Investment Notes

By CUSTOS

Ithe chart of prices for industrial shares in 'London is superimposed on the chart of the political opinion polls it will be seen how 'political' our markets have become. The stagna- tion of the industrial production index this year means that industrial profits are reaching their maximum. But there is still room for recovery in a number of cases' where profits fell sharply during the Selwyn Lloyd deflation—oEc, AEI and the boiler companies are the prime examples --while companies now working at full capacity have another six months or more of excellent profits to come. This was shown in no uncertain fashion by ICI, whose • half-year profits, pub- lished on Tuesday, were 45 per cent up—with the interim dividend slightly increased. The result was a blaze-up in most markets. I feel we are getting near the peak.

Rolls-Royce With tax reform coming from one Gover'n- ment or another, it is always advisable to confine equity purchases to shares with a high dividend cover. ROLLS-ROYCE satisfies that test with an earnings yield of over 134 per cent at the current price of 36s. 6d., the dividend yield being 54 per cent on the forecast of 10 per cent. A report pre- pared by a leading firm of brokers makes out a very good case for investment in these shares. As non-aircraft products only account for about 20 per cent of the company's turnover, its earnings potential still depends on its aero-engine busi- ness. And this is still promising, in spite of the intense competition. As the last report pointed out, Rolls-Royce engines power over half the gas turbine airliners of the Western world, while the comp'any's military turbine engines are in service with the armed forces of thirty countries. It is claimed according to this report, that growth in demand for Rolls-Royce engines is 'almost assured.' At the end of 1963 outstanding orders for the major products were £115 million against £91 million a year earlier. It is only recently that the shares have come into investment favour. Profit margins in 1961 and 1962 were adversely affected by excess capacity and by exceptional expenses arising from the introduction of new types of aero-engines. The Government is now providing support for this sort of development and is actually contributing 50 per cent of the cost of developing the latest versions of the Spey engine. With lower research charges against

Bristol Aeroplane

The main competitor of Rolls-Royce in this country is Bristol Siddeley Engines, which is owned half by HAWKER SIDDELEY' and half by BRISTOL AEROPLANE. Another firm of brokers pre- fers Bristol Aeroplane to Rolls-Royce, because Bristol Siddeley is ahead in the development of gas turbines for industrial uses. (At the end of last year their orders to date for this class of business were £18 million against £5 million for Rolls-Royce.) There is no,doubt that there is a big future for the use of gas turbine engines in the electricity supply industry. Apart from its low capital cost, the aircraft type of gas turbine has another advantage over other generating equipment—the amazing speed with which it can be brought into operation. According to these brokers, within two minutes of starting from cold it can be supplying power to the grid. If gas is discovered in the North Sea there is bound to be a huge demand for the gas turbine engine. Bristol Aeroplane remains, of course, as de- pendent on the aircraft industry as Rolls-Royce, but the Bristol Siddeley engines account for nearly 75 per cent of its revenues. At the present price of 23s Bristol Aeroplane yield 5.9 per cent on dividends and. Ill per cent, on earnings.

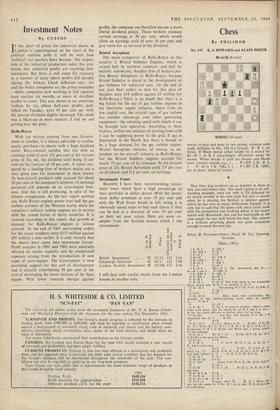

Investment Trusts

Recently I have been recommending invest- ment- trusts which have a high percentage of their portfolio in dollar shares. With the invest- ment dollar premium at over 10 per cent and with the Wall Street boom in full swing it is obviously sound sense to buy such shares if they can be had at a discount of over 10 per cent on their' net asset values. Here are some ex- amples from the Scottish houses which I can recommend: -t

• -■

N >-4

52 15/14 134 3.14 42 10/3 134 3.90 30 23/104 114 3.14

I will deal with similar stocks from the London houses in another note.

British Investment Edinburgh Securities London Scottish Investment

profits, the company can therefore pursue a more liberal dividend policy. These brokers estimate current earnings at 30 per cent, which would allow an earnings yield of over 16 per cent and give room for an increase in the dividend.

Previous page

Previous page