THE . MONEY MARKET.

STOCK EXCHANGE, FEIDAY EVENING.—This has been a very stormy week here, and the events of it are well calculated to confound all who pretend to the gift of

prophecy in affairs of Stock. The October Account was apparently so well settled

last week, and the news from abroad so far favourable, that we really began to hope that some improvement was about to follow, and the closing of Saturday's Market at 84 to 87, seemed to confirm, or at least to encourage such hopes. Nor did the transactions of Monday appear to lead far from the same conclusion; for the lowest price of that day for Consols was HI and the closing one 861. On Tues- day, however, the case became widely different ; and it was very soon evident that somebody was selling largely, although nobody pretended to know exactly who or why. The first price of that day was 861, and the closing one, Without the slightest re-action, 85/.. On Wednesday the opening price was 85/, from which it fell Ohnost immediately to 841. A reaction then occurred, and Consols touched 84/ bat almost instantly fell again to 84, and ultimately to 83.1; from whence it ascended to 841 and closed at 84. Yesterday the opening price was 831, after which it rose, with some fluctuations, to 84/, then fell to 84, and a little before four o'clock descended to 831. To-day the first price was 831, and immediately after advanced to 84.1, and by mid-day to 84} ; it then fell to 841 rose to 841, and closed at 841. All the Heavy Stocks are now open, and have followed the fate of Consols in all its fluctuations ; but the most remarkable fact is a fall in India Bonds and Exchequer Bills, which have been done at lower rates than for several yews past ; viz. Exchequer Bills 32s. and India Bonds 25s. prem. yesterday, although to-day rather higher, viz. for Bills 40 to 43, and for Bonds 33. Money is understood to be more scarce out of doors than usual ; but no difficulty has been experienced in obtaining loans on Stock at very moderate rates of interest. Having thus stated briefly the history of the week's transactions, it may be ex- pected that we should offer a few observations upon their causes. But here we candidly confess ourselves to be wholly at fault, and amidst a thousand theories, do not happen to have any particularly our own. All that we can venture is to state a few general facts, and leave to our readers the task of comparing or reasoning upon them. In the first place, it seems an admitted fact that that portion of the holders of Stock usually denominated Bulls, or speculators for a rise, whether with their own or their neighbour's money, are now thoroughly alarmed, and have been selling largely, or in the phrase, "getting out." It is also nearly as certain that the Lona fide holders of Stock are not yet alarmed, and have brought no large amount to market ; and, on the other hand, a very considerable Sum has been taken off the market in small amounts for the public. It is not doubted that the policy of Govern- ment will be non-interference to the letter, that reductions of expenditure will be attempted, and that other measures will be brought forward to appease or pre- vent discontent. On the other hand, the confusion of public affairs abroad has operated ruinously to all commercial enterprises, and pecuniary distress and embar- rassment is spreading so rapidly in France, Germany, and elsewhere, that it cannot fail to react most injuriously here at home, by the losses it must inflict on our mer- chants. This prospect has made our bankers unusually circumspect in their opera- tions of late ; and even the Bank is suspected of curtailing its issues from fear of a fall in the Exchanges. In the Foreign Market the price of every description of security has fallen with Consols, although now a little higher. Russian was done at 941, Danish at 601, Brazilian at 601, and the other South American Bonds are all at wretchedly low prices : Spanish alone kept its ground at or near 22, the hopes of the holders baying been greatly strengthened by news of the Constitutionalists having passed the frontiers. To-day, however, upon a report of one of their divisions having been cut off, the price fell to 101; and although now higher, viz. 201, yet we have no great confidence in the stability of this last price, looking to the effect which such repeated disappointments must have on the nerves and patience of the holders.

In the Share Market there has been little or no business ; but what there has been, has been at lower prices.

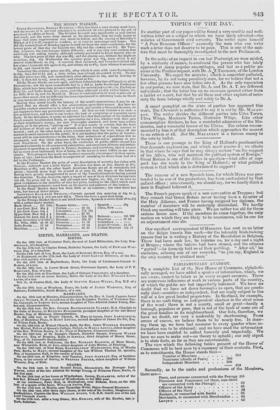

SATURDAY HALF-PAST TWELVE.—COBSOls opened this morning at 84} to a, advanced to 841 to f, and are now 841/. There has been a good deal doing. In the Foreign Market there is not much business; Spanish is about from 20 to 20.1 with a rather heavy market. - Bank Stock .... 211 2101 Buenos Ayres... — Spanish . 201

3 per Cent. Red. 831 Chilian ... 22 24 Ditto, New ..... 3 per Cent. Cons. 84s k Colombian ..... 17/ 381

31 per Cent. New 941 Danish...... .. 61 62 Consols for Acct. 841 1 Greek... 28/ 29f Bolanos ..... 195 200 Long Annuities 17 9-16th g- Mexican ....... 361 37 Brazilian . 62 64 Ex. Bills, 10001. 43 40 42 Peruvian ....... 15 16 Columbian ... . —

India Bonds .... 37 38 Portuguese ..... 52 54 Anglo Mexican.. 34 35

Brazilian....... 62 4 Russian........ 96 97 United Mexican 121 13

SHARES.

Previous page

Previous page