Investment Notes

By CUSTOS

ANEW account opened on the Stock Exchange with an uncertain note, but the underlying firmness, which indicates shortage of stock on jobbers' books, was still apparent. This shortage will be intensified by the success of Mr. Clore's new bid for LEWIS'S stores, for the happy—or unhappy—shareholders will be seeking to re- invest their 17s. cash. The bread strike caused weakness in the shares of the milling Companies, which, I think, had been overvalued in the market,

but a strong feature was the recovery in gold shares—an unexpected reaction to the news that tlie American payments deficit had returned in some size. Since August, the gold share index had dropped from 74.7 to 58.6 early last week— a fall of 21 per cent. Certainly we have good 'jobbing' markets, but alas! the penal short-term capital gains tax makes jobbing for the outsider a worthless occupation.

Steel Shares

It might have been expected that with the opinion polls favouring Labour, and the Chan- cellor repeating the Prime Minister's assurance that steel nationalisation will come as soon as the party has a good enough majority to enforce it, steel shares would be looking up, but they have lost their recent recovery and are slipping back to offer discounts up to 40 per cent on their nationalisation price. It is clear that the market finds the political prospect too distant and uncertain and the immediate economic pros- pect too depressing. We are witnessing the down- ward half of the steel cycle, with demand falling, 'costs rising and profits being reduced. LANCASHIRE STEEL are cutting their dividend, COLVILLES, ONSE1T and SOUTH DURHAM may follow and RICHARD THOMAS AND BALDWINS have announced that they will be working short-time after Christ- mas. A leading firm of brokers, in their annual review of steel shares, come to the conclusion that prospects for the industry will remain un- promising for two to three years. There is a world overcapacity and severe competition will tend to keep prices and profit margins down.

Nationalisation Prices Valid?

I do not, therefore, agree with the view that steel sharei present good buying opportunities. A slight rise in prices for certain products may be agreed upon before long, but this, like the 1 per cent rise in April, will be insufficient to offset the rise in costs. And the effect of the new corporation tax is to bring severe pressure on current dividends. DORMAN LONG, JOHN SUMMERS, STEWARTS AND LLOYDS, STEEL OF WALES and UNITED STEEL should be able to maintain their dividends—not without difficulty in some cases —but if nationalisation is postponed for, say, another twelve months, it is doubtful whether a new Parliament would endorse the nationalisa- tion prices fixed in May 1965. As Mr. Callaghan said, much government money would be needed if the steel industry is to be reconstructed.

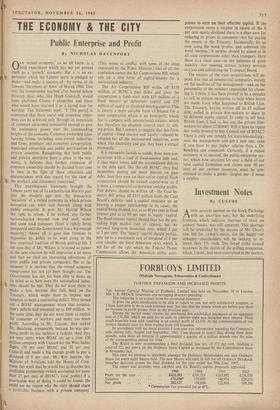

Compen- nation Price Present Price

Divi- dend

% Yield Colvilles 47/6 31/3 16 10.1 Consett 19/10 16/- 10 12.3 Dorman Long 29/10 27/3 14 10.2 Lancs Steel 34/3 18/10# 10

S. Durham 26/3 21/9 12 10.9 Steel of Wales 32/5 21/3 10 9.3 Stewarts and Lloyds 32/5 35/- 17f 10.0 Summers 36/- 32/3 16 9.8 United Steel 38/3 31/- 15 9.5

Those who bought steel shares on the market spurt which followed on the compensation terms have now suffered substantial losses. Perhaps they should hold on and wait for better times. After all, mergers between such companies as Dorman Long, Consett and South Durham might be car- ried out before nationalisation is determined: Caister Group A correspondent who did not seem to relish my bearish note on holiday-camp shares has written to say that there could be an exception to the rule in CAISTER GROUP. This company was originally a firm of motor dealers, but went into the holiday business in 1953 with the purchase

of a caravan site at Great Yarmouth. Then in 1959 it bought the Caister-on-Sea holiday camp —and later the caravan site adjoining—and in 1965 the firm of Herbert Woods, the largest pleasure-boat hirers on the Norfolk Broads. Finally, the California Lakeside Holiday Camp at Wokingham. The motor section now con- tributes only 15 per cent of the total profits, which have been advancing year by, year. Unlike other companies in the business, Caister has not over- expanded its holiday-camp capacity and seems likely to increase its profits from the caravan sites and pleasure boats. The company has re- cently made a rights issue of one in six at 8s. and at an ex-rights price of 10s. lid. the ordinary shares yield 4.8 per cent on the fore- cast dividend of 25 per cent. The price-earnings ratio on the forecast profits to March 1966 is around thirteen with corporation tax at 40 per cent.

Previous page

Previous page