Major miner

PORTFOLIO JOHN BULL

I have decided to sell my small holding in John I. Jacobs, the shipowners and tanker brokers. 1 bought 600 shares at 8s last Novem- ber and make my exit at the same price. I expected the company to gain substantially from the closure of the Suez Canal, which it did. But I also looked for further improvement in the current year, of which there is no sign in the latest report and accounts. The best the chairman, Mr J. H. Jacobs, can say is : 'with the business already concluded I am confident that, subject to no more than a normal degree of adversity, the increased total dividend of 12f per cent can be maintained for the year.' With the market at its present exalted level, I have kept my first portfolio pretty liquid. But as it happens, the Rio Tinto Zinc report published this week persuades me that I must devote some of my funds to that giant, well diversified, mining group. Accordingly I have purchased sixty shares at 125s. Yielding 14 per cent and selling at twenty-eight times last year's earnings, nrz is an expensive share. Or, -to put it another way, it is a share which I have bought on a two-year view rather than in the hope of a quick turn. It belongs properly, therefore, to my first portfolio. What is the case for Ku?

I must start with the group's Hamersley venture in Western Australia, profits from which jumped last year from £853,000 to £8 million as the project got under way. This year shipments of ore to Japan are expected to rise by- 70 per cent. Indeed, output should be run- ning at three times last year's level by 1970-71. This is a low-cost enterprise. It is- tied to con- tracts- with Japanese buyers which run to 1972 and include the benefit of escalation- clauses. So here is a commodity selling at a fixed price and, it seems, on a fixed-cost basis. It is a remarkable business.

R-rz's big investment in the Palabora copper mine is also turning out extremely well. Profits from this metal rose from £15 million to £23 million -last year, helped, of course, by the favourable impact Upon prices which resulted

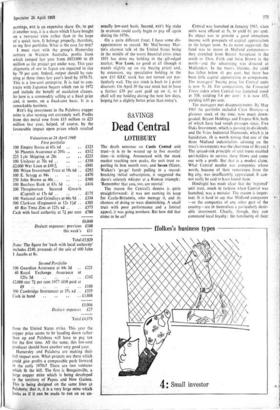

Valuations at 24 April 1968 First portfolio

100 Empire Stores. at 65s. xd £325

50 Phoenix Assurance at 205s £512

.225 Lyle Shipping. at 20s

100 Unilever at 70s xd £350

,aocio War Loan at £49-196 £991

300 Witan Investment Trust at 19s 6d .. £292 100E. Scragg at 94s £470 250 John Brown at .40s_.. £500 100 Barclays Bank at 83s 3d .. £416 200 Throgmorton Secured Growth

(Capital) at 17s 6d £175 100 National and Grindlays at 66s 9d .. £334 500 Clarkson (Engineers) at 12s 14d... £303

60 Rio Tinto Zinc at 125s xd £375 -Cash with local authority at 7+ per cent £780 /6,048 Deduct: expenses: previous• £108 this week's £11 Total 15,929 Note: The figure for 'cash with local authority' includes £240, proceeds of the sale of 600 John I. Jacobs at 8s.

Second Portfolio

100 Guardian Assurance at 44s 3d .. £221 40 Royal. Exchange Assurance at

121s 3d .. .. .. .. £242 £2,000 otx 74 per cent 1977 (£10 paid at £9 .. .. .. .. .. £180 300 Cambridge Instrument at 37s xd .. £555 Cash in hand .. .. • • .. £3,808 £5,006 Deduct: expenses £27 Total £4,979 from the United States strike. This year the copper price seems to be heading down rather than up and Palabora will have to pay tax for the first time. All the same, this low-cost producer should have another very good year.

Hamersley and Palabora are making their full impact now. What projects are there which could give profits a comparable push forward in the early 1970s? There are two ventures which fit the bill. The first is Bougainville, a large copper mine which is being developed in the territory of Papua and New Guinea. This is being designed on the same lines as Palabora; that is, it is a very large mine which looks as if it can be made to run on an un-

usually low-cost basis. Second, tyres big stake in uranium could easily begin to pay off again during the I970s.

On a quite different front, I have some dis- appointment to record. Mr McChesney Mar- tin's alarmist talk of the United States being in the middle of the worst financial crisis since 1931 has done my holding in the gilt-edged market, War Loan, no good at all (though it stands slightly up on my buying price) and, by extension, my speculative holding in the new £10 GLC stock has not turned out par- ticularly well. The otc stock is back to + point discount. On April 30 the Gt.c stock has to have a further £30 per cent paid up on it, so I shall sell my holding during the next few days, hoping for a slightly better price than today's.

Previous page

Previous page