How Rich We Are!

By NICHOLAS DAVENPORT

THE Budget.like the shrubs and trees, will soon be bursting into blossom. Why be nervous about its fruit? Are you still worry- ing about the January trade Zfc;i: r£,K,WZ. figures? Are you appre- hensive of a balance of payments deficit which will make the Budget fruit bitter? I cannot speak for Mr. Maudling but I can assure you that no one in the financial world is worried in the slightest at the prospect of a balance of payments deficit in a year of stock- building after the long night of the Lloydian recession. In its last quarterly bulletin the Bank of England has been at pains to tell the world how rich we are, how great our underlying strength, and how smoothly the new machinery is working which helps the central banks to meet speculative attacks upon their currencies.

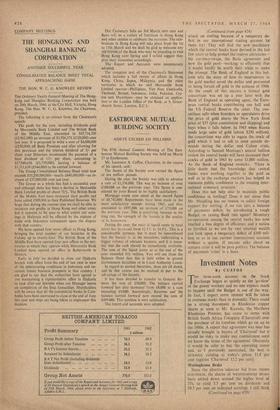

This bulletin gave an inventory of our ex- ternal assets and liabilities at the end of 1962 classified as 'short-term' and long-term' (twelve months being the dividing line) and as official and private (official being the Government and its agencies, local and other public authorities, the Crown Agents for overseas administrations and the Bank of England). The Bank assures us that the effect of the incompleteness or unavail- ability of statistics for several important items is 'undoubtedly to understate UK external assets more seriously than the corresponding external liabilities.' This is very gratifying, seeing that the grand totals showed that assets exceeded liabilities by £1,629 million--the figures being £12,821 million against £11,192 million. Call it an assets surplus of over £2,000 million and we would not be exaggerating. Here is the abbreviated table: UK EXTERNAL ASSETS AND LIABILITIES: END-1962

In millions

ASSETS Short-term (a) Official (gold reserves) .. £1,002

(b) Private claims, sterling and non-sterling .. £2.104

Long-term (a) Official—loans, etc. .. £684 non-sterling securities £385 (b) Private—portfolio .. .. £3,000 direct investments .. £4,950 UK subscriptions to IMF .. £696 £12,821 LIABILITIES Short-term (a) Official .. £2,462 (b) Private .. £2,738 Long-term (a) Official .. .. £2,640 (b) Private—portfolio .. £735 direct investments .. £2,100 IMF sterling holdings .. • • £517 £11,192

To say that in spite of two world wars we are once again a great creditor nation is not something of which we should be particularly proud. It may point to the fact that our invest- ment policy since the war has been slanted too much overseas. And the fact that our short- term liabilities greatly exceed our short-term assets, so that to that extent we remain depen- dent upon foreign confidence and the goodwill of overseas financial authorities, is a reminder that we are still indulging in the old banking habit of harrowing short (including Euro- dollars) in order to lend long as well as short. But in the face of this table who can pretend that our position as a great trading and banking nation is not a strong one? To meet the short- term liabilities of £5,200 million we had gold and convertible currency reserves of £1,002 mil- lion, official holdings of marketable dollar securities of £385 million and drawing rights on the IMF of £876 million (£357 million auto- matically), making a total of £2,263 million. No commercial banker Works on such a high liquidity ratio as 434 per. cent. Only Germany could claim to have a greater degree of solvency.

The Bank of England emphasises another point of strength. Where the balance of pay- ments is concerned, it says, the profit and loss account on international investment is more significant than a balance sheet of assets and liabilities. We have profitable long-term invest- ments abroad of £7,950 million (of which £3,000 million is portfolio) against foreign.

investments in the UK of £2,835 million (of which £735 million is portfolio). So behind the sterling lies an immense amount of invested wealth overseas.

If foreigners want to make another 'bear' (Continued in col. 3, page 426) (Continued from page 424)

attack on sterling because of a temporary de- ficit in our international trading account let them try! They will find the new machinery which the central banks have devised in the last few years to help protect the reserve currencies— the currency-swaps, the Basle agreement and now the gold pool—working so efficiently that it would hardly be worth their while to make the attempt. The Bank of England in this bul- letin tells the story of how its intervention in the gold market saved the dollar and prevented its being forced off gold in the autumn of 1960. As the result of this success a formal gold consortium was set up a year later with the Bank of England as operating agent, the Euro- pean central banks contributing one half and the US Federal Reserve the other. The con- sortium sells when hoarders or speculators drive the price of gold above the New York fixed price of $35 (plus commission and shipping) and buys when it falls below. In 1963 when Russia made large sales of gold (about $290 million), the consortium was able to regain the stock of gold which it had to sell to meet outside de- mands during the dollar and Cuban crisis. According to Samuel Montagu's annual bullion review the central banks will have increased their stocks of gold in 1963 by some $1,000 million. As the Bank of England reniarks: 'There is little doubt that the knowledge that central banks were working together in the gold as well as in the exchange markets has helped to maintain public confidence in the existing inter- national monetary structure.'

Does this not help also to maintain public confidence in sterling? Does it not mean that Mr. Maudling has no reason to solicit foreign support for sterling, if we run into a balance of payments deficit, by introducing a tough Budget, or raising Bank rate again? Monetary co-operation among the central banks has now reached a fine degree of efficiency and a nation as fortified as we are by vast external wealth can look upon a temporary deficit of £100 mil- lion or so in our current international account without a qualm. If anyone talks about an autumn crisis it will be pure politics. The balance of payments 'crisis' is a hoax.

Previous page

Previous page