Trusts on Trial

By DEREK MOORE

NINETY-NINE articles in ninety-nine papers have been telling 999,000 people with money in the bank to put it into unit trusts. This is the hun- dredth—and the exception. But don't jump to any conclusions yet. I am not going to fulminate against the unit trust movement. But there are some things that have to be said which are not being said. Some things to put right which are going to be wrong otherwise.

The whole accent on unit trust investment is being changed, not by the movement itself which, if the truth be known, is rather fearful of the responsibilities it is assuming. What people are looking for now in unit trusts is capital apprecia- tion, the odds-on chance–in the market, the tinsel and glamour of the City tycoons. The usual approach of the public now is to compare the price rises of different trusts over the past year, see which is the biggest and plunge in quickly to get on top of the next wave. 'ABC trust has gone up 1 per cent. more than DEF: QED—the management has proved itself better accordingly and ABC is the trust for my money.'

This is absolutely the wrong approach, particu- larly with the Financial Tiinis industrial share index, the barometer of share prices, standing at or near its highest point since it started in 1933. Unit trusts are' for small savings—not for the would-be Mr. Clores with £50 or so to splash. Do not study form in your evening paper each day and start worrying if the unit trust price does not come up to your best expectations. You have backed the management of the trust to invest for you: let them do it and rest yourself at nights.

Perhaps it is the enthusiastic sales approach of some unit trusts themselves that has led to this unhealthy concentration on rising prices. If so, the propaganda should be changed and changed quickly. If this type of blandishment is still being dangled when the peak of the boom is passed, the trusts will be making a heap of trouble for them- selves. With over £100 million in their keeping the managers must avoid any action that ultimately might lead to wholesale disappointments and forced selling on an unwilling market. If the newly found faith of the public in this form of saving is not to suffer a• near-mortal blow when markets fall, then the new savers must be educated to look for something other than the repetition of the recent breathtaking climb in share prices.

One of the ways to turn the profits of today to good account is to have them generally, regarded as a reserve against a setback in the market. Every bull market in the past eighty years has been followed by a bear market with prices sliding away. The investor buying today and seeing his units appreciate in Value had best regard his profit as his insurance policy against the uncer- tainties of the future.

The good trusts will meet the change in invest- ing climate with a thorough spring-clean of their portfolios. I would be happier if I were sure that the trusts were prepared to move into defensive stocks at the strategic moment—even into gilt- edged which, at the time, would probably enable them to double their income anyway and provide something to cover the expenses of switching. It is not always necessary to sell a lot of securities to effect a safety-first switch. New money can be diverted and the balance of a trust with a good flow of new savings can be soon trimmed to meet heavier weather.

Perhaps this is looking too far ahead and first the 'reserves' have to be built up in preparation Tor the uncertainties. Will the best be made out of the present opportunities when trust efforts are being so widely scattered over so many com- panies? It may look impressive to point to nearly 200 companies and say that the trust money is spread over them. But the average that most investors look to and make their comparisons with is composed of no more than thirty shares, and of necessity it has to include some pretty slow movers to make it representative. If the trusts are really going all out to secure capital profits, then this is the wrong kind of shopping they are doing. If they do not feel inclined to take the responsi- bility--after all, buying every share in the Stock Exchange Official List over a period has precious little to commend it save caution—then they should move over. There are bound to be others that will take on the task. Personally I like the approach of the US trusts who put 53 million or more into one company, though before they do, they reckon to know even which side of the bed the President sleeps on.

So we have come back to the crucial question of management, the most important qualification for unit trust success and the most difficult for the investor to judge for himself. Here the trusts could do a lot more to help the new saver, even if the City found the process somewhat embarras- sing at first. The people that are needed to run the trusts are those who have had such signal success with, say, the Scottish investment trusts, whose flair is recognised both in this country and the United States. Perhaps their names might not mean a thing to the public now. But that is only a job for a public-relations officer. Every sales blurb put out for a unit trust should include some brief biographical details of the people who are guiding the choice of the investments. The law on this point is a bit awkward as it makes it diffi- cult to list the individuals whose task it is to chose the fund investments. Laws are only made to pro: tect investors. This step I am suggesting is for investors' protection too, so here is one of the ways in which the path can be smoothed for the smaller investors.

It will be interesting to see who will emerge as the real experts. It will be a great day for the movement when it is run entirely by the experts in investing. The time passed in 1929 when guinea- pig directors were the fashion and the public lost its shirt backing them. This, we hope, is the age of the specialist. The trouble today is that they do not command the pay they undoubtedly deserve. One bad decision on an off-day can cost a trust some thousands of pounds. What I would like to see is the trust that advertises what it is paying its experts. The only assets a trust has besides its portfolio arc men. The movement has attracted some good men to it. Now it has the funds to be able to command the service of the beSt.

This is the moment of challenge for the unit trusts. This is when they have to decide whether or not their organisation is fitted for the full task of investing not only in the easy early days of the upward swing in the market, but also in the more difficult days nearing the top and especially after that, when safeguarding capital and income becomes of paramount importance. If the trusts see their role as no more than collectors of divi- dends from investments they have already made —with notable success—and admit no necessity for change, then they are not havens for the sav- ings of the people. It should be obligatory—in the American pattern—for trust literature to point out both the snags of equity investment through the market cycles, and the trust's policy when the present bull market seems to have run its course.

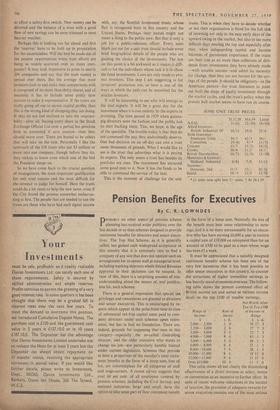

SOME UNIT TRUST PRICES

31.12.58 30.6.59 Latest

A.E.G.

11/64 12/104 14/104

Allied Investors : British Industrial IV

16/11 19/6 23/6

Bank Insurance : Insurance Units

34/3 42/3

54/-

Consolbits 29/45 9/-* 11/74 Unicorn 13/7 15/21

19/54

Crosby 10/4 11/3 14/I British Shareholders .. 10/75 11/34 13/1B4 Municipal & General:

Midland Industrial _ 6/81 7/9 11/11

National :

Domestic 2nd 11/3 13/- 1631

Shield .

100 11/3

13/91 units now split into 5/- units. t At 30.1.59.

Previous page

Previous page