The share slide starts

Nephew Wilde

A trivial thought crossed my mind after I had heard Mr Heath's economic measures last Wednesday. Who on earth is going to put his proposals into effect? Will we have a Control Squad or Men from the Margin Department, I wondered? Whatever they are, in fact, going to be called it seems impossible that 700 or so extra civil servants will be able to cope with the mountains of documents that will have to be examined. I do believe, however, that to facilitate movements between this new section of the civil service the Government has an ingenious plan. Little known to most of us who live in London, a tunnel that was used during the war runs underground from Whitehall towards Tottenham Court Road. There is a good chance, in view of the tunnel's location, that the Government will very soon lease, buy or simply requisition Centre Point thereby having a direct link from the Power House to branch office, so to speak.

But more important, of course, is the shambles that the Heath measures have caused in the City. My own broker, Wotherspool is even putting money on an October election. And when I asked him what he recommended I buy this week I heard a faint voice on the telephone whisper: " I shouldn't , say this, old man, but sell everything you've got. The bubble has burst."

Now Wotherspool is prone to exaggeration and lets himself be carried away. However I do find his comments disconcerting. Nevertheless, personally I feel rather more cheerful after the collapse. Yet I have still to decide what to buy when my investment adviser fails me. My strategy, in fact, has been to select a share that has performed comparatively well even in the shake-out of the last few days, on the hypothesis that if it can do well in this climate it must be pretty spectacular. Now there are two such situations that I have stumbled across. One is Savoy Hotels and the other Perak River Hydro. I know only vaguely what they do. I thoroughly recommend the former's cabarets — but then this is not a buying exercise based on fundamental criteria.

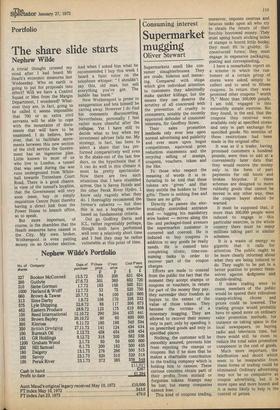

Out go Godfrey Davis and ICL, rather regrettably perhaps, though both have performed well over a relatively short time and I feel they may be rather vulnerable at this point of time.

Previous page

Previous page