Market Notes

By CUSTOS

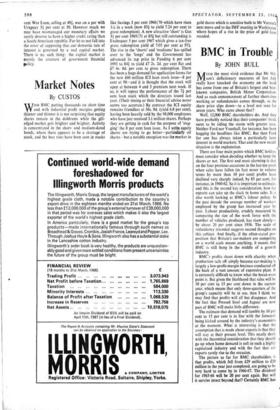

WITH BMC putting thousands on short time and with industrial profit margins getting thinner and thinner it is not surprising that equity shares remain in the doldrums while the gilt- edged market gets brighter and brighter. Activity is concentrated in the short- and medium-dated bonds, where there appears to be a shortage of stock, and the best rises have been seen in stocks

like Savings 3 per cent 1960/70 which have risen He in a week (now 851 to yield 7.24 per cent to gross redemption). A new attractive 'short' is Gas 31 per cent 1969/71 at 851 but still outstanding is Exchequer 5 per cent 1967 which gives a tax-free gross redemption yield of 7.05 per cent at 971. The rise in the 'shorts' and 'mediums' has spilled over to the 'longs' and the Government has advanced its tap price in Funding 6 per cent 1993 to 841 to yield £7 2s. 2d. per cent flat and £7 6s. 8d. per cent to gross redemption. There has been a huge demand for application forms for the new £60 million ICI loan stock issue-8 per cent at 98—and it is thought that the stock will open at between 4 and 5 premium next week. If so, it will repeat the performance of the 7+ per cent loan stock which the directors issued last year. (Their timing or their financial advice never seems too accurate.) By contrast the ICI equity remains friendless at 36s. 9d. (yield 6.8 per cent), having been heavily sold by the 98,000 employees who have just received 3.1 million shares. Perhaps they are getting in cash for the purpose of 'stag- ging' the 8 per cent loan issue. As I write equity shares are trying to go better—particularly oil shares--but a notable exception was the market in gold shares which is sensitive both to Mr Vorster's next move and to the IMF meeting in Washington where hopes of a rise in the price of gold have receded.

Previous page

Previous page