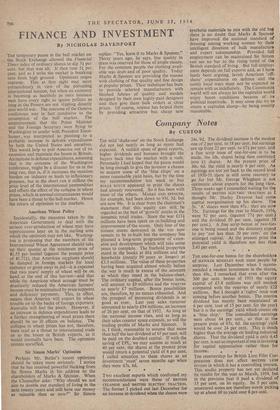

Company Notes

By CUSTOS

THE mild 'shake-out' on the Stock Exchange did not last nearly as long as many had expected. A sudden spate of good reports, higher dividends and bonuses brought the buyers back into the market with a rush. Personally I had hoped that the pause would be long enough to give the investor a chance to acquire some of the `blue chips' on a more reasonable yield basis, but by the time my recommendation last week to buy ROLLS ROYCE appeared in print the shares had already recovered. So it has been with most of the others. MARKS AND SPENCER, for example, had been down to 93g. 3d. but are now 98s. It is clear from the chairman's statement that this equity can still be regarded as the best of 'growth' stocks in the domestic retail trades. Since the war £131 millions have been spent on re-building and improvement of the stores. Only four of the sixteen stores destroyed in the war now remain to be re-built but the company has planned a long-term programme of exten- sion and development which will take some years to complete. The freehold properties stand in the books at £61 millions and the leaseholds (mostly 99 years or longer) at £3.3 millions. The value of these properties having been acquired almost wholly before the war is much in excess of the amounts at which they stand in the balance-sheet. The ordinary capital, after the bonus issue, will amount to £9 millions and the reserves to nearly £7 millions. Bonus possibilities are, therefore, by no means exhausted. And the prospect of increasing dividends is as good as ever. Last year sales turnover amounted to nearly £94 millions, an increase of 26 per cent. on that of 1952. As long as , the national income rises, and as long as their sales counter space expands, so will the trading profits Of Marks and Spencer. It is, I think, reasonable to assume that more than half the last dividend of 65 per cent. will be paid on the doubled capital. If with the saving of EPL, we may assume as much as 40 per cent. the shares at the present price would return a potential yield of. 4 per cent. I called attention to these shares as an investment `must' seven months ago when they were 67s. 6d. a * • Two excellent reports which confirmed my recommendations were those of BRITISH CELANESE and BRITISH ELECTRIC TRACTION.

• The former I picked out last December for an increase in dividend when the shares were 24s. 9d. The dividend increase is the modest one of 2 per cent. to 18 per cent, but earnings 'are up from 22 per cent. to 671 per cent. and a free scrip issue of one-for-one is to be made, the 10s. shares being then combined into £1 shares. At the present price of 30s. 6d. the yield is nearly 6 per cent. As earnings are not yet back to the record level of 1950-51. there is still some recovery to go for but Mr. George Whigham is not optimistic about exports for the long view. Three weeks ago I counselled waiting for the results of BRITISH ELECTRIC TRACTION as I. thought Mr. Harley Drayton had some capital reorganisation up his sleeve. The 5s. 'A' shares were then 47s.: they are now 55s. Earnings for the year to March, 1954, were 92 per cent. (against 771 per cent.) and the dividend 50 per cent. (against 35 per cent.). A free scrip.-bonus of two-for- one is being issued and the directors expect to pay 'not less than 20 per cent.' on the enlarged capital. At the present price the potential yield is therefore not less than 5.45 per cent.

THE one-for-one bonus for the shareholders of HAWKER SIDDELEY tOOk most people by surprise. Last December when I recom- mended a modest investment in the shares, then 49s., I remarked that even after the 300 per cent. bonus of 1951 the equity capital of £5.8 millions was still modest compared with the reserves of nearly £22 millions. But I thought a 'rights' issue was coming before another bonus. The interim dividend has merely been maintained at 6 per cent. (out of 15 per cent. for the year) but it is the earnings' yield which counts on a 'blue chip.' The consolidated earnings were about 84 per cent., so that at the present price of 67s. 6d. the earnings' yield would be over 24 per cent. This is much higher than the average on leading industrial shares. That the dividend yield is only 4.45 per cent. is not so important if one is investing for capital appreciation rather than for income. • • • THE receivership for British Lion Film Cor- poration does not affect BRITISH LION STUDIO in which it has a controlling interest. This studio property has not yet declared its results for the year to March, 1954, but in the previous year it paid a dividend of 15 per cent. on its equity. Its 5 per ceht. unsecured notes are therefore worth picking up at about 60 to yield over 8 per cent.

Previous page

Previous page