PROPERTY: THE SPECTATOR POLL

Report by Andrew Gimson

IN THE second Spectator Poll, we set out to determine the attitude of those holding senior positions in Britain (see box) to home ownership and mortgages. The re- ceived political wisdom is not only that mortgages matter a great deal to 'owner- occupiers' (or 'borrower-occupiers', as many might be called), but that any politi- cian who dared to abolish mortgage tax relief would thereby commit electoral suicide. While the Spectator Poll does not overturn this received wisdom, it does reveal a much larger level of support for abolition or modification of mortgage. tax relief than might have been expected, amounting to very nearly a third of those polled.

But the preponderant importance of property, as the leading form of personal investment in Britain (excluding pensions), was strongly confirmed by the Spectator Poll. Two-thirds of the sample at present have a mortgage, and a further 20 per cent have had one in the past, leaving only 12 per cent who have never had one. Among younger respondents, those under 45, the proportion of current mortgage payers rises to 93 per cent: it is very rare for someone in Britain who is both young and successful to be unmortgaged. Only six of the 146 respondents owned no residential property.

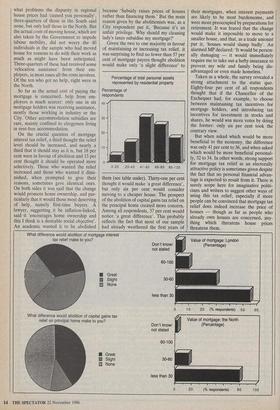

Moreover, residential property repre- sented, on average, 60 per cent of total personal wealth, excluding pension rights. This average conceals, of course, a very wide range (see table over). Property is, paradoxically, of greatest financial signifi- cance to those who have least of it. For example, for seven of the 11 individuals in the Poll whose homes were worth under £50,000, their house accounted for over 70 per cent of their personal assets, in most cases well over. For eight of the 14 individuals with houses worth more than £250,000, the house accounted for under 40 per cent.

Nearly a third of the total sample own residential property other than their prin- cipal home: the two most frequent uses of this were as a holiday house (17 people) and as a week-day place of work (13). Most respondents were keenly aware of changes in the value of their property. From their answers it could be inferred that on aver- age, over the last 101/2 years, values had risen at a flat rate of about 40 per cent a year, or at the compound rate of 15 per cent.

As might be expected, mortgages in London, the South-East and the South- West were much larger than those of respondents in the Midlands and the North (42 per cent of the sample), reflecting higher property values in the South. No- body in the North or Midlands had a mortgage of over £60,000, and only 17 per cent had one of more than £30,000, where- as nearly two-fifths of Southerners have borrowed over £30,000, including 13 per cent who have borrowed over £60,000.

It follows that to move from the North to the South must generally entail moving to a smaller house — and vice versa. Asked. what problems the disparity in regional house prices had 'caused you personally', three-quarters of those in the South said none, but only half those in the North. But the actual costs of moving house, which are also taken by the Government to impede • labour mobility, did not worry the 40 individuals in the sample who had moved house for reasons to do with their work as much as might have been anticipated. Three-quarters of these had received some `relocation assistance' from their em- ployers, in most cases all the costs involves. Of the ten who got no help, eight were in the North.

So far as the actual cost of paying the mortgage is concerned, help from em- ployers is much scarcer: only one in six mortgage holders was receiving assistance, mostly those working in industry or the City. Other accommodation subsidies are rare, mainly confined to clergymen living in rent-free accommodation.

On the crucial question of mortgage interest tax relief, a third thought the relief level should be increased, and nearly a third that it should stay as it is, but 18 per cent were in favour of abolition and 13 per cent thoUght it should be operated more selectively. Those who wanted the relief increased and those who wanted it dimi- nished, when prompted to give their reasons, sometimes gave identical ones. On both sides it was said that the change would promote home ownership, and par- ticularly that it would those most deserving of help, namely first-time buyers. A lawyer, suggesting it be inflation-linked, said it 'encourages home ownership and this I think is a desirable social objective'. An academic wanted it to be abolished because `Subsidy raises prices of houses rather than financing them.' But the main reason given by the abolitionists was, as a City respondent put it, 'Because it's an unfair privilege. Why should my cleaning lady's taxes subsidise my mortgage?'

Given the two to one majority in favour of maintaining or increasing tax relief, it was surprising to find no fewer than 57 per cent of mortgage payers thought abolition would make only 'a slight difference' to

Percentage of total personal assets represented by residential property Percentage of respondents

them (see table under). Thirty-one per cent thought it would make 'a great difference', but only six per cent would consider moving to a cheaper house. The prospect of the abolition of capital gains tax relief on the principal home created more concern. Among all respondents, 37 per cent would notice 'a great difference'. This probably reflects the fact that most of our sample had already weathered the first years of their mortgages, when interest payments are likely to be most burdensome, and were more preoccupied by preparations for retirement. It was feared that the change would make it impossible to move to a smaller house, and that, as a trade unionist put it, 'houses would slump badly'. An alarmed MP declared: 'It would be person- ally damaging — it would immediately require me to take out a hefty insurance to prevent my wife and family being dis- advantaged or even, made homeless.'

Taken as a whole, the survey revealed a strong attachment to the status quo. Eighty-four per cent of all respondents thought that if the Chancellor of the Exchequer had, for example, to choose between maintaining tax incentives for mortgage holders, and introducing tax incentives for investment in stocks and shares, he would win more votes by doing the former: only six per cent took the contrary view.

But when asked which would be more beneficial to the economy, the difference was only 41 per cent to 36, and when asked which would be more beneficial personal- ly, 52 to 34. In other words, strong support for mortgage tax relief as an electorally attractive policy is sometimes given despite the fact that no personal financial advan- tage is expected to result from it. There is surely scope here for imaginative politi- cians and writers to suggest other ways of using this tax relief, especially if more people can be convinced that mortgage tax relief does indeed increase the price of houses — though as far as people who already own houses are concerned, any- thing which threatens house prices threatens them.

Previous page

Previous page