INVESTMENT NOTES

By CUSTOS

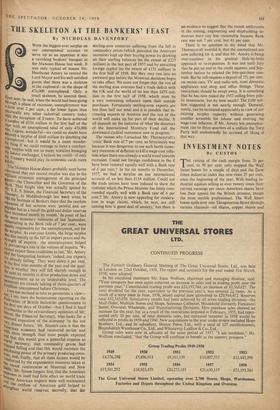

THE raising of the cash margin from 70 per cent. to 90 per cent. only stopped the Wall Street boom for a couple of days and the Dow Jones industrial index has now risen 25 per cent. since the beginning of the year. With leading in- dustrial equities selling at over twenty times their current earnings per share American shares have lost their appeal for the British investor, except the most nimble professional. The Wall Street boom spills over into Throgmorton Street through various channels—oil shares, copper shares and even South African gold shares. I have just been reading an American broker's circular recom- mending the purchase of SHELL as being the cheapest of the international oil equities quoted on Wall Street. American. buying has pushed up Shell to 163s. 6d. and as the gross yield at this price is still over 4 per cent. (compared with 2.4 per cent. on SHELL on., the American subsidiary) there is still scope for a further rise. BURMAH OIL has yet to decide what to do with its 100 per cent. bonus on BRITISH PETROLEUM. It now has 53,429,850 British Petroleum •shares (valued in the market at 56s. ex bonus) and 3,339,660 Shell shares against an issued ordinary capital of 41,209,540 shares, which are quoted today at 86s. 3d. As today's value of Burmah's holdings of BP and Shell works out at 85s. 10d, per share, the market is valuing the oil trading side. of Burinah at only 5d. per share, which is absurd. Sooner or later Burmah Oil must face Lip to the fact that its whole structure has become lopsided. , The best thing it can do is to form a holding com- pany for its oil investments and distribute the shares of this holding company to its own share- holders as a bonus.

From Cunard to Wallpaper and Lewis's Although the Governor of the Bank poured some cold water on the Stock Exchange boom in his speech at the Mansion House dinner, the market has gone merrily ahead, with an increas- ing turnover. Great care should now be takcn, for the boom shows signs here and there of losing its sense of proportion. It was foolish to ignore the passing of the interim dividend by CUNARD (except by Marking the shares down temporarily), and I would suggest a sale of these shares at 20s. 6d. and an exchange into a domestic trade equity like WALLPAPER, which has raised its dividend from 25 per Cent. to 27+ per cent. and declared a one- for-two scrip bonus. If the company distributes, say, 20 per cent. next year on the enlarged capital, as the more optimistic expect, the shares at the current price of 113s. 3d. cum bonus will return a yield of 4.4 per cent., which is attractive fora share of this quality. .A purchase of Wallpaper might be combined with one of LEWIS'S INVEST- MENT TRUST which has just declared a one-for- four scrip bonus. Last year Lewis's Investment paid a dividend of 17 per cent, out of earnings of 54 per cent, and if they were to pay, say, 15 per cent, on the enlarged capital, which is not at all impossible, as the interim dividend has been in-

creased, the shares at the present price of 18s. 6d. cum bonus would return a potential yield of just over 4 per cent. This again is an attractive return

for a share which is usually on a yield basis of 34 per cent.

Capseals For the small investor the small company is not usually to be recommended as a suitable investment, for continuity of management efficiency is not as assured as it is with the large combine, but from time to time exceptions can be found. For example, I hear well of CAPSEALS, which has a capital of only £100,000. This is a company which manufactures all types of liners for the bottle-cap trades. It is one of the largest producers in this country of milk-bottle discs and its other products cover a wide range of tubes and containers used in packaging; it also makes cable reels for the electrical cable industry. For the year ended December its trading profits were 20 per cent, up and its earnings amounted to 69 per cent. on capital which had been doubled by the 100 per cent. scrip bonus of June, 1957. A conservative dividend policy is being pursued, the dividend being 25 per cent. As the -carry-forward, was equivalent to 110 per cent. pf the capital and the net tangible assets to 210 per cent, there must soon come a time when another scrip bonus is given or the dividend policy made more liberal. At 3s. 9d. the Is. shares return a yield of just under 7 per cent. Unfortunately no interim dividend is paid and the next dividend will be declared in May.

Previous page

Previous page