COMPANY NOTES

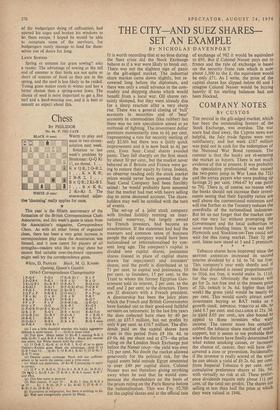

BY CUSTOS THE revival in the gilt-edged market, which has been the outstanding feature of the Stock Exchange, was overdue. The war scare had died away, the Cyprus news was helpful, the July trade figures were very satisfactory, and last week £167 million was paid out in cash for the redemption of the National War Bond remnant. The rumour is that the banks are re-entering the market as buyers. There is not much evidence of this at present. It was probably the speculative professional who caused the two-point jump in War Loan (to 720 and the surtax payers who were pushing up Savings 21 per cent. 1964-67 by one point to 79i. There is, of course, no reason why the banks should not increase their invest- ments seeing that their liquidity ratios are well above the conventional minimum and will rise further as the Treasury reduces the overdrafts of the nationalised industries. But let us not forget that the market can- not rise very far without prompting the Government and the local authorities to issue more funding loans. It was sad that Plymouth and Stockton-on-Tees could not wait for this rising market. Their 5+ per cent. loans now stand at 3 and 2 premium.

Tobacco shares have improved since the BRITISH AMERICAN increased its second interim dividend by a Id. to 7d. tax free. This company's year ends shortly and If the final dividend is raised proportionately to 101d. tax free, it would make Is. 111d. for the year. Obviously the market will go for 2s. tax free and at the present price of 52s. (which is 3s. 6d. higher than last week) the gross yield would be nearly 6+ per cent. This would surely attract some investment buying as BAT ranks as a growth stock. IMPERIAL TOBACCO at 48s, to yield 8.7 per cent. and GALLAHER at 21s. 3d. to yield 8.05 per cent., are also bound to appeal to those investors who want income. The cancer scare has certainly robbed the tobacco share market of much support, but it seems to me probable that when the doctors have finally determined to what extent smoking causes, or increases the chance of, cancer, they will have dis- covered a cure or prevention. Incidentally' if the investor is really scared of the scare he can obtain a yield of £6 2s. 6d. per cent. from Imperial Tobacco 6 per cent. non- cumulative preference shares at 18s. 9d. with virtually no risk at all. These prefer- ence dividends require only about 112 Per cent. of the total net profits. The shares are selling at less than half the price at which they were valued in 1946.

Previous page

Previous page