Martins Bank

SPEECH BY MR. E. B. ORME.

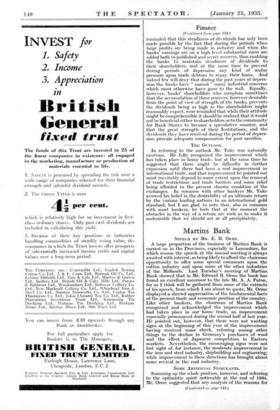

A large proportion of the business of Martins Bank is carried on in the Provinces, especially in Lancashire, for which reason the speech at the annual meeting is always awaited with interest, as being likely to afford the chairman opportunity to offer some special comments upon the cotton industry and upon some of the other industries of the Midlands.. Last Tuesday's meeting of Martins Bank showed that in Mr. Edward B. Orme the bank has found an excellent successor to the late Mr. A. A. Paton, for as I think will -be gathered limn some of the extracts of his speech, from which I am about to quote, Mr. Orme displayed a shrewd appreciation of the fundamental-facts of the present trade and economic position of the country. Like other bankers, the chairman of Martins Bank recognized and acknowledged the improvement which had taken place in our home trade, an improvement especially pronounced during the second half of last year. He pointed out, however, that there were not wanting signs • at the beginning of this year of • the improvement having received some cheek, referring among other things to the decline in Germany's purchases of wool and the effect of Japanese competition in Eastern markets.. Nevertheless, the encouraging signs were not lost sight of, for instance; 'the 'moderate improvement in the iron and steel industry, shipbuilding 'and. engineering; while improvement. in these directions has brought about some revival in the coal industry. : Son ARTIFICIAL. STIMULANTS.

Summing up the whole position,- however,- and referring to the optithistic spirit noticeable at the end of 1984, Mr. 'Orme suggested that any analysis of the reasons for

(Continued on page 142.)

Finance

(Continued from page 140.) optimism disclosed the fact that it was mainly due to improvement in our internal trade; and, moreover, that such trade had been fostered by a measure of pro- tection by quotas, agreements, and schemes of various kinds. "These movements," said Mr. Orme, " have no doubt benefited the country at any rate temporarily but the United Kingdom lives by international trade, and until this flows freely it is useless our expecting a return to that abundant prosperity we have enjoyed in the past." Mr. Orme then drew attention to the extent to which the decline in international trade might be associated with the practical cessation of international lending by the -great creditor - countries. Millions of pounds which formerly were diffused annually over the world in the form of foreign loans are now withheld, while gold itself is stored and sterilized in vaults in France and America or hoarded privately elsewhere. Thus, what formerly was regarded as the basis of credit and an increase in the holding of which permitted legitimate expansion in credit is now no longer functioning. The problem therefore of how to bring about distribution of gold throughout the world, said Mr. Orme, is still with us, and, he added, " Is it too much to hope that America will take the first step in this direction by lowering her tariffs to an extent which will allow those countries starved of gold to trade with her and so restore to the world the free movement of goods, services, capital and credit ? "

BANKS AND THEIR CUSTOMERS.

With regard to Martins Bank itself Mr. Orme had only to appeal to the Annual Report and Balance-Sheet as testifying to the great liquidity of the position. He added; however, a few remarks by way of reply to uninformed criticism. Dealing with the charge sometimes made of banks favouring the larger customer at the expense of the smaller, Mr. Orme declared that nothing could be further from the facts, and by way of proof he stated that no less than 87.7 per cent. of the Bank's borrowing customers had overdrafts of £1,000 or less and 9.17 per cent. between £1,000 and £5,000. In other words the large borrower accounts for a very small percentage of the whole, and, added Mr. Orme, " we prefer this because we like our risks to be well spread." And, finally, when touching upon the type of criticism which appears to resent the prosperity of the banks and their ability to maintain dividends, the Chairman of Martins Bank remarked that while the meeting was about to approve a dividend at the rate of 14 per cent. per annum, the return on the £1 shares at the present price represented the modest figure of £8 8s. per cent. or on the partly-paid shares 18 18s. per cent. " It must be remembered," said Mr. Orme, " that the dividend represents not only the earnings of capital but also the earnings of reserves, which have taken over one hundred years to accumulate." That is a point which is now being made by most of the Banks, and it is a fair one.

Previous page

Previous page