Investment Notes

By CUSTOS

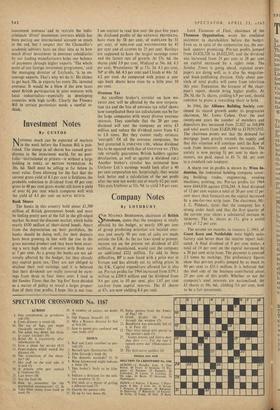

OTIIING much can be expected of markets in the week before the Finance Bill is pub- lished. The slump in oil shares has caused great distress to the investment world, for no port- folio-institutional or private-is without a large holding in SHELL or BRITISH PETROLEUM. At 30s. 6d. Shell must be selling at far below its asset value. Even allowing for the fact that the current gross yield of 8.3 per cent is fictitious, the probable reduction in dividend from 49 per cent gross to 40 per cent gross Would still leave a yield of over 64 per cent which compares well with the yield of 4.1 per cent on ROYAL DUTCH.

Bank Shares

The banks in this country hold about £1,500 million of British government bonds and must be feeling pretty sore at the fall in the gilt-edged market. So must the discount market, which holds nearly £430 million of short-dated bonds. Apart from the depreciation on their portfolios, the banks should be doing well, for their deposits have been growing in line with the rise in the gross national product and they have been secur- ing a very high rate of interest with Bank rate at 7 per cent. As a group the banks are not ad- versely affected by the budget, for they already pay capital gains tax. They are not obliged to disclose their real earnings and it is believed that their dividends are really covered by earn- ings from three to four times over. I read in the Sunday Times that the 'big five' have decided as a matter of policy to reveal a larger propor- tion of their true profits. I hope this is not true. 1 am content to read that over the past five years the disclosed profits of the NATIONAL PROVINCIAL have risen by 58 per cent, of BARCLAYS by 51 per cent, of MIDLAND and WESTMINSTER by 45 per cent and of LLOYDS by 25 per cent. Barclays are supposed to have the largest earnings cover and the fastest rate of growth. At 57s. 6d. the shares yield 3.9 per cent, Midland at 54s. 6d. 4.3 per cent, Westminster 'B' at 57s. 3d. 4.1 per cent, NP at 69s, 6d. 4.5 per cent and Lloyds at 44s. 3d. 4.2 per cent. As compared with prices a year ago bank shares have risen by a little over 10 per cent.

Overseas Tax

An excellent broker's circular on how RIO TINTO ZINC will be affected by the new corpora- tion tax and the loss of overseas tax relief shows how complicated these tax calculations can be for the large companies with many diverse overseas interests. They conclude that the 20 per cent dividend will cost the company an extra £3 million and reduce the dividend cover from 4.2 to 1.8 times. But they cannot really estimate `overspill.' Of all the overseas companies, the best protected is UNILEVER LTD., whose dividend has to be equated with that of UNILEVER NV. (This rule virtually guarantees British holders against, devaluation, as well as against a dividend cut.) Another broker's circular has estimated bow Unilever Ltd.'s earnings would look after a 40 per cent corporation tax. Surprisingly, they would look better and a calculation of the net profit after the new tax works out at nearly 62 per cent. This puts Unilever at 32s. 9d. to yield 3.8 per cent.

Previous page

Previous page