BUILDING SOCIETIES SURVEY Progress During the Credit Squeeze

BY ANDREW BREACH, F.C.1.S.

THE total assets of all building societies at the end of 1955 amounted to £2,063 million; an increase for the year of some £196 million, which hardly seemed possible in the summer of 1955, when the first stage of the credit squeeze was imposed. An adjustment in rates during the autumn of last Year was no doubt largely responsible for the satisfactory results eventually achieved. The year 1956 has followed a somewhat similar pattern in regard to the inflow of funds; but withdrawals to date have been running at a higher level and it seems unlikely that the record figures established in 1955 will be repeated for the current year. This is perhaps in tune with official policy, and a Year of less expansion, with consolidation, may well be a good thing for the movement as a whole.

The heavy withdravyal rate experienced in the first seven Months of 1956, and the earlier increase in the general level of Money rates touched off by the increase in Bank rate in Feb- ruary last, made an increase to investors and borrowers inevit- able; and we now have a general structure of 31 per cent. net (income tax paid by the society) for ordinary shares; 3 per cent. net for deposits; and a general mortgage level of 6 per cent. In respect of houses for owner-occupation. These upward adjustments have already tended to damp down the withdrawal rate and to stimulate to a small extent the new investment inflow.

Building societies, as the principal lenders in respect of house Property, are keenly interested in the trend of values (which. In turn, are influenced by the money available for sale and purchase); and, for the whole of the current year to date, the demand for mortgage accommodation has exceeded the supply (If funds available. This has inevitably led to greater selectivity .11c1 individual boards have applied their own particular formula to equate supply and demand. Most are on a quota sYstem (by the allocation of reduced target figures to their various branches in the case of the large national societies); and some have reduced their percentage advance to a level at which the amount they are prepared to lend is taken up. Experience has not been uniform, by any means, and difficul- nes have apparently been more acute for the smaller and -..... medium-sized metropolitan societies. Similarly, in the pro- vinces one hears of very varied experience, with some barely matching the inflow of funds against withdrawals, while others. with a strong local or regional connection, appear to be main- taining progress almost at the 1955 rate. Irrespective of the ration or quota which may be used, there appears (generally speaking) to be a decided preference in favour of modern houses, or, at any rate, houses built since the First World War: and those which are quite out of favour are the older types. particularly those with more than two floors which are costly to maintain and which, as house agents know only too well, are far more difficult to sell.

The price of new houses is unfortunately showing no sign. as yet, of being affected by the credit squeeze and many have been concerned at the very considerable premium which home- owner borrowers seem prepared to pay in order that they may be the first occupiers of a new house. It is true to say that there are many excellent second-hand houses built in the 1930s which change hands at prices considerably below those of similar-sized houses built today. There is little doubt that there has been too much activity in building; and shortage of labour, with its attendant difficulties, has not made any easier the task of the contractor.

It is not the practice of building societies, generally speaking. to undertake building finance and no doubt many builders' programmes recently completed, or about to be completed during the next few months, were arranged with bank accom- modation prior to the instructions of February last. When this current work has expired it is hoped that we shall see rather less activity; which, in turn, may bring about an arrest in the constantly rising price of new building. Many building societies have been very concerned at the ever-increasing costs of the industry and some have fixed prices for standard building work which results in valuations being considerably less than selling price, notwithstanding the fact that houses are sold freely at the higher figure.

The new investment rates offered by societies (which, in the case of paid-up shares is equivalent to £6 Is. 8d. per cent. to an investor liable to tax at the full standard rate) are now considered sufficiently attractive and competitive with other forms of investment such as those of the National Savings movement and local authority loans. The status of the building society share is constantly iinproving, as the evidence since the war fully illustrates, and many argue that the differential of per cent. between the share and deposit rate is now too wide for the sake of what must be a very theoretical advantage.

The great merit of a building society investment is fully publicised by the many first-class societies operating today. and no doubt many who in earlier days would have lent by private mortgage now prefer the equally remunerative and far more liquid building society holdings. Withdrawals are paid by most societies at very short notice, and many frequently allow withdrawal on demand. Furthermore, the ease with which investment and withdrawal can be effected and the fact that no stamp duty or commission is payable make it a very serious competitor with the ordinary bank deposit.

It should be remembered that the work of building societies is very similar to that of the National Savings movement and, indeed, might be termed almost collateral; since any surplus savings which societies receive are invariably invested in the gilt-edged market : which must assist official policy. Alterna- tively, if they are lent on mortgage they reduce the demands of local authorities for advances through the Public Works Loans Board. In its widest sense a building society is possibly the ideal form of saving, since it is not only the investor who saves but the borrower also. There are now over two million borrowers buying their houses at the present time, and they are committed to regular monthly payments which, in addition to interest, consist partly of capital in order that the debt may be repaid in the agreed term of years. The movement may well claim to be a most important instrument for the Chancellor in his dual aim to generate greater saving and, at the same time, to create a property-owning democracy.

In an effort to cater for the needs of the small and regular savers (particularly the young) most building societies have a savings share, or subscription share, whereby regular saving is encouraged at a rate of interest slightly in excess of that paid on ordinary shares.

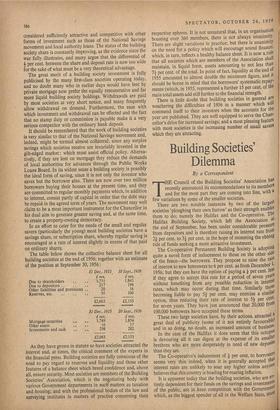

The table below shows the collective balance sheet for all building societies at the end of 1956; together with an estimate of the position at September 30, 1956:

31 Dec., 1955, inn. 30 Sept., 1956 inn.

Due to shareholders 1,731 1,843 Due to depositors .. 217 194 Other liabilities and provisions .. 20 16 Reserves, etc. 95 100

£2,063 £2,153

31 Dec., 1955 £mn. 30 Sept„ 1956 £ MIL

Mortgage securities

• •1

1,749 1,854 Other assets

16 17 Investments and cash

298 282

£2,063 £2,153

As they have grown in stature so have societies attracted the interest and, at times, the critical comment of the experts in the financial press. Building societies are fully conscious of the need to pay regard to reserves and liquidity and those other features of a balance sheet which breed confidence and, above all, ensure security. Most societies are members of the Building Societies' Association, which is the negotiating body with various Government departments in such matters as taxation and housing; and with the professional bodies of the law and surveying institutes in matters of practice concerning their respective spheres. It is not unnatural that, in an organisation boasting over 360 members, there is not always unanimity. There are slight variations in practice; but there is unanimity on the need for a policy which will encourage sound finance; which, in turn, reflects a healthy balance sheet. It is now a rule that all societies which are members of the Association shall maintain, in liquid form, assets amounting to not less than 74 per cent. of the total. In point of fact, liquidity at the end of 1955 amounted to almost double the minimum figure, and it should be borne in mind that the borrowers' systematic repay ments (which, in 1955, represented a further 15 per cent. of the main total assets add still further to the financial strength.

There is little doubt that building societies in general are weathering the difficulties of 1956 in a manner which will commend itself to their investors when the accounts for the year are published. They are well equipped to serve the Chan' cellor's drive for increased savings; and a most pleasing feature with most societies is the increasing number of small savers which they are attracting.

Previous page

Previous page