FINANCE-PUBLIC AND PRIVATE

STOCK EXCHANGE DEPRESSION

By ARTHUR W. KIDDY.

VERY early in the present year, attention was called in these columns to the tendency on the Stock Exchange to over-emphasize the optimism occasioned by such developments last year as the adoption of the Dawes Plan and the rise in the American Exchange on London, and to under-estimate the gravity of the industrial and social problems with which the country was still con- fronted. To an extent which, I am afraid, must some- times have been wearisome to your readers, I have also from month to month commented upon the seriousness of the position of our foreign trade and the growing extent of our adverse balance. It is a recognition of the gravity of these problems which must be held respon- sible for the Stock Exchange reaction of the past few weeks, though, in some directions, and more especially in high-class investment stocks, the fall has also been very definitely accentuated by the rush of large capital creations of an investment character.

FACTORS OPERATING.

Nor is it altogether a case of the volume of these issues being in excess of the previous year, but rather of their having been in excess of the present saving power of the community, while in many instances those making the flotations have endeavoured to exact too high a price from the investor, with the final result that underwriters lately have been called upon to take up so much stock as to occasion serious financial congestion. These conditions, moreover, have been aggravated during the past week by such circumstances as the serious trouble in China, the further fall in some of the Continental exchanges, and, last but not least, perhaps, the general hardening of Money Rates and the liquidation of stocks preparatory to the publication of balance sheets at the end of the half-year.

SIX MONTHS MOVEMENTS.

Before the next number of the Spectator is published, the half-year will have turned, and it may be of some interest, therefore, to recall what has been the general trend of market movements during the past six months. This it is possible to do by reason of the monthly valuation of Stock Exchange securities by the Bankers' Magazine, .which takes each month a list of 865 repre- sentative stocks and registers the movements in capital values. At the end of December last, this great group of securities had shown an appreciation for the year of £262,000,000. During the past six months, however, this same group has shown a setback of no less than £185,000. In other words, considerably more than one-half of the appreciation of the preceding year has been lost.

FALL IN INVESTMENTS.

Even more striking, however, is the decline which has taken place in the gilt-edged group. The Bankers' Magazine divides its stocks into Fixed Interest desert). tions and Variable Dividend securities. In the former group which, of course, includes British and Indian Funds and Prior Charges of English Railways, there was an appreciation for the whole of last year of £64,000,000, but during the past six months there has been a decline of no less than £159,000,000, so that it will be seen that much more than the entire appreciation of last year has been wiped out. What, it may be asked, has been the cause of this great decline in high-class investment securities, led by British Funds ?

CAUSES OPERATING.

As is generally the case in a great movement of this character, the causes have probably been numerous and among them must be included the simple fact of Money Rates having risen slightly during the six months and also the fact that the rise in stocks had gone too far. In other words, having regard to the high state of taxation, the cost of living and so forth, the yield on securities was insufficiently attractive. Added to these influences, there has, of course, been the further weight of new capital issues already referred to which, as I have said, have tended latterly to go ahead of the national savings. I think, however, that there is another cause which, perhaps, has been imperfectly appreciated, namely, the extent to which bankers may have had to aid many of our industries in meeting the great demands of Labour by financing industries, although such financing has in many cases not been rendered necessary by an expansion in activities, or at all events in profit-earning power. Nevertheless, it will be found that during the past year or so bankers have evidently been heavy sellers of high-class investment securities, and simultaneously —the trade depression notwithstanding—there has been a great increase in the total of bankers' advances. Then, it will be noted that Prior Charge stocks of English Railways, in common with the Ordinary stocks, have fallen heavily, and here again, of course, we have the effect of apprehensions engendered by the general Labour unrest and by the further great demands on the part of railway employees.

IRREGULAR MOVEMENTS.

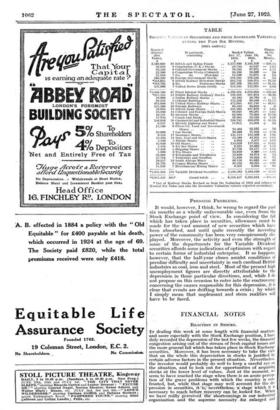

It may be of interest, as indicating the general trend of markets, to study a table taken from the Bankers' Magazine showing how the various departments have been affected by the trend of price movements during the six months. There it will be seen that the net decline in Variable Dividend securities has been far less serious than in the case of the gilt-edged descriptions, and this rather confirms the view taken in these columns months ago with regard to the tendency on the part of the investor to shift from gilt-edged securities to the more speculative descriptions. Somewhat strangely, it will be noted that the commercial and industrial group itself has risen, that circumstance being due, no doubt, to the great rise which has taken place in a few outstanding issues like Courtaulds, and some of the shares in the Tobacco group. On the other hand, the real tendency of trade is reflected more truly In the decline which has taken place in shares of Iron, Coal and Steel companies, and in the shares of Shipping con- cerns, while there has been quite a heavy fall in the Ordinary shares of American railroads. In the purest speculative departments, a feature has been the recovery in Oil and Rubber shares, while South African Mines have been fairly well maintained when allowance is made for the practical disappearance of the gold premium, owing to the rise in the American Exchange on London.

PRESSING PROBLEMS.

It would, however, I think, be wrong to regard the past six months as a wholly unfavourable one, even from the Stock Exchange point of view. In considering the fall which has taken place in securities, allowance must be made for the vast amount of new -securities which have been absorbed, and until quite recently the investing power of the community has been very conspicuously dis- played. Moreover, the activity and even the strength of some of the departments for the Variable Dividend securities affords some indications of optimism with regard to certain forms of industrial enterprise. It so happens, however, that the half-year closes amidst conditions of peculiar difficulty and uncertainty in such cardinal British industries as coal, iron and steel. Most of the present high unemployment figures are directly attributable to the depression in those particular directions, and, while I de not propose on this occasion to enter into the controversy concerning the causes responsible for this depression, it is clear that events are drifting towards a crisis ; by which I simply mean that unpleasant and stern realities will have to be faced.

Previous page

Previous page