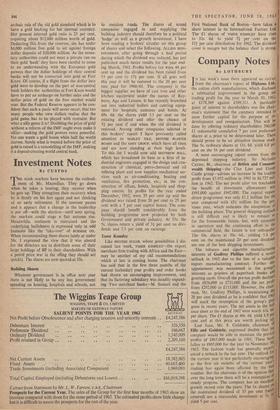

Investment Notes

- By CUSTOS

HE stock markets have become the embodi- ment of Mr. Macmillan. They go down when he takes a beating; they recover when he gets up. They strengthen their recovery when he is firmly on his feet again and not thinking of an early retirement. If the summer passes and it appears that a change in the leadership is put off—with the election—until next spring, the markets could stage a fair autumn rise. Meanwhile, sentiment is restrained and the underlying bullishness is expressed only in odd fantasies like the lake-over' of BURMAH OIL. When recommending these shares lately at under 50s. I expressed the view that it was absurd for the directors not to distribute some of their large holdings of BP to their shareholders. With a petrol price war in the offing they should act quickly. The shares are now quoted at 55s.

Building Shares Whatever government is in office next year there is not likely to be any less government spending on housing, hospitals and schools, not

to mention roads. The shares of sound companies engaged in and supplying the building industry should therefore be a political `hedge' as well as a growth investment. I have been reading a brokers' circular on this group of shares and select the following. ALLIED IRON- FOUNDERS, after going through a bad period during which the dividend was reduced, has just published much better results for the year end- ing March, 1963. Profits before tax were 44 per cent up and the dividend has been raised from 15 per cent to 171 per cent. If all goes well this year it will be restored to the 20 per cent rate paid for 1960/61. The company is the biggest supplier we have of cast iron and other kitchen equipment under the names of Ray- burn, Aga and Leisure. It has recently branched out into industrial boilers and catering equip- ment for hospitals, canteens and hotels. At 69s. 6d. the shares yield 5.1 per cent on the existing dividend and offer the chance of 51 per cent if and when the old dividend is restored. Among other companies selected in this brokers' report I have previously called attention to MARLEY TILE, BRITISH PLASTER BOARD and the AMEY GROUP, which have all risen and are now standing at their high levels. To this list I would now add MATTHEW HALL, which has broadened its base as a firm of in- dustrial engineers engaged in the design and con- struction of chemical, petro-chemical and oil refining plant and now supplies mechanical ser- vices such as air-conditioning, beating and ventilation, fire protection, etc., in the con- struction of offices, hotels, hospitals and shop- ping centres. Its profits for the year ended December, 1962, were 35 per cent up arid the dividend was raised from 20 per cent to 25 per cent with a 5 per cent capital bonus. The com- pany should benefit considerably from the building programme now projected by both Government and private industry. At 35s. the 5s. shares return a yield of 31 per cent on divi- dends and 7.3 per cent on earnings.

Tozer Kemsley

Like BRITISH SUGAR, whose possibilities I dis- cussed last week, TOZER KEmstxv—the export merchant firm trading with Africa and the East— may be another of my old recommendations which at last is coming home. The chairman has said that in the first three months of the current (calendar) year profits and order books had shown an encouraging improvement, and that its factoring subsidiary was steadily expand- ing. Two merchant banks—M. Samuel and the First National Bank of Boston—have taken a share interest in its International Factors Ltd. The £1 shares of TOZER KEMSLEY have risen to 32s. 6d. to yield 71- per cent on the 12f per cent distribution for 1962. The dividend cover is meagre but the balance sheet is strong.

Previous page

Previous page