Investment Notes

By CUSTOS

PRESIDENT KENNEDY'S bombshell of a tax on buying foreign securities had surprisingly little effect upon the market in Throgmorton Street International shares such as PHILIPS LAMPS, ROYAL DUTCH, UNILEVER NV (not to mention the Canadians) were sharply marked down, but some recovery followed when it seemed likely that Congress would modify the proposals. Later a modification did, in fact. follow in Canada's favour, for American citizens can now make tax-free purchases of new Canadian issues 111.. -inadian banks. NICKELS and HUDSON BAY qtc.L.Iv recovered. Even the gilt-edged market threw off its apprehension at the rise in American short-term money rates. Wait LOAN, which had fallen to 623. went up to 633. How long the authorities can maintain the trend towards cheaper long-term money while the short-term rate moves up is a matter of much controversy. But political 'funk' money is pouring into the gilt-edged market and main- taining its upward trend.

Good Reports

Elsewhere there were some firm features in domestic equities. PLESSEY, for example, rose 5s. 3d, to 61s. 6d. on the statement that its profits for 1962-63 will be no less than £10 million before tax, against the £64 million for the pre7 vious year. The recent acquisitions make the comparable 1961-62 figure £7.3 million, but even so a jump of 37 per cent in profits is no mean record and the shares seem bound for higher levels in spite of the comparably low dividend yield of 23 per cent. The Dowty Group, manu- facturers of aircraft equipment and guided mis- sile components, also produce an excellent report with the pre-tax profits 14 per cent up. and equity earnings of 33 per cent against 27 per cent tax free. The dividend has been raised from 10-1 per cent, tax free, to 13 per cent, tax free, and the directors propose a four-for-five scrip issue. The shares rose promptly to 54s. to yield nearly 4 per cent, but with an earnings yield of close on 9 per cent, they still seem fairly valued.

Burmah Oil

The letter to the shareholders from the BUR- MAH OIL directors justifying their rejection of the BP/SHELL bid was well received in the market. 1 he two most reassuring statements were, first, the projected rise in trading profits from £5.9 million to £8 million by 1966, and, secondly, the directors' view that their 241 per cent hold- ing in BP is worth far more than its current market valuation. I do not agree with their state- ment that this holding forms 'an integral and vital part' of Burmah's operations. In my opinion it should be distributed to shareholders. But I agree with them that the Shell holding 'is a marketable investment' for use either as a means of raising development capital or as a source of capital profit for the shareholders. Perhaps the most satisfactory part of the latter was the decision to pay 2s. 9d. per share. free of tax, for 1963 against last year's 2s. 3d. The shares rose sharply on this to 66s. 6d.. to yield 6.7 per cent on the new dividend.

British Petroleum Burmah's statement that their holding of BP shares was under-valued led to a rise in the BP market from 56s. to 58s. 3d. to yield 63 per cent. BP is obviously enjoying an excellent trading year. A firm of brokers points out that the total output of crude oil in the Middle East has risen by 13.3 per cent in the first five months of this year. BRITISH PETROLEUM is de- veloping the new offshore oilfields at Abu Dhabi which were only brought to the producing stage in June, 1962. Last year's output was 785,000 tons, whereas in May output was running at an annual rate of 2,230,000 tons and by the end of this year will rise to 3,000,000 tons. This in- crease in crude output is all the more welcome because the rise in European consumption of oil products for the first quarter of 1963 was close on 20 per cent. If Burmah directors would see the light of reason and distribute these BP shares to their shareholders, Burmah Oil would still be considered cheap.

Previous page

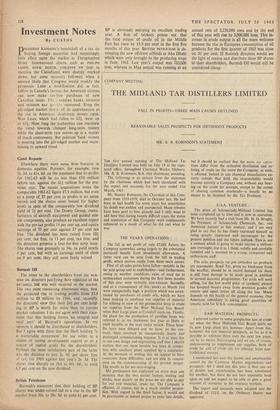

Previous page