Account gamble

A sell and a buy

John Bull

I was left smarting last week when I saw Shipping Industrial Holdings plummet on the news of the Clarkson losses. This is the sort of situation that the •account gambler must look for.

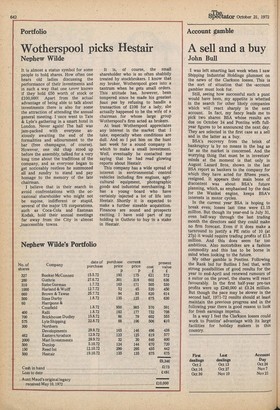

Still, seeing how successful such a punt would have been, my appetite is whetted in the search for other likely companies which will react sharply in the next account. In fact, my fancy leads me to pick two shares: BSA whose results are due on October 24 and Pontins with fullyear figures to be announced the next day. They are selected in the first case as a sell and in the latter as a buy.

BSA's recovery from the brink of bankruptcy is by no means in the bag as far as the market is concerned. And the worrying thing that must be in investors' minds at the moment is that only in August Lazard Bros, shown in the last BSA report as bankers to the company for which they have acted for fifteen years, resigned. It appears their main bone of discontent was about BSA's future planning, which, as emphasised by the deal for the Wankel engine, keeps BSA's interests in motor cycles.

In the current year BSA is hoping to break even; losses last time were £1.15 million. But though its year-end is July 31, even half-way through the last trading month the directors said they could make no firm forecast. Even if it does make a turnround to justify a PE ratio of 10 (at 27p) it would require trading profits of £1.5 million. And this does seem far too ambitious. Also motorbikes are a fashion commodity and this has to be borne in mind when looking to the future.

My other gamble is Pontins. Following the Rank bid for Butlins I feel that, with strong possibilities of good results for the year to end-April and renewed rumours of a suitor on the prowl, the shares will react favourably. In the first half-year pre-tax profits were up 040,000 at £3.24 million. But though the pace may be slower in the second half, 1971-72 results should at least maintain the previous progress and in the following year there is good reason to look for fresh earnings impetus.

In a way I feel the Clarkson losses could work to Pontins' advantage with its large facilities for holiday makers in this country.

Previous page

Previous page