Insurance today

Providing for the future

John Gaselee

With inflation continuing, despite all the efforts to contain it, not Only is there the problem of regular increases in the cost of living, but also how to make sure that savings for the future do not depreciate in value, bearing in mind not only the investment as pect, but also the tax implications.

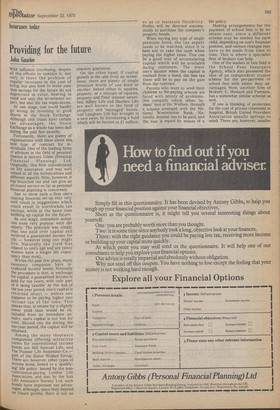

At one stage, one could hardly go wrong by investing in good Shares in the Stock Exchange. Although unit trusts have certain tax advantages, the Stock Exchange as a whole has been dull during the past few months. Fortunately, there are plenty of organisations with ideas about the, best type of contract for in dividuals. One of the leading firms of advisors in the field of personal finance is Antony Gibbs (Personal Financial Planning) Ltd. Originally, this firm concentrated on life assurance, and was weli versed in all the technicalities and different aspects. Now, however, it has branched out and can give an all-round service so far as personal financial planning is concerned.

Just to show such a firm one's existing financial set-up may very well result in suggestions which could result in worthwhile tax savings, while at the same time building up capital for the future.

At one stage, immediate annuities were very popular with the elderly. The principle was simply that one paid over capital and received a guaranteed income for life — however long one might live. Naturally the yield was related to one's age and sex (since women have a longer life expectancy than men).

Within the past few years, many insurance companies have In troduced income bonds. Normally the procedure is that, in exchange for capital, a guaranteed income is paid for ten years, with only part of it being taxable. At the end of the ten-year period, one's capital is returned intact — unless one happens to be paying higher rate income tax at the time. This means that, in return for a slightly lower yield than would be obtainable from an immediate annuity, one's capital is not lost for ever. Should one die during the ten-year period, the capital will be returned, Among the many insurance Companies offering attractive terms for conventional income bonds are Hill Samuel Life, and The Pioneer Life Assurance Co — Part of the Slater Walker Group. There are, however, other types of income bond, linked to a 'qualifylog' life policy. Issued by the noncommission-paying London Life Association, and also by the Sun Life Assurance Society Ltd, such bonds have important tax advantages, although, since they depend on future profits, there is not an absolute guarantee.

On the other hand, if capital growth is the aim from an investment, there are plenty of single premium bonds of one kind or another, linked either to equities, property, or a mixture of equities, property and fixed interest securities. Abbey Life and Hambro Life are well known in the field of property and 'managed' bonds, and Langharn Life has brought in a new twist, by introducing a fund which will be limited to El million, so as to maintain flexibility. Profits will be directed automatically to purchase the company's property bonds.

When buying any type of single premium bond, the tax aspect needs to be watched, since it is best not to take the cash when paying the higher rates. This can be a good way of accumulating ' capital which will be available during retirement. The lower one's income when the capital is realised from a bond, the less tax there will be to pay on the gain from the contract.

Parents who want to send their children to fee-paying schools are faced with plenty of problems. One company. which offers 'instant' fees is' the Welfare, through a, Scheme arranged with the t%4tional Westminker Bank. Naturally, interest has to be paid, and the loan is repaid by means of a

life policy.

Making arrangements for the payment of school fees is by no means easy, since a different scheme may be needed for each child, depending on one's financial position, and various changes may have to be made from time to time. This is where a specialist firm of brokers can help.

One of the leaders in this field is the School Fees Insurance Agency, which also pioneered the idea of an independent trustee sch6me for the pre-payment of school fees with estate duty advantages. Now, another firm of brokers, C. Howard and Partners, has a somewhat similar scheme as well.

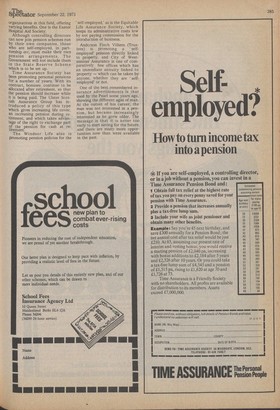

If one is thinking of protection for the cost of private treatment in hospital, British United Provident Association usually springs to mind. There are, however, smaller organisations in this field, offering varying benefits. One is the Exeter Hospital Aid Society. Although controlling directors can now join pension schemes run by their own companies, those Who are self-employed, in partnership etc, must make their own Pension arrangements. The Government will not include them in the State Reserve Scheme Which is to be set up.

Time Assurance Society has been promoting personal pensions for a number of years. With its contract, bonuses continue to be allocated after retirement, so that the pension should increase while it is being paid. The Ulster Scottish Assurance Group has introduced a policy of this type Which gives increasing life cover, an increasing pension during retirement, and which takes advantage of the right to exchange part Of the pension for cash at re tirement.

The Windsor Life also is Promoting pension policies for the self-employed,' as is the Equitable Life Assurance Society, which keeps its administrative costs low by not paying commission for the introduction of business.

Anderson Finch Villiers (Trus

tees) is promoting a ' selfemployed' pension directly linked to property, and City of Westminster Assurance is one of comparatively, few offices which has an immediate annuity linked to property — which can be taken by anyone, whether they are selfemployed' or not.

One a the best remembered insurance advertisements is that used by the Pearl some years ago,' showing the different ages of man. At the outset of his career, the man was not interested in a pension, but became increasingly interested as he grew older. The message is that it is never too early to start saving for the future, and there are many more opportunities now than were available in the past.

Previous page

Previous page