Account gamble

Carpet backing

John Bull

As a major group, Carpets International has been largely neglected by the stock market over the last few months. Too much account is given to the mess the industry got into two years ago, exacerbated by the collapse of Cyril Lord. Yet carpet manufacturers, I believe, have by and large learnt their lesson — albeit the hard way.

The prospects for Carpets International, as an international group, are much better than a company with dependence on one market. And in the past three years, during which time it has been in the throes of integration and rationalisation following the merger between Crossley Carpet Traders and Carpet Manufacturing, it has established a large share in overseas markets. In Australia particularly, Carpets International has expanded and in July this year completed the acquisition of F & T Carpets Pty. F & T is a leading Australian manufacturer of both woven and tufted carpets. The price paid was £2.15 million. Elsewhere it has interests in New Zealand, South Africa and Canada.

At home, of course, relaxation of HP restrictions and a boost in consumer spending has given the carpet industry the base for a considerable upturn. And CI has moved rapidly in new plant projects with marked reduction of overdrafts.

A good indication of the current year's progress will be given in the interim statement due on September 8. . And I expect to see a substantial increase in profits, despite the power strike.

Price increases were made at the beginning of the year and, though wool costs have risen, there should still be an improvement to margins. I expect to see the interim figures showing that CI is set for pre-tax profits of about £4 million this year, while 1973 bodes better still for the group as recent expenditure projects will then begin to show their worth.

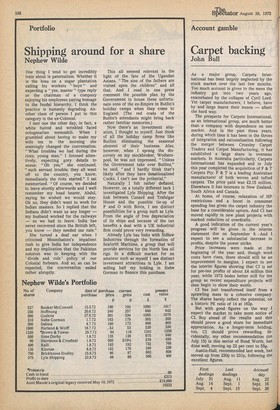

CI has just transformed itself from a sprawling mass to a cohesive company. The shares barely reflect the potential, on a historic PE ratio of 14 at 162p.

But with good figures on the way expect the market to take more notice of CI. Buy ahead of the results and this should prove a good share for immediate appreciation. As a longer-term holding, too, CI should prove rewarding. Incidentally, my other recommendation (on July 15) in this sector of Bond Worth, has done well, moving up 22 per cent to 55p.

Austin-Hall, recommended last week, has moved up from 220p to 231p, following the excellent figures.

Previous page

Previous page