Raw deal from Slater or the Press?

Bruce Page

. . Then the Gods of the Market tumbled, and their smooth-tongued wizards withdrew.

And the hearts of the meanest were humbled, and began to believe it was true

That All is not Gold which Glitters, and Two and Two make Four—

And the Gods of the Copybook Headings limped up to explain it once more.'

Kipling's sour couplets make a useful beginning to a study of the Slater Walker case, for they dramatise the central question. Why is it that the madness which afflicts Financial Man should be so strictly recurrent in form? We know that speculative idiocies similar to Slater's exploits have occurred often enough in the past to furnish all the warning anyone might rationally require. Yet it is safe to predict that in the not-so-distant future it will all be happening again. 'We were willing suckers', in the words of David Malbert, City editor of the Evening Standard. Or, as Kipling says, we may reliably expect to see that 'the burnt Fool's bandaged finger goes wobbling back to the fire'.

In order to penetrate a little way into this problem, we need to understand the spirit that moved Slater Walker and to examine the state of financial journalism. The sound which filled the land last weekend was that of financial journalists gently scraping egg off their faces, while making bitchy comparisons about who had more or less of the stuff bespattering him. There was not much doubt that Patrick Hutber of the Sunday Telegraph was the most serious case.

Mr Hutber was throughout friend and booster to Mr Slater, and remains in that relationship to Slater's successor Jimmy Goldsmith. He has rebuked more sceptical journalists for trying (as some did) to 'shine flashlights up the backsides' of these two Napoleons. Explaining his own belief that financial journalism is presently in pretty good shape, he told the BBC cameras late on Sunday night that financial affairs 'would always be a bit messy, like sex.' Possibly Mr Hutber knows people whose sexual careers have been as intricate as Slater Walker's financial organisation— but the mind boggles at the thought. It will be safer to examine City journalism through the operations of people with a slightly less exotic acquaintance.

Here is a pronouncement from The Times, made on the occasion of Slater's resignation: 'The Slater Walker problems are not those of the sort that overtook the secondary banks. . . For the most part, those were the results of the throwing away of common banking prudence. . f And of course Slater Walker would never have done that. Well,

now that Price Waterhouse and Peat Marwick Mitchell have actually been through the books, we know otherwise. A large part of the Slater Walker disaster followed, quite precisely, from 'throwing away of common banking prudence'— from making extravagant loans, failing to spread risks from borrowing short and at the same time lending long.

What matters about The Times' words is not that they are wrong. It is rather that they are wrapped in an air of great authority —such as might carry conviction to any ordinary reader—but cannot, as we may now see, have been based on any worthwhile evidence whatever. It is not possible to judge the prudence or otherwise of a bank's operations unless one has seen the loan portfolio. The Times cannot have seen the portfolio when it cleared Slater Walker with such lofty authority.

The truth is that the British financial community gets away with disgorging so little information that there is rarely a moment—without superhuman labour and insight—when anything worthwhile can be said about its activities. Silence, however, is not a profitable activity for a newspaper, and in this situation even the best journalists find it difficult to avoid trafficking in pseudo-information.

The present crop of assurances that Mr Slater has chosen to 'go down with the ship' and 'did not have a Swiss bank account' make another case in point. We are told that Mr Slater is just as broke as any participant in the wild schemes he propounded; that he meant well, and that he did not break the law.

Apart from the fact that the Singapore government pretty clearly thinks that its own laws have been broken, a matter it would like to discuss with Mr Slater—and the strong evidence which suggests that his companies broke Section 54 of the British Companies Act—the fact is that many of the people who tell us these things were until recently assuring us that he was a financial genius and an agent of national regeneration.

Mr Slater may be destitute: I shall begin to believe that from the moment when his personal accounts, properly audited, are available for inspection. So far as breaking the law is concerned, every man in this country is innocent until proven guilty. But a rich man remains rich until he demonstrates otherwise—especially if, like Mr Slater, he is in a position where it may suit his book to appear somewhat woebegone. Because possession of a Swiss bank account is taken, often wrongly, to be evidence of turpitude, it must not be assumed that lack

of one assures uprightness. Considered as financial hidey-holes, they are only of specific interest to Third World dictators and the like, whose access to the Western banking system tends to be limited. NobodY in Mr Slater's position would need to bother with one. Far more to the point is that during the dissolution of Slater Walker's Far Eastern operations it was possible for vigilant observers to spot a Bahamas' registered dealing company which was absorbing certain profits on behalf of Mr Slater. Its role, not previously disclosed, has yet to be accounted for.

It is difficult to realise that after all this time we still have only two serious chunks of information about Slater's activities: the newly-published Price Waterhouse/Peat Marwick report, and the Singapore Government's comments, which came out earlier this year. Neither is to be compared in scope to Charles Raw's full-scale history of the firm and its principals. Of this, those of us who have seen it are not allowed to speak: the book is, for the moment, suppressed until Mr Raw can extract himself from the toils of a breach-of-contract action in which Mr Slater has succeeded in involving him• The implications of this contract may be worth discussing later: meanwhile, one should record the point that the effect of our remarkable legal system is that at this moment, when the behaviour of Slater Walker is a national issue, it has succeeded in gagging the single man who knows more than anyone else about the subject.

In the almost total absence of real information, Mr Slater has been portrayed—and thereby defended—as a bold entrepreneur, of the type needed to re-energise our sagging economy. Thus, the Financial Times: 'The vitality of the capitalist system requires. • • the existence of entrepreneurs and marauders who spot situations where assets are being badly managed and move in to Pat them to better use.. ."Or, as expressed in a headline: 'THE CITY STILL NEEDS RISK" TAKERS'.

Leaving aside for a moment the question of whether the City—or anyway, the economy—really needs risk-takers, and if so what sort, we may ask : was Slater a risk-taker in any possible beneficial sense of that description? At the time those words were written last year, their author must have been almost wholly ignorant about Mr Slater's actual operations. But since then, we have acquired some citable evidence which tends to support the hunch which some of us had quite a while ago—namelY, that Mr Slater, so far from being a risk taker, was a man whose chief aim in life was to so arrange things that he need never place

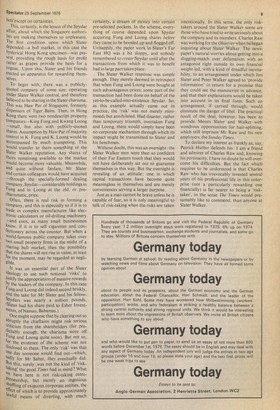

Spectator 25 September 1976

bets except on certainties.

This, certainly, is the lesson of the Spydar affair, about which the Singapore authorities are making themselves so unpleasant. The first condition upon which Slater dePended—a bull market, in this case the

hysterical Hong Kong specimen was present, providing the rough basis for profit rather as grapes provide the basis for a cognac. Upon this, Slater and his friends erected an apparatus for rewarding themselves.

To begin with, there was a publiclyquoted company of some size, operating under Slater Walker control, and therefore believed to be sharing in the Slater charisma. This was Haw Par of Singapore, formerly dispensers of Tiger Balm. Then, in Hong Kong there were two nondescript property companies—King Fung and Kwang Loong —small, but also with publicly-quoted Shares. Assumption by Haw Par of majority control in K. Fung and K. Loong would be accompanied by much trumpeting. This Would transfer to them something of the Slater Walker reputation. Any shares of theirs remaining available to the market would become more valuable. Meanwhile, and quite without fanfare, Mr Slater and certain colleagues would have acquired —through the specially-formed dealing Company, Spydar—considerable holdings in Fung and in Loong at the old, or precharismatic, price.

Often, there is real risk in forming a company, and this is especially so if it is to trade in complex manufactures like electronic calculators or oil-drilling machinery —and even, as many small businessmen know, if it is to sell cigarettes and confectionery across the counter. But when a world-famous public company takes over two small property firms in the midst of a roaring bull market, then the possibility that the shares will not rise in value, at least for the moment, may be regarded as negligible.

. It was an essential part of the Slater Ideology to use such notional 'risks' to Justify the appropriation of massive rewards by the leaders of the company. In this case Fling and Loong did indeed ascend briskly, and the take for Mr Slater and his fellowSPYdars was nearly a million pounds. (Slater had his share paid to Esher Investnnems, of Nassau, Bahamas.) One might suppose that by clearing out so abruptly the chieftains might risk serious criticism from the shareholders (for predictably enough, the charisma wore off rung and Loong quite soon). But not so, for the existence of the scheme was not disclosed to them. The only 'risk' was that °Ile day someone would find out—which, s,,actly for Mr Salter, they eventually did. 'Kit this, surely ,was not the kind of 'risktaking' the good Times had in mind ? What We have here is not risk-taking entrepreneurship, but merely an ingenious Shuffling of exiguous corporate entities, the f'fect of which is to provide approximately lawful means of diverting, with much certainty, a stream of money into certain pre-selected pockets. In the scheme, everything of course depended upon Spydar acquiring Fung and Loong shares before they came to be boosted up and flogged off. Unhappily, the paper work in Slater's Far East HQ was a bit sloppy, and nobody remembered to create Spydar until after the transactions from which it was to benefit had in large part taken place.

The Slater Walker response was simple enough. They merely deemed in retrospect that when Fung and Loong were bought at such advantageous prices, some part of the transaction had been done on behalf of the yet-to-be-called-into-existence Spydar. So, as this example actually came out in practice, the 'risk' was not merely minimised: but annihilated. Had disaster, rather than temporary triumph, overtaken Fung and Loong, there would simply have been no corporate mechanism through which its impact might be transmitted to Slater and his henchmen.

Without doubt, this was an oversight: the Slater Walker men were then so confident of their Far Eastern touch that they would not have deliberately set out to guarantee themselves in this way. But the oversight is revealing of an attitude: one in which capital transactions have become quite meaningless in themselves and are merely conveniences serving a larger purpose.

Just as a man cannot be brave unless he is capable of fear, so it is only meaningful to talk of risk-taking when the risks are taken

intentionally. In this sense, the only risktakers around the Slater Walker scene are those who have tried to write seriously about the company and its members. Charles Raw was working for the Observer when he began inquiring about Slater Walker. The newspaper's natural worries about getting into a slugging-match over defamation with an antagonist right outside its own financial weight led, with a kind of dreadful inevitability, to an arrangement under which Jim Slater and Peter Walker agreed to 'provide information' in return for a promise that they could see the manuscript in advance, and that their explanations would be taken into account in its final form. Such an arrangement, if carried through, would eliminate the danger of libel. The practical result of the deal, however, has been to provide Messrs Slater and Walker with wondrous opportunities for hair-splitting, which still imprison Mr Raw and his new employers, the Sunday Times.

To declare my interest as frankly as, say, Patrick Hutber defends his: I am a friend and admirer of Charles Raw and, knowing his pertinacity. I have no doubt he will overcome his difficulties. But the fact which requires to be understood is that Charles Raw who has irrevocably invested several years of his professional life in this enterprise (not a particularly rewarding one financially) is far nearer to being a 'risktaker', in the sense The Times would presumably like to commend, than anyone at Slater Walker.

Previous page

Previous page