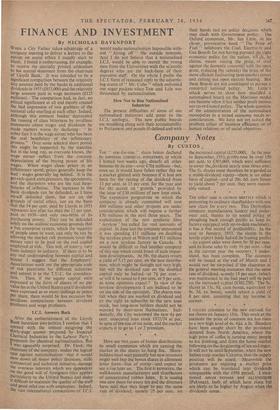

FINANCE AND INVESTMENT

By NICHOLAS DAVENPORT WHEN a City Father take* advantage of a company meeting to deliver a lecture to the nation on social ethics I usually start to blush. I found it embarrassing, for example, to receive the specially printed addendum to his annual statement from the chairman of Lloyds Bank. It was intended to be a significant comparison between the relatively tiny amount paid by the banks in additional dividends in 1953 (£853,000) and the relatively large amount paid in wage increases (L125 millions). The comparison had, in fact, no ethical significance at all and merely created the bad impression of two grabbers of the national cake snarling at each other. Indeed, although this eminent banker deprecated the rousing of class bitterness by invidious statements about wages and dividends he made matters worse by declaring : " In sober fact it is the wage earner who has been the real beneficiary of the inflationary process." Over some selected short period this might be supported by the statistics but in the long run, as everyone knows, the wage earner suffers from the constant depreciation of the buying power of his wages. When wages chase prices in an inflationary spiral; prices generally keep the lead : wages generally lag behind. It is the get-rich-quick entrepreneurs, the speculators, and the sharpsters who are the real bene- ficiaries of inflation. The increases in the bank dividends can be defended, as I have myself defended them, but not on the grounds of social ethics, not on the basis that the 14 per cent. paid by Lloyds in 1953 represents less after tax than the 12 per cent. paid in 1938—and only two-fifths of its purchasing power. They can be defended solely on the realistic economic grounds that a free enterprise system, which the majority of people seem to want, can only be run by allowing the market risk premium (over the Money rate) to be paid on the real capital employed at risk. This will, of courFe, vary from industry to industry. If there is to be any real understanding between capital and labour I suggest that the Employers' Associations work out the appropriate scale of risk premiums for different industries and submit it to the T.U.C. for considera- tion. Then, if' the equity capital were expressed in the form of shares of no par value (as in the United States) and if dividends were expressed as so many shillings or pence Per share, there would be less occasion for invidious comparisons between dividend Profiteers and wage profiteers. would make nationalisation impossible with- out " hiving off " the outside interests. And I do not believe that a nationalised I.C.I. would be able to recruit the young men from the Universities with the sc:cntific degrees who are the back-bone of their executive staff. On the whole I prefer the I.C.I. form of reasoned reply to the advertis- ing stunts of " Mr. Cube " which enlivened our sugar packets when Tate and Lyle was threatened by nationalisation.

How Not to Run Nationalised Industries The present difficulties of some of our nationalised industries add point to the 1.C.1. apologia. The new public boards are muddling along with their accountability to Parliament and people ill-defined and with

their hands tied on policy decisions which may clash with Government policy. The Oxford economist, Mr. Ian Little, in his clever, provocative book " The Price of Fuel " belabours the Coal, Electricity and Gas Boards for not having pursued the right economic policy for the nation, wit ch, he claims, meant raising the price of coal against the domestic consumer with the open. grate, reducing (by subsidy) the price of the more efficient fuel,F.aving (anti-smoke) stoves and cutting out open electric heating. But these Boards are not constituted to pursue a concerted national policy. Mr. Little's attack serves to show how muddled a nationalised board on the Morrison model can become when it has neither profit motive nor co-ordinated policy. The whole question of the administration of the nationalised monopolies in a mixed economy needs re- consideration. We have not yet solved the problem either of business efficiency or of human relations or of social objectives.

Previous page

Previous page