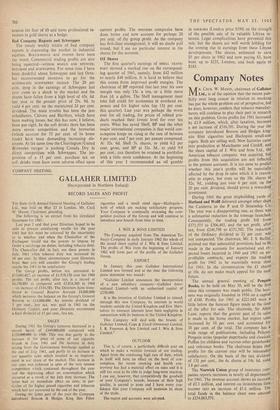

Investment Notes

By CUSTOS

THE Stock Exchange Council reminds us that in the year to March 31, 1962, the total by value of all quoted securities fell slightly IDy £700 million to £50,223 million. However, if the selective investor had followed the cautious Custos policies he would have fared better, for shares in banks, discount companies, breweries, insurance and investment trusts all finished higher at the end of this financial year. The same investment pattern still obtains, except that these 'safety' shares are now entering a 'consoli- dation' phase and cannot be expected to make further headway until it is complete. The new- comer to the bullish tack is the market in gold shares. The rumour that the American authorities are considering raising the price of gold is, I am sure, moonshine, but what is real enough is, first, that the US is still losing gold at a brisk rate; secondly, that South Africa has greatly strengthened its international trading account and its reserves and is likely to relax the rules restricting South African residents' buying of gold shares in the cheaper London market; thirdly, that industrial and commercial shares have been falling in most markets—on the Con- tinent as well as in London and New York— and that this usually foreshadows a trade re-

cession (or fear of it) and turns professional in- vestors to gold shares as a hedge.

Bad Company Reports and Schweppes

The steady weekly trickle of bad company reports is depressing the market in industrial equities. ROLLS-ROYCE and FISONS have been the worst. Commercial trading profits are also . being squeezed—witness MARKS AND SPENCER, BEECHAM and SCHWEPPES. For some time I have been doubtful about Schweppes and last Octo- ber recommended investors to go for the AUSTRALIAN SCHWEPPES instead. The 20 per cent. drop in the earnings of Schweppes last year came as a shock to the market and the shares have fallen from a high level of 43s. 6d. last year to the present price of 29s. 9d. to yield 4 per cent. on the maintained 24 per cent. dividend. The main trouble has been the jam subsidiaries, Chivers and Hartleys, which have been making losses, but this has now, I believe, been put right. In the soft drinks there has been more severe competition and the breweries (which account for 75 per cent. of its home trade) have been demanding increasing dis- counts. At the same time the Charrington/United Breweries merger is pushing Canada Dry in direct competition with Schweppes. The im- position of a 15 per cent. purchase tax on soft drinks must have some adverse effect upon

current profits. The overseas companies have done better and now account for perhaps 20 per cent. of the group profit. As the company has first-Class management, it will no doubt pull round, but I see no particular interest in the shares for the moment.

Oil Shares

The first quarter's earnings of SHELL TRANS- PORT showed a marked rise on the correspond- ing quarter of 1961, namely, from £42 million to nearly £48 million. It is hard to believe that this comes from improved profit margins. The chairman of BP reported that last year his own margin was only 15s. a ton, or a little more than fd. a gallon. The Shell management must take full credit for economies in overhead ex- penses and for higher sales (up 13f per cent. this quarter). Last year was perhaps the worst ever for oil trading, for prices of refined pro- ducts reached their lowest level for over ten years. What has saved Shell, BP and the other major international companies is that world con- st.mption keeps on rising at the rate of between 6 per cent. and 7 per cent. per annum compound. At 32s. 6d. Shell 5s. shares, to yield 6.2 per cent. gross, and BP at 32s. 3d., to yield 9.9 per cent., can therefore be retained in portfolios with a little more confidence. At the beginning of this year I recommended an oil gamble in AMERADA (London price $190) on the strength of the possible sale of its valuable Libyan in- terests. Legal complications have prevented this sale, but the shares are well worth holding for the coming rise in earnings from these Libyan developments. The shares, estimated • to earn $5 per share in 1962 and now paying $3, have been up to $235, London, and back again to $185.

Previous page

Previous page