FINANCE

EMPIRE EXCHANGES AND PRICE LEVELS

EXCHANGE rates between London and the principal British Dominions drew much attention to themselves during the earlier post-War years by a persistent disequilibrium. There was, in fact, quite a crop of suggestions for keeping them in some sort of balance, which in those days meant approximate parity with sterling. In the long run, however, considerable adjustments of rates were necessary, reflecting changed economic balances and a long period of world currency disturbance.

More recent experience almost suggests that the time of adjustment has passed, for nearly five years have elapsed since the last important alterations were made in Empire exchange rates. South Africa abandoned the gold standard at the end of 1932, and the rate for New Zealand currency against sterling was raised from to to £125 at the beginning of the following year. Since then the principal Empire rates have remained unaltered for all practical purposes, South Africa at about parity with London, New Zealand and Australia at £125 to Doc sterling, and India at just over is. 6d. per rupee.

India has continued to operate the sterling exchange standard, while the three Dominions have maintained their exchanges by the informal and arbitrary but apparently -0 efficacious adoption of a fixed rate by the banks or the monetary authorities.

The position of Canada is exceptional owing to the close affinity of Canada's economy with that of the United States, and the influence of that country's exchange on the price of the Canadian dollar.

CAPITAL MOVEMENTS.

Long-term capital movements have not played any very active part in the maintenance of Empire exchanges during the past four or five years. All the Dominions have raised loans of greater or less importance in the London market, but these operations have consisted almost exclusively of conversions. Australia, in particular, has converted many millions of debt, to the great reduction of her annual bill for interest. In the case of New Zealand, loan operations dtiring the paSt few years have resulted in an actual reduction of long-term indebtedness to this country.

On balance, India's new borrowing has been relatively small-certainly no more than might be expected from the normal adjustment of balances between any country and the centre to which its exchange is anchored. Gold shipments from India to this country remain on a con- siderable, if much reduced, scale, but the resources of the country in this respect are so great that gold movements need not enter into immediate exchange consideration.

NEW ZEALAND'S BALANCES.

Changes in New Zealand balances in this country have been rather in the opposite direction. The total declined by £12,500,000 between December, 1934, and December, 1936, and was £7,000,000 less at June 3oth last than on the corresponding date in 1936. New Zealand, however, as already noted, has been repaying loans in this country. Moreover, the impression prevailing in some quarters that the sterling value of the New Zealand pound was fixed too low in 1933 is reported to have prevented the transfer of considerable sums to London. These factors would have accounted for a large part of the decline in the London balances of New Zealand.

Devaluation of the South African pound to approximate parity with sterling was preceded at the end of 1932 by a considerable outflow of funds to London, in anticipation of the adjustment of the rate. There was a correspondingly abnormal reflux of money to South Africa early in the follow- ing year, but since that time the volume of South Africa's London funds has not shown any decided movement in one direction or the other.

. If, as appears from a general view of the foregoing, the movement of London balances of each Dominion has not been exceptional, it follows that the Empire exchanges have maintained themselves at their pre-determined levels by the normal balance of financial and trade transfers, with little impetus either way from loan operations. The fixers of the rates in each country would seem on this showing to have hit fortunately on optimum levels which are just supported by the balance of payments.

PRICE DISPARITIES.

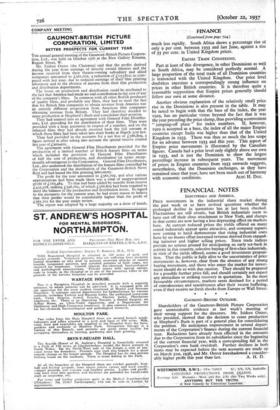

While Dominion exchanges have remained stable for nearly five years, price fluctuations in different parts of the Empire present an entirely different picture. During the period from the beginning of 1933 commodity prices in Empire countries; like those in the United Kingdom, have conformed to the general upward trend of world prices. But there has been considerable divergence in the extent of the price rise--in different parts of the British Commonwealth. These dis- crepancies are apparent from the following table of wholesale price index figures* Wholesale prices. (1929= too) Monthly average.- Per cent. increase. June, 1937,

1933. 1936. =June, 1937. over 1933.

United Kingdom 68.3 78.8 .. 91.2 .. 33.6 Australia .. 78.2 85.6 .. 94.5 .. 20.9 Canada.. .. 70.2 78.0 .. 88.5 .. 26.1 India .. 61.7 64.5 .. 72.3 .. 17.2 New Zealand .. 87.9 94.6 .. 101.7 .. 15.7 South Africa .. 80.2 85.0 .. 87.4 .. 9.o • * Extracted from The Economist.

It will be seen from this table that by far the largest per- centage rise in wholesale prices from 1933 up to June this year is shown by the United Kingdom. The only Dominion to experience any comparable advance in the price level has been Canada, although, since that Dominion is so closely linked with the United States, its direct association with the United Kingdom is comparatively slight. The explanation for this phenomenon is doubtless to be found in the fact that, despite the currency changes made in the United States in 1934, price levels in the United Kingdom and the United States have not fallen very much out of alignment over the complete period covered by the table. This correspondence between the wholesale indexes of the two countries has tended to keep Canada's index relatively close to our own.

In other parts of the Empire the price level has moved up

(Continued on page 726.)

FINANCE (Continued from page 724.) much less rapidly. South Africa shows a percentage rise of only 9 per cent. between 1933 and last June, against a rise of 33 per cent. in United Kingdom prices.

EMPIRE TRADE CONNEXIONS.

Part at least of this divergence, in other Dominions as well as South Africa, may be considered perfectly normal. A large proportion of the total trade of all Dominion countries is transacted with the United Kingdom. Our price level doubtless exercises a correspondingly strong influence on prices in other British countries. It is therefore quite a reasonable supposition that Empire prices generally should follow our own at some distance.

Another obvious explanation of the relatively small price rise in the Dominions is also present in the table. It may be noted to begin with that the base of the index, the year 1929, has no particular virtue beyond the fact that it was the year preceding the price slump, thus providing a convenient " jumping-off place " for index numbers. If, however, 1929 is accepted as a base, the index of all the major Empire countries except India was higher than that of the United Kingdom in 1933. There was thus so much the less scope for an advance between 1933 and this year. This aspect of Empire price movements is illustrated by the Canadian figures. Canada had a price level only slightly above our own in 1933, and is just the Dominion to show the largest percentage increase in subsequent years. The movement of prices in Empire countries from 1933 onwards suggests, nevertheless, that the Dominion exchanges, as they have remained since that year, have not been much out of harmony

Previous page

Previous page