Backing a banker

PORTFOLIO JOHN BULL

This prolonged period of 8 per cent Bank rate may not be exactly ideal for gilt-edged holders, of which I am one, but it is wonderful for bank profits. Mr, Aubrey Jones fastened on this point in the Prices and Incomes Board report on bank charges. Lending rates are tied to Bank rate and move in step, but a proportion of bank borrowings—current account deposits —remain available at no cost at all. Thus, said Aubrey Jones, bank profits derive from two elements : the bank's own efficiency in the broadest sense, and an 'endowment' element in profits resulting from public policy as expressed in the level of Bank rate.

Bank chairmen are, however, quick to pro- test that high Bank rate produces disadvantages as well as advantages. First,, the growth of ad- -vances is hindered if not turned back. Secondly, bad debt experience worsens quite sharply : in- deed, I think ,the swings in profit produced by varying bad debt experience are more marked than generally realised. And thirdly, because high interest rates involve gilt-edged prices, there is a corresponding book loss on invest- merits to be taken into account. Mr Duncan Stirling, chairman of Westminster Bank, summed up the position in his annual report this week by writing: `The comparatively liberal conditions that go with Bank rate at 5 or 51 per cent are more favourable to us than those which accompany the crisis rates of 7 or 8 per cent; we like to see our customers pros- perous.' All the same, in terms of revenue, many outside estimates of clearing bank profits (banks' published profits are struck after trans- fers to reserves and thus disguise the true position) have agreed that high Bank rate means high bank profits.

What average level of Bank rate can be ex- pected this year? I think it is now generally assumed that 8 per cent is here to stay until near the budget, though originally the impres- sion was that 8 per cent would last only a few weeks past 18 November, devaluation day. Then, I suppose, 7 per cent for some months and possibly 61 per cent by the end of the year. The timetable is necessarily vague, but however it actually turns out I do not think there can be much doubt that interest rates this year are likely to average out at a sig- nificantly higher level than they did in 1967. In that year the average was 6.15 per cent compared with 6.18 per cent in 1966. This time the result could be 7 per cent or so.

The investment question is whether the market has sufficiently well discounted the possibilities. It is, of course, difficult for the market to be too precise because of the dis- guised nature of bank profits announcements. None the less, I am impressed by the fact that the average dividend yield on clearing bank shares at the moment is 4.03 per cent com- pared with an average return on the Financial Times-Actuaries all-share index (604 shares) of 41 per cent. That, I believe, means that bank shares are attractive. And there is always the possibility that the Government will require banks to publish their true profits, though this is, I admit, a dwindling hope. But if that hap- pened, bank shareholders would wake up to a pleasant surprise. To illustrate this point I take the exercise contributed to the Bankers'

Magazing every year by Phaedra. Looking at the 1966 position, he concluded that, for in- stance, Barclays' true net profits totalled £45 million—compared with a published figure of £13-1- million. Indeed, in almost every case, true profits seem to be about three times higher than published net profits. As a result dividends are in fact covered upwards of four times. This, I think, reinforces the case for bank shares. The question is which one?

Looking over clearing bank records in terms of growth of deposits and rise in dividend pay- ment, I don't think there can be any doubt that Barclays Bank leads the field. I have, accord- ingly, bought 100 shares at 70s.

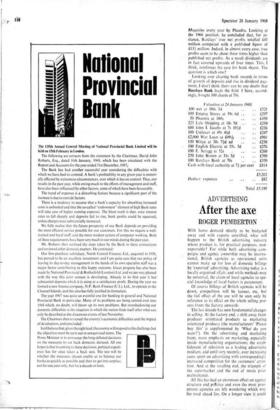

Valuation at 24 January 1968 .100 BAT at 104s 3d .

100 Empire Stores at 59s 6d ..

50 Phoenix at 180s

225 Lyle Shipping at 18s 9d ..

600 John I. Jacobs at 7s 10jd 100 Unilever at 49s 4d..

£2;000 War Loan- at £49T16- 150 Witan at 30s 74d xd

100 English Electric at 55s. 3d

100 E. Scragg at 52s 250 John Brown at 31s 3d

100 Barclays Bank at 70s Cash with local authority at 71 per cent £5,262

Deduct: expenses • • .. £82

Total £5,180

• • • • • • • • • • • • • • • • •

£521 £297 £450 £210 £236 £247

Ent

£2-30 £276 £260 £390 £350 £814

Previous page

Previous page