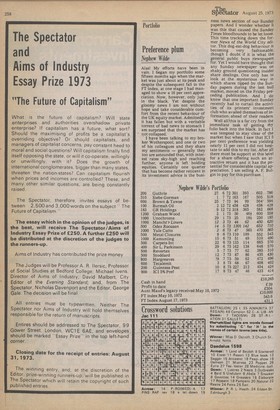

Preference plum

Nephew Wilde

Alas! My efforts have been in vain. I began my portfolio some fifteen months ago when the market was just about at its peak and despite the subsequent fall in the FT index, at one stage I had managed to show a 16 per cent ,appreciation. Now, however, only just in the black. Yet despite the gloomy news I am not without hope and take considerable comfort from the recent behaviour of the UK equity market. Admittedly it has fallen but with a veritable torrent of bad news to stomach am surprised that the market has not collapsed. • I have been talking to my broker Wotherspool, and one or two of his colleagues and they share my sentiments — generally they too are astounded that, with interest rates sky-high and reaching further, anyone is left holding equities. Certainly one quarter that has become rather reticent in its investment advice is the busi

ness news section of our Sunday papers, And I wonder whether it was this that caused the Sunday Times bloodhounds to be let loose. This time tracking down the former News of the World City editor. This dog-eat-dog behaviour is becoming very fashionable, though I doubt if it is what the general public buys newspapers for. Yet I would have thought that any Sunday newspaper was ori shaky ground questioning insider share dealings. One only has to look at the mysterious way in which shares tipped by the Sunday papers during the last bull market, moved on the Friday preceding publication. And I do know that one important Sunday recently had to curtail the activities of its printers' investment club who availed themselves of infOrmation; ahead of their readers.

Well all this is a far cry from the immediate task of getting MY folio back into the black. In fact 1 was tempted to stay clear of the market but when I saw that ICI 5 per cent preference was yielding nearly 11 per cent I did not hesitate to add this to my list. After all there must be support at this level for a share offering such an attractive return and it has the potential for considerable capital appreciation. I am selling A. F. Bulgin to pay for this purchase.

Previous page

Previous page