The City image

Nicholas Davenport

The chairman of the Stock Exchange was fully justified in protesting to the BBC against the money programme which sought to bring the whole City into disrepute. We all know that there are roguish people about who will abuse the freedom of a market, and often do — ' Skinflint' is even complaining about some of the techniques of the honest People who run Unit Trusts — but we must not forget that in any sophisticated capitalist system the Stock Exchange is the essential hub of the whole machine; it Provides the free capital market where the savings of the community are converted into the investment required for the growth of the economy. In point of fact the Stock Exchange Council applies rules before it allows a new issue or grants leave to deal which are far stricter than any rules laid down by the Board of Trade. If the financial world is looked, upon as a Jungle this Council is the best game warden we have ever had.

It was distressing to hear an economist of the repute of Roger Opie join in the denigration of the Stock Exchange as nothing more than a casino. I suppose Roger Opie took his cue from his leader, Harold Wilson, who referred in the House Of Commons on November 2 to 'the almost obscene list of conglomerate takeover bids . . . with the City becoming, in the words of Harold Macmillan, a casino day by day." He should know that Harold Wilson has always been so ignorant of the City that he used to condemn it as a place Where you make money out of money. As money happens to be the commodity they deal in for the good and growth of the capitalist economy how else could they make their living? Playing marbles?

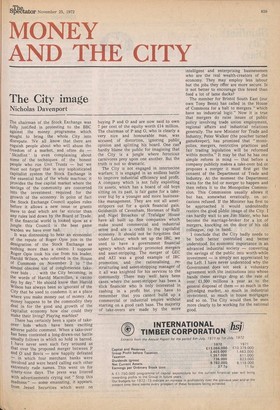

There has certainly been a spate of takeover bids which have been exciting adverse public comment. When a take-over has been contested a long-drawn-out battle usually follows in which no hold in barred. I have never seen such fury 'aroused as that over the proposed merger between P and 0 and Bovis — now happily defeated in which four merchant banks were Involved and were heard calling each other extremely rude names. This went on for mnety-nine days. The press was littered With advertisements crying out " Stop this madness" — some emanating, it appears, from Jessel Securities which went on

buying P and 0 and are now said to own 7 per cent of the equity worth £14 million. The chairman of P and 0, who is clearly a very nice and honourable man, was accused, of distortion, ignoring public opinion and splitting his board. One cant hardly blame the public for imagining that the City is a jungle where ferocious carnivores prey upon one another. But the truth is not so dramatic.

The City is not engaged in internecine warfare; it is engaged in an endless battle to improve industrial efficiency and profit. A company which is not fully exploiting its assets, which has a board of old boys sitting on its past, is fair game for a takeover bid by a younger and more businesslike management. They are not all assetstrippers out for a quick financial gain. Goldsmith of Cavenham, Horsman of Ralli .and Nigel Broackes of Trafalgar House have all built up fine companies which make sound commercial and industrial sense and are a credit to the capitalist economy. It should not be forgotten that under Labour, which set up the IRC, we used to have a government financial agency which actually promoted mergers and asset-stripping. The merger of GEC and AEI was a good example of IRC promotion, and the rationalising, restructuring and asset-stripping manager of it all was knighted for his services to the community. There may well have been cases where the asset-stripper has been a slick financier who is only interested in cashing in a profit but you have to remember that you cannot build up a commercial or industrial empire without starting on a good cash base. The majority of take-overs are made by the more

intelligent and enterprising businessmen who are the real wealth-creators of the economy. They may employ less labour but the jobs they offer are more secure. Is it not better to encourage this breed than feed a lot of lame ducks?

The member for Bristol South East (our own Tony Benn) has called in the House of Commons for a halt to mergers "which have no industrial logic." Now it is true that mergers do raise issues of public policy involving trade union employment, regional affairs and industrial relations generally. The new Minister for Trade and Industry, Peter Walker (the poacher turned gamekeeper), has promised that "monopolies, mergers, restrictive practices and fair trading legislation will be reformed within months." It may be that he has one simple reform in mind — that before a company publicly makes a take-over bid or proposes a merger it must first get the consent of the Department of Trade and Industry. At the moment the Department waits for the bid or merger to happen and then refers it to the Monopolies Commission. This Commission usually allows it but has, somewhat erratically, on occasions refused. If the Minister has first to be approached it would undoubtedly restore the good ptiblic image of the City. I can hardly wait to see Jim Slater, who has become the marriage-broker for a lot of mergers, knocking on the door of his old colleague, cap in hand.

I conclude that the City badly needs to be both better controlled and better understood. Its economic importance in an advanced industrial society — converting the savings of the public into worth-while investment — is simply not appreciated by the Left. I have never understood why the Government does not seek a voluntary agreement with the institutions into whose hands these savings drop at the rate of over £1,500 millions a year as to the general disposal of them — so much in the gilt-edged market, so much in industrial investment, so much in house mortgages and so on. The City would then be seen more clearly to be working for the national good.

Previous page

Previous page