rapidly complicated that nobody knows whether BT is just a British utility company with a virtual monopoly which — after some prodding — will eventually instal a copper wire into your home in the manner of gas, electricity and water; or whether it is a highly technological, global company which will be able to connect people all over the world, handling calls from Aus- tralia directly to China, and, linking the telephone to that other key element of homes the world over, the television.

The difficulty for BT is that telephones arc no longer what they used to be. The concept of dialling M for Murder or phon- ing home has, even since ET's time, trans- formed into dialling M for Multimedia, whereby a great many household chores such as shopping and banking will soon be conducted over the telephone with a visual screen attached; and newspapers, maga- zines, books, computer games and, crucial- ly, films, music and television will be piped back.

'Should we really be associating with something that kills people?' Whilst telephones have the ability to transform the way we do business with the outside world, BT itself may not necessarily be the company which provides the service. Telephones are just a device for customers to have access to wires, and BT's monopoly on wires in Britain is at an end. There are now over 127 cable television franchises across the country, where American com- panies are busily laying wires outside peo- ple's houses with the hope that they will hook up their televisions on to them. If and when they do, they can then use the same cable as a telephone almost as an afterthought. Indeed, in time telephone calls may be offered at no charge just to keep customers hooked on to cable televi- sion, where the profits are driven by adver- tising, which is in turn driven by the number of viewers.

Other companies which already have a wire network or any kind of grid system are also pushing their way into BT's territory. The electricity companies have woken up to the fact that they can offer telephone services: Norweb plc, based in Manchester, has won a telephone licence; the National Grid company has set up an operation called Energis which is wrapping fibre optic wires around the overhead power lines and using the Circle Line in London; someone has even resurrected the old canal system as a route which can be used, since it is easy to lay cables there — no traffic to interrupt and no ground to dig up.

The traditional telegraph and telephone services, which everyone used to under- stand when they saw swallows sitting on the wires, have collided with fibre optic cable technology and cellular mobile telephones, which use radio waves. Eventually there will be a wide choice of telephone wires or radio waves to use, rather like choosing between six or seven airlines to fly to New York. Already several companies have set up business buying job lots of telephone capacity at a discount and selling them on to customers.

At the moment telephone conversation is still just a commodity — so long as we can hear each other clearly we don't mind how the telephone works, and we pick the cheapest option so that we can talk for longer. Thus the battle between Mercury and BT is currently fought as a straightfor- ward price war. But very soon — two, three years' time — conversation will be just one aspect of a telephone system, and we will decide whether we would like our tele- phone to be mobile, or to link up with video, or which television channels it offers.

In order to position themselves in this industry, the leading players are frantically buying up anything which might help them — and spending extraordinary sums of money which would severely test the bud- gets of most countries, let alone compa- nies: AT&T, valued at £55 billion, is currently buying McCaw, America's largest cellular telephone company, for £8.5 bil- lion. Craig McCaw, who founded the busi- ness in 1987, will receive £1.8 billion. US West, a regional American telephone corn- Patty worth £12 billion (one of the so- called 'Baby Bells'), paid £1.7 billion to buy 25 per cent of Time Warner Entertain- ment, the cable television arm of Time Warner. BT itself has not been averse to Spending large sums of money — last year it spent £2.8 billion for a 20 per cent share in MCI, AT&T's closest rival. Across the world trillions of dollars are being spent on joint ventures between the major indepen- dent or state-owned telephone and televi- sion companies.

But BT is trapped by government legis- lation, which has outlawed it from broad- casting television until 2001 in order to give cable television companies the chance to enter the market. Without prospective broadcasting revenues, it is not worthwhile for BT to lay the fibre optic cable which is the key to the future. This is in part why the company's share price has collapsed: the City has suddenly decided it is not an electronics company with a future but a utility with few prospects.

To BT's immense irritation, the future of British telecommunications is now being seized by the American cable television and telephone companies. Of the 127 British cable television franchises, 77 were awarded to American companies, 35 to Canadian, six to UK and foreign joint ven- tures, five to French and just four to pure UK companies. So far, cables have been laid past 3 million houses. These cable companies can afford to lay expensive fibre optic lines because they will yield two sources of income — from television and telephone services.

Last month, BT's chairman, Sir lain Val- iance, told the House of Commons Trade and Industry Select Committee that BT was prepared to invest .£15 billion in pro- viding fibre optic cables only if the laws were changed. Spending £15 billion would have quite an impact on the economy, but nobody will ever know whether this was bluff or not: last week John Cruickshank, the director-general of Oftel, the regulato- ry body which supervises BT, maintained the ban on BT or Mercury providing tele- vision. Mr Cruickshank thus paved the way for the £1.6 billion stock-market flotation of Telewest, an American cable company which will now start digging up pavements in earnest, with others close behind. By the time BT is allowed to broadcast television in 2001, there will only be a few hill farms left for it to supply.

While BT's wires are crossed by red tape, the new entrants are not the embry- onic start-ups which the Government origi- nally might have imagined would invest in cable television, but multi-billion-dollar American and Canadian corporations which BT has to watch entering its market by the back door. For instance, Telewest, which will operate 40 franchises, is owned by TCI, the largest American cable company, and US West.

Despite the cable television ban, BT could have done more to stimulate greater use of its network to boost profits. Instead, the top management has been diverted by an ambition to become a big player in America and has spent billions of pounds on some rather doubtful investments.

BT's ambitions to become a global com- pany operating in America, Europe and Japan have taken several wrong turnings. First, it bought a 12 per cent share of McCaw — which it then sold on to AT&T at minimal profit. Second, it spent £2.8 bil- lion on a minority stake in MCI, an Ameri- can equivalent to Mercury. Far from giving BT a foothold in America, this investment has effectively shut BT out because, whilst MCI will continue to man the phones, BT will just foot the bill. MCI is locked into a price war against AT&T with only a frac- tion of the resources. BT has been slow to enter other markets, unlike Cable and Wireless, for instance, which has bolstered its international portfolio with a string of alliances across East Europe and Asia.

And even in its home market BT has not been too bright at winning friends and influencing people. Until Mercury came along, BT refused to itemise bills and just charged a quarterly lump sum — rather as if a supermarket checkout girl simply eyed up your trolley and charged you £78.21. Suddenly — how surprising — BT was able to produce itemised bills as soon as Mercury did. Moreover, BT has had the technology to provide call waiting, voice- mail, conference calls and freephone num- bers for a long time, but has never properly marketed them. AT&T makes around a quarter of its telephone income from freephone calls paid for by the receiving party.

Another failure is the mobile phone market, where BT and the fledgling com- pany Vodafone started at the same time, but Vodafone stormed ahead of BT both in market share and, more importantly, profits. Vodafone is now worth over £5 billion — a fifth of BT's entire value — which should be an absurd valuation in the context of BT's overall business. But Vodafone's management is led by the self- made multi-millionaire Sir Ernest Harri- son, whereas Sir lain Valiance was all but born and bred in the Post Office, hardly the obvious career choice for an ambitious manager.

For a £20-billion company, the BT board does look oddly lopsided, with non- executive directors outnumbering execu- tives by eight to five. There has been a succession of senior managers who were brought in to shake up the company, but each of them was quickly spat out: Graeme Odgers, Barry Romeril and David Dey all failed to change the company and left. David Dey is now managing director of Energis, the National Grid company which promises to offer long-distance calls at a third of the price of BT, and might invite AT&T to take a stake.

As one of the world's biggest companies in the world's fastest-growing markets, BT should have glorious prospects. Yet, hedged in by local regulation on one side and dithering overseas ventures on the other, it might defeat all business logic and fade away.

Perhaps the root of the trouble is that the Government privatised BT as a monopoly and is now honour bound to reg- ulate its power away. If BT had been split up into several operating companies, one for trunk calls and several for local areas, then the various forms of BT could have all competed for cable television and there would be no need to keep a large part of British business out of the market. The shareholders — the same ones who bought BT in one lump — would then have enjoyed the rapid growth which the Ameri- can cable companies are about to exploit.

As it stands, BT's fortunes may well mir- ror those of Britain at large: at one time a company set on a vast international empire, but reduced to a tangle of copper wires, short circuits and diminished value for all concerned.

Previous page

Previous page