THE CITY-AND SUEZ SHARES SET AN EXAMPLE

BY NICHOLAS DAVENPORT IT is worth recording that at no time during the Suez crisis did the Stock Exchange behave as if a war were likely to break out. There was not the slightest sign of panic in the gilt-edged market. The industrial share market came down slightly, but re- covered long before the diplomats, and there was only a small advance in the com- modity and shipping shares which would benefit from a local war. Oil shares cer- tainly slumped, but they were already due for a sharp reaction after a very sharp rise. There was a general closing of 'bull' accounts in securities and of 'bear' accounts in commodities (like rubber) but there was no new speculation aimed at an outbreak of fighting. The investment dollar premium momentarily rose to 61 per cent. (representing a rate for security sterling of only $2.60) but there was a fairly quick improvement and it is now back to 4+ per cent. Even Suez Canal shares avoided panic. They fell sharply on the first shock by about 30 per cent., but the market never behaved as if Britain and France were go- ing to restore their equity by force. Indeed, an observer reading only the stock market prices would never have guessed that the Suez Canal Company had been forcibly seized: he would probably have assumed that the market had met with heavy selling due to some deceased account. The share- holders may well be satisfied with the turn of events.

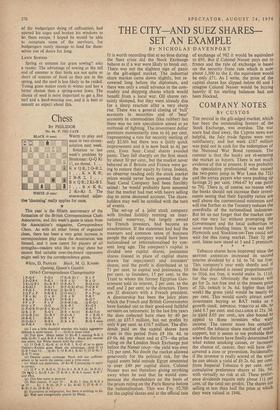

The set-up of a joint stock company with limited liability running an inter- national waterway, but largely owned by French investors, had become an anachronism. If the statesmen had had the manners and common sense of business people the old company would have been nationalised or internationalised by con- sent long ago. The company's capital is divided into capital shares, jouissance shares (issued in place of capital shares drawn for repayment) and founders' shares, and the profit is distributed as to 71 per cent. to capital and jouissance, 10 per cent. to founders, 15 per cent. to the Trust to whom the former Egyptian Gov- ernment sold its interest, 2 per cent. to the staff and 2 per cent, to the directors. There are 32 directors with a French president. A directorship has been the juicy plum which the French and British Governments have handed out to their good-and faithful servants on retirement. In the last five years the dues collected have risen by 40 per cent. to £37.3 million, but net profits by only 6 per cent. to £10.7 million. The divi- dends paid on the capital shares have risen in this period from £8 10s. 4d. to £9 Os. 4d. per share and at £73-the price ruling on the London Stock Exchange just before the Nasser coup-the yield was over 12+ per cent. No doubt the market allowed generously for the political risk, for the liquid assets held outside Egypt amounted to over £40 per capital share. Colonel Nasser was not therefore giving anything away when he said that he would com- pensate the shareholders on the basis of the prices ruling on the Paris Bourse before the nationalisation. This was Frs. 92,700 for the capital shares and at the official rate

of exchange of 982 it would be equivalent to £93. But if Colonel Nasser pays out in francs and the rate of exchange is based on the security franc rate which is now about 1,300 to the £, the equivalent would be only £71. As I write, the price of the capital shares has slipped below 60 and I imagine Colonel Nasser would be buying heavily if his sterling balances had not been blocked.

Previous page

Previous page