The Year's . Market Winners

By NICHOLAS DAVENPORT

1 RECKON that at the close of this year the apprecia- tion in the market values of the securities quoted on the London Stock Ex- change amounted to over £3,000 million. I arrive at this figure by relating the present index numbers for the various groups of securities to the

total market values pub- 'shed at the end of 1962. These were £19,772 lillian for British government bonds and fixed- nterest securities, £1,097 million for preference hares and £21,204 million for ordinary shares

a total of £42,073 million. This year there as been little or no appreciation in fixed-interest ocks, but an over-all appreciation in ordinary hares of around 12 per cent. The Financial lines industrial index, which has only thirty hares, actually rose 16 per cent-or 23 per cent (ram the low point of 279 at the end of January but this index is not representative of equity hares as a whole. An appreciation of £3,000 lillion may sound wonderful to some people, ut it was not really a good year for investment ortfolios. One can only get spanking appre- lation when government bonds are rising in OMpany with equity shares.

This happy conjuncture is usually in the first base of a re-expansion of the economy when e government is making money cheaper in rder to help a business recovery forward. It hould have happened this year, but first there as the attack on sterling in the early months hich upset the gilt-edged market, and then

the latter part of the year there was the Ise ill the American Treasury bill rate (to rated t the dollar), which caused interest rates move up sharply in London. The result was at War Loan, which had risen at one time to 4: to yield 51 per cent, came back to 58 to ield 6 per cent. At the moment of writing it 581.

Equity shares have provided the only means of laking a good tax-free capital profit this year, St is, if the shares were held for more than X months. After a dip and much hesitation in anuary, the market became convinced that hancellor Maudling really meant expansion, nd as the various steps were taken to stimulate e economy, it went merrily ahead for the t of the year. On the chart it looked very Inch like a repetition of the strong bull market { 1958 which lasted two whole years. The resent bull market, having started in June, 2, has so far lasted eighteen months. The chief winners have been the shares of °Inpanies which stand to benefit from the Chan- or's stimulating measures. First were the °tor shares, which began to rise immediately fter the cut in purchase tax. BMC, for example, limbed from a low point of 14s. 11.d. to 18s. 74d. a rise of nearly 32 per cent. The sharp in- "ease in government spending on electricity dis- libation and telephones brought an equally larP rise to the shares of the heavy electrical IA cable group-no less than 331 per cent 11 the average. The star performer in this sec- (In was GEC, which from a low point of 35s.

Custos is on holiday reached 70s. 9d.-a rise of over 100 per cent. This proves once again that seekers after capital profit should always go for a share which has been 'down and out' and has started to recover under better management. BICC was another winner in this group, having enjoyed a rise of 56 per cent, and AEI was not far behind with a rise of 42 per cent. In contrast, Reyrolle, which has never been `down and out' like the others, rose by a modest 23 per cent.

Another group basking in the sun of govern- ment capital spending was that of building materials and road materials. Ameys, which were a newcomer to the market, enjoyed a spurt of no less than 78 per cent and Marley Tile one of 64 per cent. British Plaster Board, a slower- moving company, saw a rise of 33 per cent. The contracting group, benefiting from huge housing contracts, was also prominent in the market with a rise of 28 per cent. Turriff Construction, for example, which is rebuilding the Barbican, saw its shares soar 83 per cent-from 18s. 41d. to 33s. 9d. (now 32s.). Some of the shares in the road-material group yielding under 3 per cent begin to look fully valued. Would any 'takeover' merchant buy a company like Derbyshire Stone, yielding 2.7 per cent on dividends, on the basis of nearly thirty years' purchase?

The chemical industry, which reflects the general growth (or otherwise) of the economy, has been favoured by investment managers in this wonderful bull market. ICI have climbed from a low of 36s. 6d. to 50s. ex the 50 per cent bonus. When the leader of our industrial equities rises 37 per cent in a year the equity investor should have no qualms.

Another example of the excellent profits which can be made by buying 'down and out' shares in the first phase of a business recovery is the aircraft group, Bristol Aeroplane re- covered in the year by 89 per cent and Hawker Siddeley by 50 per cent to 36s. (now 30s. 6d.) My colleague Custos was on to Hawker Siddeley at an early date and to most of the other shares mentioned above, but not, alas, always at the low point of the year. His best recommendation was William Press at 17s. 6d. in September, 1962.

They are now 33s. ex 50 per cent bonus. To get with or on the most spectacular rises you would have to go to a fortune-teller. For example, who could have seen that Mr. John Bloom would regalvanise English and Overseas Investment, which soared from 4s. 9d. to over 50s.-a rise of

900 per cent-before relapsing to 43s. Or that Alice Edwards, a store company, would change its name and get its shares moving up from Sid. to 4s. 11d.---another rise of 900 per cent?

There were, of course, exceptions to the up- ward trend. Insurance shares, depressed by the underwriting losses of the composite companies, did particularly badly, falling on the average by 14 per cent, or 30 per cent from their high

of 1962. Property shares, which would be threatened by the advent of a Labour Govern- ment, fell on the average by 11 per cent, or 331 per cent from their high of 1962, Bank shares were also down- -by about 12 per cent. But even these depressed groups started to show signs of ree9N cry before the end of the year.

I should add that the year's appreciation of £3,000 million is a paper figure, of which a little over 10 per cent belongs to the insurance com- panies and other investment institutions. How much of the appreciation was cashed in by pri-

vate holders is anybody's guess. If you spread £2,700 million around about two and three- quarter million shareholders you only get about £1,000 per investor. It was not, therefore, a great investment year. And I would guess that the capital gains tax will bring in exactly nil --or a loss carried forward.

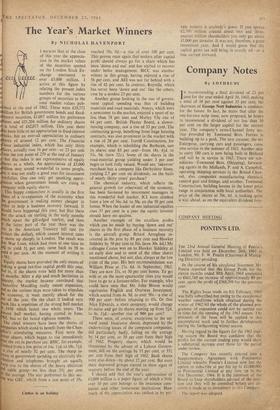

Previous page

Previous page