Portfolio

Down under

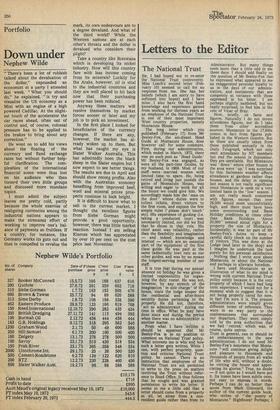

Nephew Wilde

"There's been a lot of rubbish talked about the devaluation of the dollar," expounded an economist at a party I attended last week. "What you should do," he explained, "is try and visualise the US economy as a Mini with an engine of a high powered Cadillac. At the slightest touch of the accelerator the car races ahead, often out of control and, of course, colossal pressure has to be applied to the brakes to bring about any correction."

He went on to add his views about the floating of the currency and fixed exchange rates but without further helpful clarification. The complexities of the international financial scene were thus lost on his audience who then formed their own little groups and discussed more mundane topics.

I must admit the subject leaves me pretty cold, partly because the whole exercise of realigning currencies among the industrial nations appears to make the strenuous effort of working to improve one's balance of payments so fruitless. If a country, for instance, like Germany works its guts out and then is compelled to revalue the mark, its own endeavours are to a degree devalued. And what of the third world? While the Western nations are at each other's throats and the dollar is devalued who considers their plight?

Take a country like Botswana which •is developing its nickel industry. How will this country fare with less income coming from its minerals? Luckily for the Arabs, however, oil is vital to the industrial countries and they are well placed to hit back now that their purchasing power has been reduced.

Anyway these matters will resolve themselves by market forces sooner or later and my job is to pick an investment.

In the first place I looked for beneficiaries of the currency changes. If there are any, however, the market has already woken up to them. But what has caught my eye is Slater Walker Australia. This • has admittedly been the black sheep in the Slater empire but I now expect to see better things. The results are due in April and should show record profits. Also with the Australian economy benefiting from improved beef, wool and mineral prices prospects continue to look bright.

It is difficult to know what to sell in the current market. I thought the excellent figures from Siebe Gorman might provide a good opportunity, however, there was little market reaction. Instead I am selling Kinross which has appreciated by over 10 per cent on the cost price last November.

Previous page

Previous page