Account gamble

Hopes for Homfray

John Bull

The current climate of the market is most unhealthy for the speculator. On the one hand economic growth prospects look much better while on the other we are faced with the possibility of strikes by just about every major union. So what happens to shares? They move sluggishly lower. Yet I usually find that this state of affairs doesn't last long and I am hopeful that the Government's tough measures will succeed. In fact I am sufficiently optimistic this week to recommend the purchase of Homfray, whose results are due on February 26.

Last results were somewhat disappointing for Homfray because while most other carpet manufacturers were doing much better its results were unchanged. However, after missing out on last year's boomlet Homfray looks assured of doing better this time. For one thing the group has raised its prices and it should not be so troubled by such factors as reorganisation of various plants and installation of the carpet printer as it was last year.

In fact with carpets sales running some 17 per cent higher in the first quarter of the current year I am expecting to see at least a 10 per cent growth in pre-tax profits this year. On this basis earnings should work out at around 9.6p against 8.2p so at the current level of '76p the share are on a prospective PE ratio of 7.9 and yield 8.2 per cent. Even for income alone, therefore, the shares have definite attractions. And I expect the market will wake up to Homfray when it sees the interim figures.

In conclusion this week should any readers who followed my advice and bought Thomas Firth and John Brown (my share of the year) be wondering whether or not to take profits after seeing the shares come up from 224p to 250p, the answer is no. In fact, my sources of information tell me that GKN is now looking closely at the current bid battle in which Firth is engaged. There is definitely more to go for.

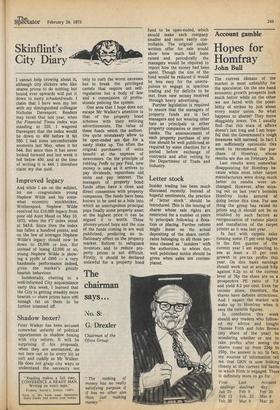

First Last Account

dealings dealings day Jan 29 Feb 9 Feb 20 Feb 12 Feb. 23 Mar 6 Feb 26 Mar 9 Mar 20

Previous page

Previous page