Investment Notes

By CUSTOS

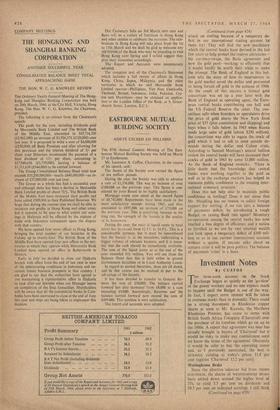

three-week account on the Stock I Exchange began as quietly as the `go-slow' of the power workers and no one expects much to happen until the Budget is out of the way. In fact, I expect more interest will be taken in overseas stocks than in domestic. There could be a strong movement in Rhodesian copper shares as soon as Mr. Kaunda, the Northern Rhodesian Premier, has come to terms with British South Africa Company (Chartered) over the purchase of its royalties which go on up to the 1980s. A report that agreement was near has already brought in buyers of 'Chartered' but it would be risky to make any commitment until we know the terms of the agreement. Obviously it would be safer to buy the operating mines and, as I previously mentioned, the best is NCHANGA yielding a/ today's prices 11.8 per cent (against 'Chartered' 12.2 per cent).

Westinghouse Brake

Since the abortive takeover bid from THORN ELECTRICAL the shares of WESTINGHOUSE BRAKE have settled down around the higher level of 37s. to yield 5.3 per cent on dividends and 10.5 per cent on indidated earnings. I still think

(Continued on page 428)

(Continued from page 426)

they are a good recovery prospect. It will be recalled that after the cancellation of the vacuum brake contract with British Railways, for which they have now received £1,600,000 in compen- sation, the company has set up a plant to manu- facture automatic transmission for motors. This was a flop and the plant is now engaged in high precision gear cutting and other sub-contract work for the motor and other industries. I am told that it will break even in the current year and earn a profit thereafter. Meanwhile orders for brakes and signalling equipment are noW coming in well from British Railways and from buyers overseas. The sales of metal rectifiers have taken a 'steep upward trend' and demand from the coal industry for the mine car and traffic control equipment is increasing. The parent company's orders at the end of January, 1964, were about 50 per cent up (a quarter being export orders) while those for the group as a whole were 35 per cent up. The problem is how to raise output sufficiently to meet the increasing demand. The new management is obviously on its toes and anxious to avoid another takeover bid. Hence the encouraging news it has lately divulged to shareholders. After the loss for the preceding year the current year's results should be brilliant.

Delta and BICC

Two of my constant recommendations have come home. The fast-expanding DELTA METAL

recently acquired Johnson and Phillips and made a rights issue of one-for-eight. Now it is pro- posing a one-for-two scrip issue after announcing better than ever profits—up II per cent—and a 21 per cent dividend, one point up on the forecast. Equity earnings were a little over 40 per cent and may be expected to show a further rise this year when the benefits of in- tegration are realised. It is thought that 15 per cent will be paid on the increased capital, which would give a return of 3.9 per cent on the present price of 27s. 3d. In view of its aggressive and able management this 'growth' share should be kept. Mt, which is the obvious beneficiary of the increased government spending on electricity output and distribution, has an- nounced pre-tax profits about 50 per cent higher and declared a dividend of 15 per cent against the forecast 131 per cent. The shares have risen to 86s. to yield 31 per cent on dividend and 7.6 per cent on earnings. They do not look as cheap as Delta but I would be reluctant to sell.

AEI Recovery

The results from AEI were disappointing. The last half-year failed to show the expected re- covery, profits dropped and it was only a lower tax charge which prevented the dividend of 10 per cent being short-earned. But the market is still hopeful and the shares have improved to 40s. to yield 5 per cent. The company should obviously do well out of heavy electricals and cables but it is the appliance side which has been the stumbling-block. The new management are

confident that they will pull this round and I hope that this section will eventually be sold off. The directors have encouraged the market by predicting that profits will be higher in 1964.

Previous page

Previous page