THE LONDON INVESTOR'S FEAST

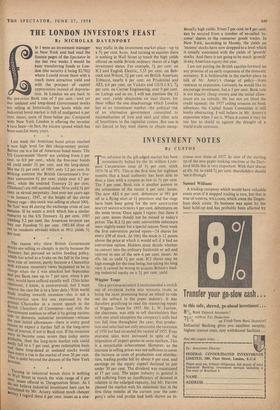

-By NICHOLAS DAVENPORT Last week the American bond prices reached a new high level for this cheap-money period. Before me is a list of American bond issues. The US Government 'shorts' are yielding from -- per cent. to 0.9 per cent., while the five-year bonds all yield under 21 per cent. and the long-dated, like the 3+ per cent. of 1985, only 3.2 per cent. In striking contrast the British Government's five- Year conversion 4+ per cent. yields over 4.7 per cent., while the undated Treasury 21 per cent. (`Daltons) are still quoted under 50 to yield 5+ per cent. in virtual perpetuity. Just over ten years ago --in January, 1947, at the height of the cheap money rage—this stock was selling at about 100+. Its 'low' was 44 during the exchange crisis of last autumn. If he wants' a stock which has a similar Maturity to the US Treasury 31 per cent. 1985 Yielding 3.2 per cent. the American investor can buy our Funding 51 per cent. 1982-84 (free of tax to residents abroad) which at 99-14 yields 51 Per cent.

The reason why these British Government stocks are selling so cheaply is partly because the Treasury has pursued an active funding policy, which has acted as a brake on the fall in the long- term rate of interest, partly because a Chancellor With extreme monetary views happened to be in charge when the £ was attacked last September and put Bank rate up to 7 per cent. when 6 per cent, would have sufficed equally well. (This latter statement, I know, is controversial, but I must reserve the case for it to a later date.) With world trade tending towards recession—this is not a controversial view but one expressed by the present Chancellor in a recent speech to the British Chambers of Commerce—and with the Government anxious to offset it by giving various atds to domestic industrial investment—witness the new initial allowances—there is every good reason to expect a further fall in the long-term were of interest, if not in Bank rate. If the recession were to become more severe than today seems Prnbable, then the long-term market rate could easily fall to a 5 per cent. gross redemption basis and these long-dated or undated stocks would then enjoy a rise in the market of over 20 per cent. Thatis quite beyond the dreams of the New York Investor.

* * *

to Turning to industrial bonds there is nothing Wall Street to match the wide range of 6 per eentnot.issues offered in Throgmorton Street. As I believe industrial investment here can be sti mulated by Mr. Amory without much cheaper ey I regard these 6 per cent. issues as a one-

Mon

way traffic in the investment market-place—up to a 51 per cent. basis. And turning to equities there is nothing in Wall Street to touch the high yields offered on stable British ordinary shares of a high investment status. For example, 51 per cent, on ICI and English Electric, 5.35 per cent. on Bab- cock and Wilcox, 5+- per cent, on British American Tobacco, nearly 6 per cent. on Prudential and AEI, 6.6 per cent, on Vickers and GUS CAI 7+ per cent. on Carrier Engineering, over 9 per cent. on Liebigs and so on. I will not mention the 12 per cent. yields obtainable on steel shares, for these reflect the one disadvantage which London has as an investment market—the political risk of an alternative government committed to nationalisation of iron and steel and other acts of beastliness to the capitalist system. But one is not forced to buy steel shares to obtain excep- tionally high yields. From 7 per cent. to 8 per cent. can be secured from a number of so-called 'in- come' shares in the consumer goods trades. In New York, according to Moody, the yields on `income' stocks have now dropped to a level which is usually associated with the yields of 'growth' stocks. And there is not going to be much 'growth' in any American equity this year.

I am not putting the British equities forward on any promise of an early expansion of the domestic economy. It is fashionable in the market-place to talk of Mr. Amory's change of policy—from restraint to expansion. Certainly he would like to encourage investment, but a 5 per cent. Bank rate is not exactly cheap money and the initial allow- ances are no subsidy. He has not yet lifted the credit squeeze; the 1957 ceiling remains on bank advances; the Capital Issues Committee is still busily obstructing. 1 will believe in Mr. Amory's expansion when 1 see it. When it comes it may be too late to shield us against the draught of a world trade recession.

Previous page

Previous page