Building Societies' Dilemma

By a Correspondent THE Council of the Building Societies' Association has recently announced its recommendations to its member° and for the most part they are coming into line, with a few variations by some of the smaller societies. There are two notable instances by two of the largest societies 'ploughing their own furrow' as their strength enables them to do; namely the Halifax and the Co-operative. The Halifax Building Society, which left the Association at' the end of September, has been under considerable pressure from depositors and is therefore raising its interest rate from 24. per cent. to 31 per cent. in the hope of stemming the ebbing tide of funds seeking a more attractive investment.

The Co-operative Permanent Building Society is adopting quite a novel form of inducement to those on the other side of the fence—the borrowers. They propose to raise the rate of interest to new borrowers to 6 per cent. as from December 1, 1956; but they can have the option of paying a i per cent. less if they agree to accept this rate for a period of seven years without benefiting from any possible reduction in interest rates, which may occur during that time. Similarly those becoming liable to pay 5i per cent. may exercise a simile option, thus reducing their rate of interest to 51 per cent' for seven years. They have just announced that 20,000 from 100,000 borrowers have accepted these terms. These two large societies have, by their actions, attracted 0 great deal of publicity (some of it not entirely favourable) and in so doing, no doubt, an increased amount of business. In the case of the Halifax it does seem that this octopus is devouring all it can digest at the expense of its smaller brethren who are more desperately in need of new deposits than they are. The Co-operative's inducement of i per cent. to borrowers seems very thin indeed, when it is generally accepted that interest rates are unlikely to soar any higher unless anyone believes that this country is heading for roaring inflation.

It is apparent today that the building societies, who are en' tirely dependent for their funds on the savings and investments of the public, are in keen competition with the Governme°`, which, as the biggest spender of all in the Welfare State, must and is offering greater inducements to the public to lend, to it, through the new 41 per cent. Defence and Premium Savings Bonds.

A GOVERNMENT PROMISE The Conservative Government has promised to amend the Rent Restriction Act, which in its present form makes it quite unattractive for landlords to offer property for 'letting' in this so-called property-owning democracy. Until this is done there can be little hope of the present housing shortage being satisfied. In fact the council-house waiting list is as long as ever, and for the thousands who do not want to rent one, but to own their own, it is becoming increasingly difficult for them to obtain a loan to purchase a new house and almost impossible to acquire a loan to buy an old one.

The Abbey National and the Woolwich are two notable exceptions, who for the time being are not increasing their rates to borrowers.

The building societies are clearly 'up against it,' with demands for housing loans greater than ever before (as the banks are virtually out of the market), which they are unable to satisfy. It is argued by some of them that the Government should wet-nurse the ailing child by the Treasury granting some form of tax relief as is allowed in respect of life insurance premiums, the reason being that building society deposits and shareholdings are also savings. Interest on deposits and shares is, of course, paid tax-free now, but the societies are them- selves liable to tax.

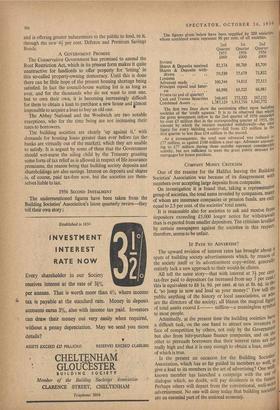

1956 SECOND INSTALMENT The undermentioned figures have been taken from the Building Societies' Association's latest quarterly review—they tell their own story : The figures given below have been supplied by 209 societies, whose combined assets represent 90 per cent. of all societies.

2nd Quarter 1955 £000 1st Quarter 1956 £000 2nd Quarter 1956 £000

SAVING

Shares & Deposits received 82,174 98,709 85,700 Shares & Deposits with- drawn .. 59,530 75,679 71,832

LENDING

Advances made .. .. 100,544 74,815

77,315 Principal repaid and Inter- est .. .. .. 66,990 65,525

66,981 FUNDS (at end of quarter) Cash and Trustee Securities 248,602 272,522 267,132 Combined Assets .. .. 1,787,129 1,913,716 1,942,772 The first two lines show the continuing effect upon building societies of the 'credit squeeze.' It is to be observed that whilst the gross investment inflow in the 2nd quarter of 1956 exceeded by over £3 million that in the corresponding quarter of 1955, the amount by which the receipts exceeded withdrawals—the vital figure for every building society--fell from £23 million in the first quarter to less than £14 million in the second.

As a consequence, the total sum advanced was reduced to £77 million, as against £100 million a year ago. Advances amount' ing to £77 million during three months represent considerable activity, but not sufficient to meet the great public demand for mortgages for house purchase.

COMPANY MONEY CRITICISM One of the reasons for the Halifax leaving the Building Societies' Association was because of its disagreement with members over accepting large deposits from companies.

On investigation it is found that, taking a representative group of societies, the total sums invested by companies, maul' of whom are insurance companies or pension funds, are only equal to 2.5 per cent. of the societies' total assets.

It is reasonable also for societies to ask and receive front depositors exceeding £5,000 longer notice for withdrawals than is expected from smaller depositors. The criticism levelled by certain newspapers against the societies in this respect. therefore, seems to be unfair.

IT PAYS TO ADVERTISE?

The upward revision of interest rates has brought about a spate of building society advertisements which, by reason of the society itself or its advertisement copy-writer, generally entirely lack a new approach to their would-be clients. All tell the same story—that with interest at 31 per cent. tax-free paid to depositors (as increased from say 3 per cent.) this is equivalent to £6 ls. 9d. per cent. at tax at 85. 6d. in the 'so jump in now and lend us your money ! ' Few tell the public anything of the history or local associations, or wilt) arc the directors of the society; all blazon the magical figure of total assets exceed £ million—a meaningless symbol to most people. Admittedly, at the present time the building societies have a difficult task, on the one hand to attract new investors in face of competition by others, not only by the Government but also from hire-purchase finance companies, and on the other to persuade borrowers that their interest rates are not really high and that it is easy enough to obtain a loan, neither of which is true. Is the present an occasion for the Building Societies, Association, which has so far guided its members so well to give a lead to its members in the art of advertising? One we'll known member has launched a campaign with the use dialogue which, no doubt, will pay dividends in the future' Perhaps others will depart from the conventional, well-warn advertisement. No one will deny today that building societies are an essential part of the national economy.

Previous page

Previous page