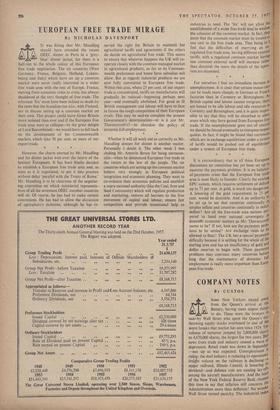

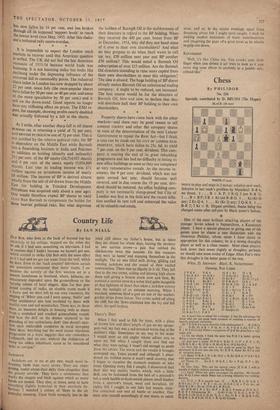

COMPANY NOTES

By CUSTOS d. SOME New Yorkers stayed away . . , from the Queen's arrival at the itil. Battery, having more urgent things to do. These were the brokers in near-by Wall Street who spent the Queen's d; Y throwing equity stocks overboard in one of the worst breaks that market has seen since 1929. The volume of turnover jumped by 2,000,000 shares to 4,670,000 shares, the largest for two years. Bad news from trade and industry caused a wave of depression. Retail trade was down in September not up as was expected. Unemployment is rising; the steel industry is reducing its operation'; freight volume on the railways is declining-7 5 major railroad, Illinois Central, is lowering its dividend—and defence cuts are causing lay-ors among the aircraft manufacturers. And the head of the New York Federal Reserve Bank chooses ( this time to say that inflation still concerns the

Administration more than deflation! No wonder Wall Street turned panicky. The industrial index has now fallen by 19 per cent. and has broken through all its supposed 'support levels' to reach the lowest level since May, 1955. After this shake- out a technical rally seems overdue.

It is impossible to expect the London stock markets to recover until this American question is settled. The UK did not feel the last American recession of 1953-54 because world trade was booming. It is not booming today but looks like declining under the depressing influence of the universal fall in commodity prices. The industrial share index in London has now dropped by about 22 per cent. since July (the once-popular shares have fallen by 30 per cent. or 40 per cent. and some of the more speculative by 50 per cent.) and is still on the down-trend. Good reports no longer have any stiffening effect on prices. The EMI re- port, for example, showing profits nearly doubled Was actually followed by a fall in the shares. * * *

As I write, after another sharp fall in oil shares BURMAH OIL is returning a yield of 54 per cent. and BRITISH PETROLEUM one of 51 per cent. This is net justified by the relative political risks, for BP is dependent on the Middle East while Burmah has a flourishing business in India and Pakistan in addition to holding (directly and indirectly) 26} per cent. of the BP equity (26,714,925 shares) and 4 per cent. of the SHELL equity (3,036,000 shares). Last year its trading income was £71 million against an investment income of nearly £8 million. The income of BP is derived almost wholly from the sale of oil drawn from the Middle East (its holding in Trinidad Development Petroleum was acquired only about a year ago). One would therefore expect BP shares to yield more than Burmah to compensate the holder for these heavier political risks. But what depresses

the holders of Burmah Oil is the stubbornness of their directors in regard to the BP holding. When they received the 400 per cent. bonus from BP in December, 1954, why did they not hand some of it over to their own shareholders? And what do they propose to do when Shell wants to call up, say, £50 million next year and BP another £50 million? This would entail a Burmah Oil subscription of over £15 million. Are the Burmah Oil directors intending to raise more capital from their own shareholders to meet this obligation? The idea is absurd. The huge holding of BP shares already makes Burmah Oil an unbalanced trading company : it ought to be reduced, not increased. The best course would be for the directors of Burmah Oil, here and now, to declare that they will distribute half their BP holding to their own shareholders. * * * Property shares have come back with the other markets—and there may be good reason to sell LONDON COUNTY and other flat company shares in view of the determination of the next Labour Government to repeal the Rent Actbut 1 think a case can be made out for CITY OF LONDON REAL PROPERTY, which have fallen to 25s. 6d. to yield 7 per cent. on the 9 per cent. dividend. This com- pany is nearing the end of its great rebuilding programme and has had no difficulty in letting its new office buildings as soon as they are completed at very remunerative rentals. As the income in- creases, the 9 per cent. dividend, which was not quite earned last year, should become well covered, and in due course the 10 per cent. divi- dend should be restored. An office building com- pany is not necessarily slump-proof but City of London was first in the field and the recent infla- tion swelled its rent roll and enhanced the value of its valuable real estate.

Previous page

Previous page