Barclays Meeting

SPEECH BY MR. WILLIAM FAVILL TUKE.

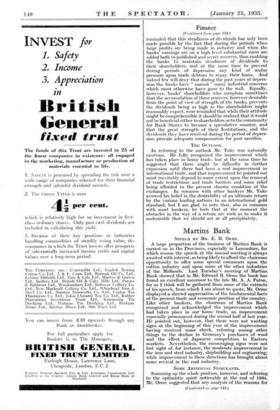

It is an unusual and it is certainly a sad experience' for two of the leading Banks to lose, by death, their chairmen within the course of a few months. Such, however, has been the experience during the past year both of Barclays and Martins Banks. As was fitting, therefore, Mr. William Favill Tuke, the new chairman of Barclays Bank, prefaced his remarks with a tribute to his predecessor' the late Mr. Frederick Craufurd Goodenough, while Mr. Orme, at the meeting of Martins Bank, referred to the great loss the bank had sustained in the death of Mr. A. A. Paton, chairman since 1929.

I consider both Mr. Tuke and Mr. Orme are to be congratulated upon their maiden speeches as chairmen of their respective institutions. I shall comment upon Mr. Orme's speech when dealing later with the meeting of Martins. Bank, but as regards the speech of Mr. Tuke to the shareholders of Barclays Bank I consider that its outstanding feature was the skilful manner in which he took not only shareholders but the general public into confidence with regard to the general nature of (Continual on page 138.)

Finance

(Continued from page 136.) the bank's business. I do not know whether Mr. Tuke had or had not in his mind sonic of the attacks on the banks to which I have already referred, but if he had he would probably have felt that the only possible danger in such attacks was to be found in the imperfect- knowledge of the general public with regard to the functions of banking, and consequently he was at some pains to explain those functions in quite simple fashion. There is unfortunately too often an idea in the minds of the public that the banks control many millions of resources which it is also supposed they are free to use in any manner which may seem desirable, and it is often affirmed that the best interests of the country might be served through the banks lending to industry at exceed- ingly low rates.

FUNCTION OF THE BANKS.

These ideas, of course, leave entirely out of considera- tion such facts as that the banks are merely trustees for the depositors for the sums placed with them, and -also that these sums would not be so deposited if there were not a perfect assurance of their being available at any time on demand. Consequently it behoves the banks to use the money in such a way that they shall always be able to have sufficient cash at their command to meet the demands of the depositors, and to produce a balance-sheet which shall convince the depositor that the deposits are not locked up in long term advances, but are placed in directions from which they can easily be converted into cash. And yet again the public too often imagines that the banks are used for the most part by large capitalists placing huge sums on deposit or current account, while it is also the often assumed that the shareholders consist of a small body of wealthy persons receiving extraordinarily high dividends. And finally the idea prevails that because bank dividends vary very little the banks consequently are little con- cerned with the prosperity or adversity of the country.

Sousa PLAIN FACTS.

It was doubtless with a full recognition of these misconceptions on the part of the public that Mr. Tuke, instead of inveighing against any proposals for nationaliza- tion, preferred quietly to set out some of the actual functions and responsibilities connected with his own institution. Thus, for example, when mentioning that advances to customers had increased during the year he emphasized the fact -that the bank had approximately 200,000 customers borrowing from it in one form or another. " I mention this fact," he said, " because from time to time suggestions are made that the banks are not sufficiently interested in the smaller borrower. This is not true, for the interests of a modern bank are so closely interwoven with the economic life of the whole country that there is no section with which it is not intimately concerned." And then by way of refuting the idea that banking depositors represent a very small section of the community and that the shareholders were a small body of wealthy people, Mr. Tuke said. with regard to his own bank, " we have over 1,500,000 customers, a staff of 12,700, and approximately 60,000 shareholders,- and we are, therefore, directly or indirectly in contact with and carry responsibilities towards a substantial portion of the adult population of this country." " I might mention," he added, " that these figures are exclusive of those of our affiliated institutions."

BANKERS' PROFITS.

After explaining the extent to which the banks were directly affected by the prosperity or otherwise of the country as a whole, Mr. Tuke then dealt with the question of the steadiness of bank dividends, and in that connexion he may be said to have addressed himself both to the Socialistic critics who object to the steadiness of the dividends and to those shareholders who consider that more of the bank's profits should be distributed in the shape of dividends. The former class of critic was (Continued on page 140.)

Finance

(Continued from page 138.)

reminded that this steadiness. of_dividencis has only been made possible by the fact that during the periods when large profits are being made in industry and when the banks' earnings are on a high level substantial sums are added both to published and secret reserves, thus enabling the banks to maintain steadiness of dividends to their shareholders, and at the same time to 'prevent during periods of depression any kind of undue pressure upon .trade debtors to repay their loans. And indeed few will deny that during the past years of depres- sion the banks have " nursed " many industrial concerns which must otherwise. have gone to the wall. Equally, however, banks' shareholders who complain sometimes that the accumulation of these reserves, however desirable from the point of view of strength of the banks, prevents the diVidends being as high as the shareholders 'night reasonably expect, were reminded that while their attitude might be comprehensible it should be realized that it would not be beneficial either to shareholders or to the community for Bank Shares. to become a speculative counter, and that the great strength of their Institutions, and the dividends they have received during the period of depres- sion provide adequate compensation for past sacrifice.

THE OUTLOOK.

In referring to the outlook Mr. Tuke was naturally cautious. He fully recognized the improvement which has taken place in home trade, but at the same time he suggested that there might be difficulty in further expansion until there had been a real improvement in international trade, and that improvement he pointed out must inevitably depend to some extent upon the removal of trade restrictions and trade barriers and some relief being afforded to the present chaotic condition of the exchanges. In common with other bankers Mr. Tuke avowed his belief in the desirability -of an ultimate return by the various leading .nations to an international gold standard, but I am glad to note that, also in common with most bankers, he feels that at the moment the obstacles in the way of a return are such as to make it undesirable that we should act at all precipitately.

Previous page

Previous page